Insights from FPA Far West Round-Up

|

As noted in the previous Digest, the Yeske Buie Financial Planning Team (Dave Yeske, Elissa Buie, Yusuf Abugideiri, Jennifer Hicks, Lauren Stansell, Sabina Smailhodzic, Russell Kroeger, Camille Bouvet, and Cody Daniels) attended the 2015 FPA Far West Round-Up Conference (FWR) on the UC Santa Cruz campus from August 13 to August 16.

With the roughly 100 attendees, FWR provides a more casual and intimate atmosphere than other financial planning conferences – a traditional regional conference can draw in about 500 attendees or more. Additionally, one popular FWR tradition is to gather all attendees together on the first evening for introductions and an informal “roundtable” type of discussion focused on “The Question”. This year, the question was proposed by the Sherriff, which was dutifully carried out by our very own Dave Yeske, and it generated some quality discussion about the future of the financial planning profession. Such a discussion could only be had at FWR.

The added benefit of the FWR conference is that you can get all this quality as well as the opportunity to network with like-minded colleagues in a relaxed collegiate atmosphere. Simply put, this conference radiates quality in everything it does, and they’ve been able to do so consistently year after year after year!

Speaker Sessions

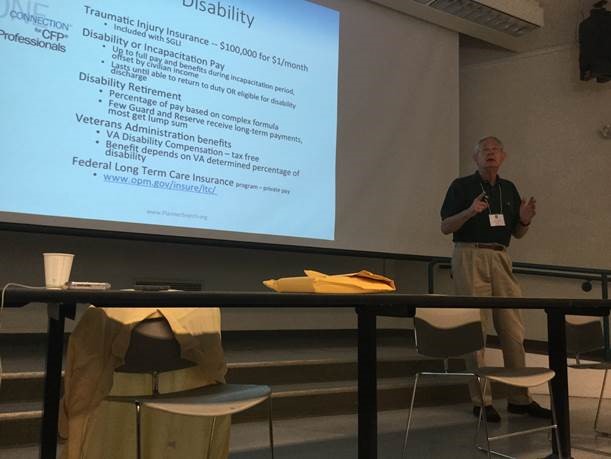

Boot Camp! – Pro Bono Military Initiative Disability Base (Col. John R. “Dick” Power)

This session was dedicated to how we can better serve our service men and women by providing pro bono financial planning to the military. Speaking from his years of experience as both a retired Army veteran as well as a financial planner, Dick provided great insight into how the financial planning profession can counsel military personnel, veterans, and their families. In an effort to highlight the need for more financial planners to offer pro bono services, Dick revealed that there are currently over 20 million military veterans, of which 3.6 million are disabled. Certainly there is a need among this group for dedicated financial professionals to volunteer their talents! Due to the nature of its content, this session was particularly interesting to Financial Planning Team member Sabina Smailhodzic, who shared, “Although all of the sessions were exceptional, my favorite was ‘Boot Camp!’. Dick Powers demonstrated the many ways we can help our military personnel and disabled veterans including defining goals, creating budgets, establishing savings plans, taking advantage of employee benefits, protecting assets and covering risks, planning for the unimaginable, and much more. This is a very large community with different and complex needs and being able to serve them to the best of our abilities is just one way we can say ‘Thank you for your service.’” Thank you indeed!

This session was dedicated to how we can better serve our service men and women by providing pro bono financial planning to the military. Speaking from his years of experience as both a retired Army veteran as well as a financial planner, Dick provided great insight into how the financial planning profession can counsel military personnel, veterans, and their families. In an effort to highlight the need for more financial planners to offer pro bono services, Dick revealed that there are currently over 20 million military veterans, of which 3.6 million are disabled. Certainly there is a need among this group for dedicated financial professionals to volunteer their talents! Due to the nature of its content, this session was particularly interesting to Financial Planning Team member Sabina Smailhodzic, who shared, “Although all of the sessions were exceptional, my favorite was ‘Boot Camp!’. Dick Powers demonstrated the many ways we can help our military personnel and disabled veterans including defining goals, creating budgets, establishing savings plans, taking advantage of employee benefits, protecting assets and covering risks, planning for the unimaginable, and much more. This is a very large community with different and complex needs and being able to serve them to the best of our abilities is just one way we can say ‘Thank you for your service.’” Thank you indeed!

