Macro-Level Conference Learnings

A few weeks ago, the Yeske Buie Financial Planning Team attended FPA’s Northern California Conference. This conference offers 40 keynote and workshop sessions with some of the most outstanding, hand-selected speakers in the profession. We believe conferences like this one provide our team with the opportunity to gain macro-level insights on the current challenges, concerns, and best practices in financial planning. We find that upon returning to the office, the conference learning’s spark a curiosity to dive deeper into one or more topics, which oftentimes leads to robust conversations about applying these learning’s with our Clients.

Below, we share a few of this year’s conference highlights – including pictures! – as shared by our Financial Planning Team. This year’s favorite conference sessions ranged from retirement planning, to estate planning, insurance planning, education planning, and personal growth and performance – what a variety! We feel this broad range of topics speaks to the caliber of opportunities and speakers at the conference. We hope you enjoy reading the following insights.

State of the Long-Term Care Industry – Solutions Available to Your Clients Today

Yusuf Abugideiri most appreciated the opportunity to attend Cindy Eisenhower’s session about Long-Term Care Insurance policies. Eisenhower began the presentation by providing her analysis of the current long-term care insurance landscape. She pointed out that several carriers have stopped providing these policies; of the 125 companies offering the product in 2000, nine remained in 2017. The companies still offering traditional long-term care insurance have significantly increased premiums in recent years.

Eisenhower explained that the reason for this shift is that long-term care insurance policies were previously all sold as guaranteed renewable (i.e. the insured is always guaranteed coverage as long as premiums are paid) with level premiums for the life of the policy. As individuals started to make claims for their benefits, the insurance companies faced the following challenges:

- Higher-than-anticipated claims (more people were making claims against their policy than the companies had expected)

- Lower-than-anticipated interest rates (the actuaries had assumed higher growth rates on the reserves used to pay for claims)

- Lower-than-expected mortality (individuals are living longer than expected)

- Lower-than-anticipated lapse rates (individuals are keeping their polices in place at a much higher rate than the actuaries assumed)

Eisenhower’s assessment of the long-term care insurance market is that, despite the fact that it has under-performed by almost any measure, there remains a need for the product and that need will grow over time as individuals continue to live longer. As a response to the challenges above, more and more carries are offering alternatives to traditional long-term care insurance policies with more affordable premiums.

At Yeske Buie, one of the alternatives we review most frequently for our Clients are life insurance policies with long term care insurance riders. Individuals can secure these policies by paying a single premium, ongoing premiums, or by doing a tax-free 1035 exchange, whereby an individual can convert the balance of an existing variable annuity or the cash value of an active life insurance policy into a policy that provides long term care coverage. We’re in the midst of doing this review for all of our Clients with existing annuities or life insurance policies that carry a cash value – if this is something you’d like to discuss with us in further detail, please don’t hesitate to reach out!

Shifting into Retirement: A Closer Look at Spending in Transition

Dan Tripp’s favorite presentation was on the topic of retirement planning and was presented by Katherine Roy, CFP®, Chief Retirement Strategist of J.P. Morgan Asset Management. The presentation examined the significant patterns and trends of household spending before and during retirement. The data from their study offered a unique look at how millions of American’s spend their money.

Here at Yeske Buie, we take the science of retirement spending seriously, so learning more about the major trends driving retirement spending is directly applicable to how we advise and understand our Clients. Some of the critical points of the presentation were as follows:

- Expenditures during retirement spending tend to peak in peoples’ mid-50s, then steadily declines as retirees reach the later decades of life.

- The most substantial portion of retirement spending is not surprisingly healthcare, housing, food, and transportation.

- The median age of retirement is age sixty-four.

- Expenditures for retirees spike during the months just before and after retirement.

Finally, perhaps the most practical pieces of information were recommendations on how we as planners can incorporate the findings of the presentation into our financial planning work. With this more in-depth understanding of retirement spending, Dan feels that he is in a better position to assist our Clients in planning and navigating the spending challenges of their retirement years.

Medicare Planning: Making Wise Healthcare Choices in Retirement

For Zach Bennedsen, while he enjoyed the entire conference, Ryan Madigan’s session on Medicare gave him the most applicable information he can use with Clients. The session offered insights on the critical components of Medicare, how effective financial planning can potentially reduce costs, and key considerations for decision making. For instance, Ryan shared that it can be unwise to automatically enroll a spouse in their partner’s employer-provided insurance plan. Oftentimes, the cost to add the spouse is more expensive than an open-market plan for the non-working partner.

Making Sure the Trust Admin Process Doesn’t Go Horribly Wrong

Lauren Stansell’s favorite educational session during the conference was by estate planning attorney, Raymond Sheffield. As uncomfortable, emotional, and sad as it may be to think about, talk about, and deal with death, we want to be as prepared as we can to help you and your loved ones in every way possible. Ray’s presentation covered three main points:

- Estate Law Changes

- Portability: Introduced in 2010, portability allows the surviving spouse to use the remaining exemption the deceased spouse’s estate did not use (if any), in addition to his/her own full estate tax exemption.

- Estate Tax Exemption: Effective in 2017, the estate tax exemption increased from about $5,500,000 per person to $11,200,000 per person, or $22,400,000 per couple.

