The Transfer of Trillions: Why Intergenerational Wealth Planning Matters

In 1999, John J. Havens and Paul G. Schervish of Boston College’s Social Welfare Institute published a report in which they estimated that at least $41 trillion would pass from older to younger generations in the US between the years 1998 and 2052. This estimate far exceeded the figure previously cited most frequently ($10 trillion, as estimated by Avery and Rendall) and sparked a conversation that has been ongoing ever since.

To be clear, Havens and Schervish’s $41 trillion figure is not completely comprised of inheritance – they estimate over $16 trillion of that number will be paid out in estate taxes and charitable giving. And while some of the remaining $25 trillion is currently being inherited by the baby-boomer generation, much of that figure will be passed to the children and grandchildren of the largest generation in US history. On the strength of these figures alone, it is clear that planning for this transfer on a national level is of the utmost importance.

But what do these figures mean to you?

The first thing to determine is on which side of this transfer you currently stand; the second is to determine your plans for the transfer. Whether you will be passing assets along to your heirs or if you are set to receive an inheritance, clear communication is the key to ensuring the transfer is successful. How that success is defined is specific to the individuals involved, but there are techniques that can be applied across the board to facilitate the process.

Engaging a financial planner to facilitate the conversation can help to ensure that the transfer is reflective of the participants’ values. Several areas can be explored:

- The benefactor’s/beneficiary’s worldview and values;

- Lessons learned about money and how they’ve shaped one’s views about money;

- The source of the assets and the definition of their purpose;

- How the benefactor/beneficiary defines success;

- Whether leaving behind a legacy is important and how that legacy is defined;

- How to address the unique challenges and/or special needs of everyone involved.

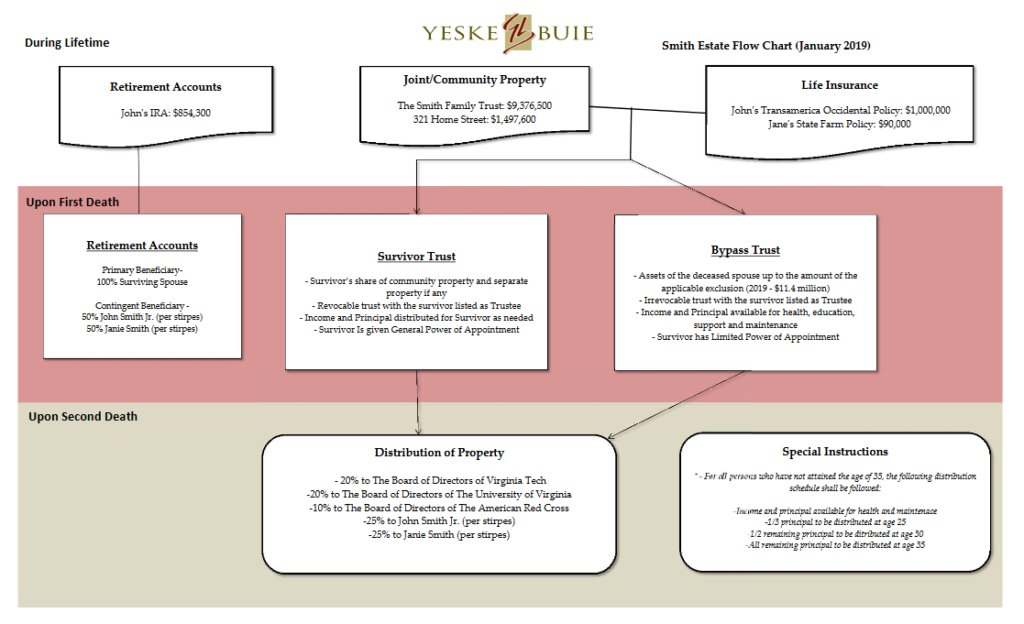

One of the ways we start this conversation with our Clients is by creating a flowchart of their estate plan to illustrate how their assets are scheduled to be distributed; creating a visual representation of the plan can be a powerful tool to jump-start the thought process of whether it truly reflects their desires. As our Clients’ plans evolve, we continually review their estate plan to see whether changes need to made. The iterative nature of revisiting this portion of their financial plan prepares our Clients for their role in the process and ensures the inevitable transfer of their assets reflects what is most important to them.