Benefits are like a dysfunctional family, they make no sense. (Daniel Fortuno)

Focusing on the difficulties surrounding disability benefits, this session was packed full of useful tips and tricks when helping Clients formulate a financial plan involving Social Security Disability Income and health coverage for people with disabilities. As part of his presentation, Daniel provided a great reminder of the real possibility that people will become disabled, walk away from their benefits, and not even realize that they were covered. Therein lies our responsibility as financial planners to ensure that our Clients are aware of their disability coverages as well as provide recommendations if coverage is inadequate. Furthermore, this type of planner awareness is a part of the added value that Yeske Buie provides to its Clients.

Traditional “Certificant Connection” at Roundup? Kevin and Rich make it happen!

The Roundup attendees were pleased to engage in a town hall style meeting with two members of the CFP® Board leadership, CEO Kevin Keller and CFP® Board Chair Rick Rojeck. As a part of their presentation, Rick spoke about the CFP Board’s Strategic Plan that began in 2013, specifically focusing on the “Five Pillars” of that plan. These pillars are comprised of competency, professional standards and enforcement, public advocacy, communications and outreach, and sustainability. In respect to the CFP Boards efforts, Kevin illustrated the impact that their awareness campaign has had on consumers. According to their data, awareness for the CFP certification brand has doubled since the awareness campaign began in 2011.

The Roundup attendees were pleased to engage in a town hall style meeting with two members of the CFP® Board leadership, CEO Kevin Keller and CFP® Board Chair Rick Rojeck. As a part of their presentation, Rick spoke about the CFP Board’s Strategic Plan that began in 2013, specifically focusing on the “Five Pillars” of that plan. These pillars are comprised of competency, professional standards and enforcement, public advocacy, communications and outreach, and sustainability. In respect to the CFP Boards efforts, Kevin illustrated the impact that their awareness campaign has had on consumers. According to their data, awareness for the CFP certification brand has doubled since the awareness campaign began in 2011.

Beyond the Estate Planning Fast Food Drive Lane – Creating a More Meaningful Estate Planning Experience (John A. Warnick)

One of the challenges regarding estate planning is finding a way for the process to be more simplified and meaningful to Clients. John A. Warnick is an estate attorney that focuses on Purposeful Planning, and turning estate planning from a transaction into an experience. Throughout the session, it was reassuring to realize that the emphasis we have in getting to know our Clients on a deeper level, helps facilitate (with the assistance of estate attorneys) the creation of a more meaningful estate plan.

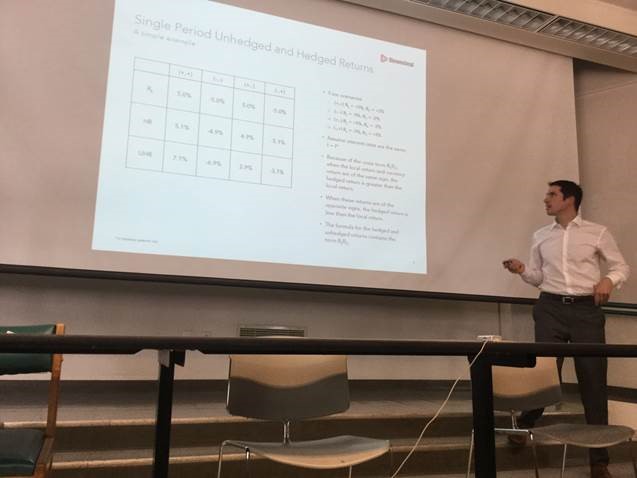

Currency Conundrums & Fixed Income Liquidity Labyrinth (Gerard O’Reilly)

As the title indicates this session was very technical, and dealt with the complexities surrounding hedging currencies and fixed income liquidity. Having said that, this session was very interesting in the aspect that it confirmed empirically Yeske Buie’s investment philosophy with respect to hedging. Financial Planning Team member Yusuf Abugideiri shared his excitement saying, “Hearing the speaker walk through the ‘math’ helped me understand our decision to not hedge the stock portion of our Clients’ portfolio on a much deeper level.” Such a session is an example of the rich content that exists at FWR.

