2016 Market Review: The Year of Living Dangerously

2016 review banner in wood type

The markets, which is to say investors, hate surprises, though that’s pretty much all we get day-by-day. It’s called news. But some years carry bigger surprises than others and 2016 surely falls into that category. From economics to markets to politics, 2016 provided one plot twist after another. As far as markets are concerned, the year ended well, notwithstanding a bit of a roller coaster ride along the way. Herewith, we offer a brief recap of what happened in the economy, the markets, and your portfolio, with a nod to the year to come.

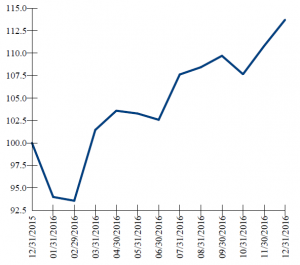

The Roller Coaster

The year opened with markets sliding worldwide. Our core stock portfolio fell by more than 6% in January before sliding another half percent in February, only to spring back with an 8% gain in March. And although there were three more down months through the balance of the year, the real theme was Onward and Upward. For the year as a whole, our core stock portfolio (which excludes bonds) was up nearly 14%, proving yet again that the markets are like San Francisco weather: if you don’t like what you’re seeing, just wait around a little while.

The Mighty Dollar

Before moving on to a breakdown of results by asset class, or investment category, it’s worth saying something about the dollar, which surged by nearly 20% against other major currencies back in 2014 and has remained strong ever since. The changing value of the dollar relative to other currencies is noteworthy for us, as half of our portfolios are invested overseas. All other things being equal, a rising dollar takes away some of the returns we earn on non-US investments when those returns are translated back into dollars, and a falling dollar does the opposite, boosting those overseas returns. The dollar continued our roller coaster theme by falling 7% during the first half of the year, only to rise 11% over the remainder, for a net 3% gain on the year. While the dollar is probably overvalued by most fundamental measures, these don’t mean much in the short run. In the long run, however, we can expect an eventual tailwind for our overseas investments as economic fundamentals reassert themselves. Until then, it’s a good time to travel overseas.

The Results

As you’ll see from the breakdown below, with the exception of Emerging Markets, which made a strong comeback in the latter half of the year, the biggest gains were to be found in the US. And the star of the show was surely small company stocks, which racked up gains of nearly 30% for the year, the best showing for US small caps since 2013, when they rose by more than 40%. The remaining categories chalked up gains ranging from 5% to 12%, with those non-US returns being shaved just a bit by the small net rise in the value of the dollar.

The Outlook

Valuation levels in US markets are higher than the long run average, prompting some to ask whether the party is over. We have two observations on that point: first, valuation levels don’t exist in a vacuum, they’re also a function of interest and inflation rates, both of which are still very low. And while both interest and inflation have started rising and will likely accelerate in the coming year and beyond, stimulative economic policies may well keep a firm foundation under the market and even pave the way for continued growth. More importantly, for truly global investors, it’s worth noting that markets outside the US are sporting valuation levels well below their long-run average, suggesting plenty of upside if global growth continues.

Valuation levels in US markets are higher than the long run average, prompting some to ask whether the party is over. We have two observations on that point: first, valuation levels don’t exist in a vacuum, they’re also a function of interest and inflation rates, both of which are still very low. And while both interest and inflation have started rising and will likely accelerate in the coming year and beyond, stimulative economic policies may well keep a firm foundation under the market and even pave the way for continued growth. More importantly, for truly global investors, it’s worth noting that markets outside the US are sporting valuation levels well below their long-run average, suggesting plenty of upside if global growth continues.

Happy New Year from the Yeske Buie Team!