A Dose of Financial Planning to Treat Your Powerball Fever

In recent years, the jackpots for the Powerball and Mega Millions lottery drawings have soared beyond record levels, maxing out every sign in America with balances up to $1.5 Billion dollars. The hype around these drawings grows with every round there isn’t a winner, even though the chances at winning don’t also improve with each round. Whether or not you choose to play the Powerball or any lottery drawing, there are a few relevant financial concepts to contemplate in light of the chaos. Indulge with us as we chronicle the roller-coaster ride of financial decisions you must make when you decide to purchase a lotto ticket.

Expected Return

When you buy a lottery ticket, at the forefront of your brain is probably, “This will be the best $2 spent if I win it all.” In fact, you actually just bought an investment that has a negative expected return. The calculations vary, but the fact of the matter is, when you take the odds of winning, the potential jackpot, the potential winnings, and the taxes and fees, your expected return on a $2 ticket is less than $2!

So why do we play? This is an example of the epitome of behavioral economics. When we can imagine what it would feel like to win, our brain makes it feel as if winning is not only possible, but probable. Some people refer to it as the availability heuristic, others just call it gambling.

When it comes to investing your hard earned money for the long-run, the world can sometimes seem like a scary place. Oppositely, when it comes to investing a little bit of money for the short-run, the lottery can seem like an exciting place. But at the end of the day, we like to say, “It is better to be resilient than nimble”. Take 13 minutes to remind yourself of how we build a resilient, all-weather portfolio that can carry you through whatever storms may come our way.

Lump Sum vs. Annuity

So, we’ve discussed the options of buying the lottery ticket or not buying the lottery ticket. Despite your expected return, if you’d rather sacrifice your morning coffee for a Powerball ticket, we can’t stop you! And imagine, after all that, YOU selected all the numbers correctly and are the grand prize jackpot winner! After a few breathing exercises to get your heart rate back to normal, you are now being confronted with all a variety of big decisions with the biggest one being whether or not you want to receive your payout in a lump sum or an annuity. Let’s define these two terms and discuss what your payout would be for each option.

- Annuity – A fixed sum of money paid out in regular installments

- Lump Sum – A single payment at one time

With regard to the Powerball, if you chose to take the lump sum you would actually “only” receive approximately $930 million (minus taxes). If you chose to take the annuity, you would end up receiving all $1.5 billion (minus taxes) but it would take you 30 years to get all of your winnings. In most cases, when facing a decision between a lump sum and annuity payments, we value the investment options, flexibility and guaranteed principal return associated with a lump sum. Annuity payments usually offer a guaranteed stream of income but for an unknown length of time with little to no growth. That being said, there are a lot of factors to consider when making this decision and we recommend that you allow us to prepare appropriate analysis to help you make an informed decision. The unique thing about the Powerball annuity is that the payments won’t cease at your death, but will be paid out to your estate and distributed to your beneficiaries. And in many cases, taking your Powerball earnings as an annuity may save you from yourself!

As an investment vehicle, annuities often charge outrageous fees with very few investment options for a reasonable return. The representatives who sold you annuities often received a commission from the sale and may not have been acting in your best interest when pitching the product to you. For those reasons among others, we do not include annuities as part of our investment philosophy. However, for those of you who may already own annuities, we recommend Jefferson National as a low-cost custodian that offers favorable investment options (including Dimensional Fund Advisor funds) that allow us to construct portfolios that are more consistent with our Investment Philosophy and your Investment Policy Statement.

Cash Flow Policies

Last but not least, once you’ve purchased your ticket, beat the odds, and decided how you wish to take home your earnings… what should you do with the money?!

At Yeske Buie, we always recommend that Clients make no “sudden movements” or irrevocable decisions when they are faced with big life changes. Accordingly, before you go off and buy a private jet, new mansion, and donate half of the money to charity, take a look at Yeske Buie’s Cash Flow Policies. A policy is a tool for making decisions in the face of uncertainty. Financial planning policies can serve both planners and their Clients by acting as a powerful touchstone in the midst of a rapidly changing world.

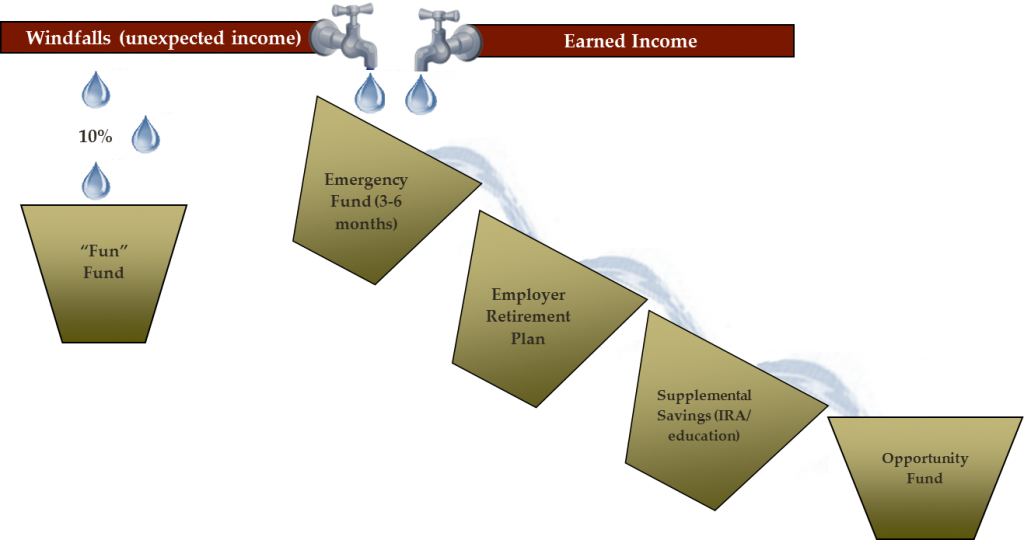

Our cash flow policies offer an opportunity to make grounded decisions by minimizing the emotions attached with spending your income and windfalls. Looking at the graphic below, your lottery winnings would be considered a “Windfall” or unexpected income.

Following our policies, you would first pay yourself 10% of the payout value for your “Fun Fund.”

Next, you use the remaining 90% to fill up your buckets in the following order.

- Emergency Fund – Three-to-six month’s worth of expenses available in cash in case of any unexpected emergencies or cash needs.

- Employer Retirement Plan – At the minimum, contribute to your employer retirement plan up to the amount your company will match. Where possible, contribute the maximum (including the catch-up contribution, if applicable).

- IRA or Supplemental Savings Account – Depending on your expected income, this may be a good opportunity to contribute to a ROTH IRA (but not in the case where you win the lottery, as your income for the year would be above the threshold).

- Opportunity Fund – Once all the buckets above are filled and overflowing, the remainder of your winnings will find its way into the Opportunity Fund or Live Big® bucket.

Winning any large sum of money in the lottery could create a roller coaster of emotions and decisions. It is important to remain grounded and focused in your decision making or else your winnings may disappear as fast as they arrived.

All in all, the Powerball lottery may be an exciting game to play, but only one person (or three people!) will end up a winner. With that in mind we’d like to recall The Live Big® list that we put together in March of 2009 and continue to update as time progresses because lottery winner or not, it’s about the size of your life, not the size of your wallet®.