As the title indicates this session was very technical, and dealt with the complexities surrounding hedging currencies and fixed income liquidity. Having said that, this session was very interesting in the aspect that it confirmed empirically Yeske Buie’s investment philosophy with respect to hedging. Financial Planning Team member Yusuf Abugideiri shared his excitement saying, “Hearing the speaker walk through the ‘math’ helped me understand our decision to not hedge the stock portion of our Clients’ portfolio on a much deeper level.” Such a session is an example of the rich content that exists at FWR.

Why the IRS is Really Your Friend—and other tax discussions (Todd Ganos)

This session dealt with a tax reduction strategy particularly beneficial to larger estates and was geared towards households with a very substantial amount of assets. With that in mind, a primary tool that can be used to avoid trust state income taxes is the creation of a Nevada Incomplete-Gift Non-Grantor (NING) Trust—due to the fact that Nevada doesn’t have any state income taxes. Additionally, Todd spoke to the importance for planners to present more value to their Clients than simply investment management, otherwise your value is minimal. Hence the reason why Yeske Buie incorporates a comprehensive financial plan that encompasses all of the areas of our Client’s financial lives.

Policies and Practical Tools to Carry Clients into – and through – a Long Retirement (Dave Yeske and Jon Guyton)

This presentation was quite popular among the Financial Planning Team (biases excluded)! In their presentation, Dave and Jon spoke about the need for creating a portfolio that will be able to withstand—Dave often refers to this as resilience—the inevitable ups and downs that will occur in the financial markets. Sound familiar? Such resiliency is generated by utilizing the financial planning and safe spending policies that Yeske Buie practices. It is always exciting to hear the reactions of other planners to the financial planning policies and safe spending policies that we use every day at Yeske Buie. This certainly wasn’t new material for Yeske Buie’s Financial Planning Team, however, it did allow us to better appreciate the policies that we use.

This presentation was quite popular among the Financial Planning Team (biases excluded)! In their presentation, Dave and Jon spoke about the need for creating a portfolio that will be able to withstand—Dave often refers to this as resilience—the inevitable ups and downs that will occur in the financial markets. Sound familiar? Such resiliency is generated by utilizing the financial planning and safe spending policies that Yeske Buie practices. It is always exciting to hear the reactions of other planners to the financial planning policies and safe spending policies that we use every day at Yeske Buie. This certainly wasn’t new material for Yeske Buie’s Financial Planning Team, however, it did allow us to better appreciate the policies that we use.

More than Green… Making a Difference (Gloria Nelund)

This session dealt with “Impact Investing”, a relatively new area of investment management that incorporates an investor’s philanthropic desires into their investment philosophy. Much has been said lately with regards to Impact Investing, however, this presentation was by far the most meaningful. Gloria states that Impact Investing could be defined as, investing with the specific objective of achieving both a competitive financial return and positive, measurable economic, social and/or environmental impact, or simply stated as competitive financial return + quantifiable impact. Moreover, Impactful Investing is increasingly popular among Generation X and Millennial Generations, who are demanding businesses to play a more active role in society.

The Science behind Motivating Humans to Save Long Term—Neuro-Economics (Denise Hughes)

As the saying goes, the Roundup Posse “Saved the best for last!” The need for financial planners to connect with their Clients beyond the numbers is increasingly noted by the financial planning community. This session expounded on bridging the gap between “knowing and doing,” and offered practical practice applications that could be integrated to re-engage Clients on their desired financial paths. One such application was the use of visualization techniques to literally “picture your future self” via photographic morphing; by doing so, it is easier for you to connect with your future self and in turn save for that future. Financial Planning Team member, Russell Kroeger, shared his thoughts about the necessity for a purposeful approach to achieving the future we envision. He says, “Statistics show that individuals who are able to strongly identify with their ‘future self’ are more likely to forego near term gratification to secure future success.”

Altogether, the Financial Planning Team had great time at Far West Roundup and left the conference motivated to incorporate the ideas and solutions that we learned in our work with Clients moving forward.