- At Yeske Buie, when reviewing estate documents with our Clients and discussing potential estate document updates with their estate planning attorney, we always discuss the flow of the estate and the usage of portability.

- Estate Settling Process

- Ray noted that we, as financial planners, should strive to be the experts in YOU, our Clients, like your estate attorney is an expert in the estate laws, and your accountant is an expert in taxes. We share this feeling and desire to be the experts in you, our Clients, and feel we make a good addition to any team discussing, planning for, or dealing with estate administration matters.

- Ten Rules for Estate Administrations

- Some of Ray’s rules include: things never go as planned; find attorneys who will work collaboratively with the Client’s entire team (their family, executor, trustees, advisors, etc.); and, one we often talk about: first things first. Ray stressed that family needs and grieving must be tended to right away; irrevocable and big decisions should not (and do not need to) be made right away.

Lauren will use these learning’s (and continue to deepen her knowledge in the area) so she can be an educated resource when discussing estate planning with Clients and when helping Clients with the administration of a loved one’s estate. By doing so, she hopes to provide a steady helping hand during times that can only be described as emotional, chaotic, and stressful.

Planning for College Bound Families

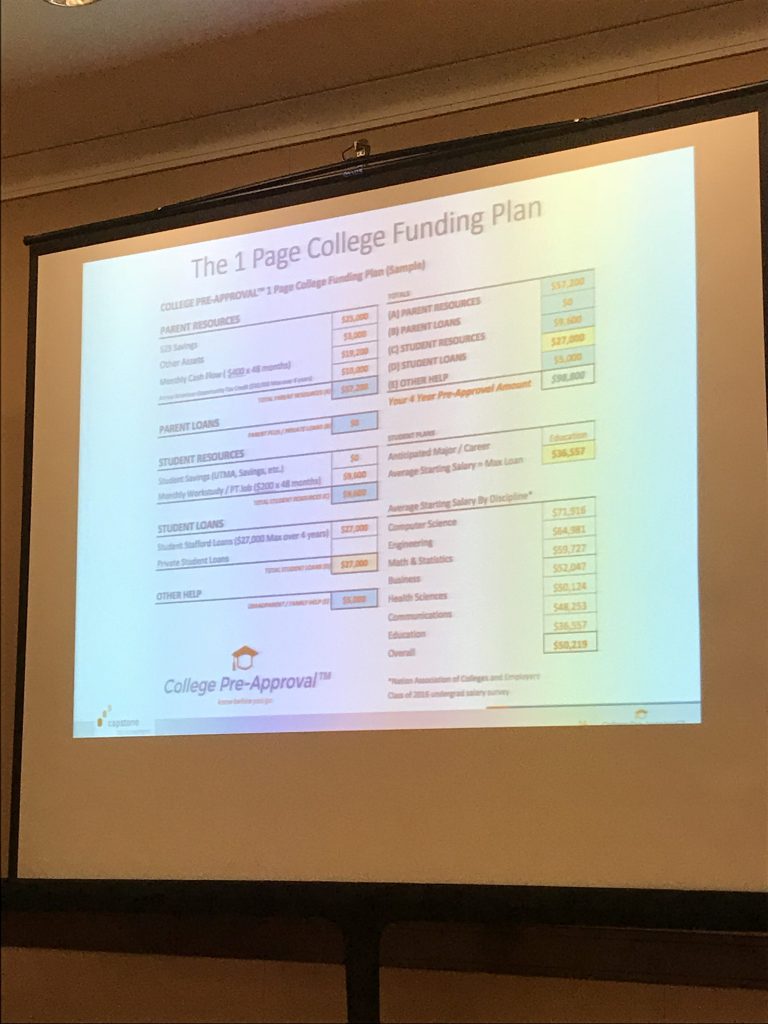

Ryan Rasmussen’s favorite presentation was on the topic of education planning and was presented by Joe Messinger, CFP®. The presentation provided a detailed process for funding college without robbing retirement goals; a topic we’ve written about for previous editions of TheLiveBigWay® Digest. As an expert in this topic, Joe provide information on deadlines for FAFSA, need-based aid vs merit-based aid, establishing student loans, and shopping for schools. Ryan’s biggest takeaways from Joe’s presentation that he feels will be most applicable in his work with Yeske Buie’s Clients were the instructions on how to build a college funding plan – stay tuned!

Bring Your Whole Self to Work

Ryan Klemm’s favorite educational session was related to personal performance and growth and was presented by Mike Robbins, an expert in teamwork, emotional intelligence, and the powers of appreciation and authenticity and author of four books. This presentation shared Mike’s core principles to build more authentic relationships with Clients and colleagues, and also to help create a dynamic, inclusive and high-performing culture for firms’ teams. Ryan enjoyed this presentation because it delved into the importance of the work environment and approach one brings to the office in service of providing exceptional work while serving Clients, a belief that Ryan also shares.

Ryan plans to use Mike’s core principles of being authentic, utilizing the power of appreciation, focusing on emotional intelligence, embracing a growth mindset and creating a championship team in his work at Yeske Buie. Ryan feels that integrating Mike’s strategies in his individual work as well as his work with the Yeske Buie team will add additional value to our office environment and the work that we provide for our Clients.