Mastering the Markets: The Case for Human Resiliency

The Merriam-Webster dictionary defines resiliency as, “an ability to recover from or adjust easily to misfortune or change.”1 At Yeske Buie, one of our fundamental worldviews is that human beings are resilient by nature. We believe when faced with obstacles, we solve problems, adapt to new challenges, and find ways to overcome seemingly impossible odds. Another of our fundamental worldviews is that markets reflect the aggregate decisions and behaviors of their participants.

It is from these two axioms that we derive both our investment philosophy and the belief that over the long-term, the global markets, despite short-term disruptions, tend to go up. In this space, we more deeply explore the relationship between the human trait of resiliency and market behavior.

Resilience is Rooted in Human Evolution

The human story is one of resilience in the face of massive change. After all, we are a species whose success is grounded in an ability to adapt to our world’s physical, environmental, and psychological challenges. Our evolutionary ancestors began as small groups of individuals struggling to adapt to a dangerous and harsh world. From these early beginnings, we’ve created a society with ever-increasing social, technological, economic, and political interconnectedness. Just in the 20th century alone, the global financial system overcame two World Wars, devastating global depressions and recessions, post-colonial and cold war conflict, and massive social and technological upheaval. We’ve overcome tremendous obstacles to create the prosperous world we live in today, and the defining feature of this story is the trait of resiliency. In fact, recent research into evolutionary biology suggests that resiliency is hard-wired into the human genome.2

Markets are the Aggregate of All Human Actions

It can be easy to feel like the movements of the “markets” are external to our lives; that somehow markets exist in a vacuum. The way we experience investing and the economy reinforces this belief. We see our account balances on statements showing numbers that may feel separate from our day-to-day activities. We experience events driving stock prices with little to no apparent connection to our everyday lives. With so much noise surrounding the economy, investing, and markets, it’s easy to lose sight of how individual behaviors affect the collective whole.

To explain how individual human behavior affects the stock market, it helps to understand the best available explanation of how the stock market works. One of the most successful investors of all time, Benjamin Graham, the mentor of Warren Buffet, said it best; “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”3 What he meant by this is that every day, millions of market participants make investment decisions representing an often irrational short-term bias to current events, both negative and positive, similar to voting for a political election. But in the long run, investors choose companies based on the weight of their fundamental factors related to a company’s perceived intrinsic value. Intrinsic value is based on an ability to generate a return on capital, how a company is positioned to navigate cyclical market forces, and its ability to generate profits. It’s the interplay between the aggregate sum of short-term investor decisions and the long-term perception of a company’s stock’s intrinsic value that drive market returns, and in turn directly affects Client portfolio values.

Harnessing Resiliency in Service of Our Clients

Bad things can and do happen. Risk is real. Events large and small negatively affect companies, the economy, and the global markets. Natural disasters occur, recessions come and go, political violence happens, government crises wax and wane, demographics change, and technology upends established orders.

But the occurrence of adverse events doesn’t have to be the end of the story. Human beings are ingenious and have an uncanny ability to solve problems. Within the human psyche, there is a deep-seeded desire for self-preservation, security, and growth. This innate drive shows up in how companies and individuals respond to stressors. When unfortunate events happen, we believe people tend to react in positive ways. Companies are streamlined, service offerings change, technology is leveraged for efficiency, process improvements increase profitability, and things get done despite political and social instability. On the consumer side, individuals and families also find ways to adapt. People tighten their budgets, improve their skills, start businesses, move to new areas in search of opportunities, and generally find ways to harness available options to lead to better outcomes. In other words, it’s the human element more than anything else that allows the economy to adapt to dynamic economic circumstances.

It is also correct that many companies (and even entire industries) do not respond well to change. Companies fail and highly successful business models eventually become obsolete. Trying to select which companies will overcome challenges and which will not is one of the fundamental reasons why investing in single stocks or attempting to time the market is a losing strategy.

From our perspective, the job of a financial planner is not to predict the future or to discern which companies are best positioned to benefit from the latest market trends. Instead, our job is to capture the resiliency of the human spirit through prudent and cost-effective investment choices and to help Clients avoid costly mistakes.

To accomplish this goal, we ascribe to the idea that if the future is fundamentally unknowable, and if you can’t pick the companies which will respond well to change in advance, then it’s better to be resilient than to be nimble. This is why we advocate highly diversified portfolios designed to capture the long-term cyclical growth of the world’s economy.

When the Markets Turn Negative Remember the Human Spirit

Stock market downturns are inevitable. This is part of being a long-term investor. There’s an old saying among stock investors which is as applicable today as ever: “the stock market climbs a wall of worry.” Our job as financial planners is to help Clients navigate the short-term market noise to capture growth as it emerges over time.

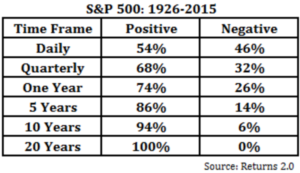

The table below is an excellent example of this principle in action and is based on data between 1926 and 2015 for the Standard and Poor’s 500 index. The table shows that in any given one-year period, an investor has a 54% chance of experiencing a positive return; over five years this number increases to 86%, and over twenty years the expected probability of a positive return is 100%.5

Does this mean you’re guaranteed to earn a certain level of returns in stocks if you hold them for a specified time frame? No. Will these same results be guaranteed to repeat themselves in the future? No.

What it does mean is that if you make an investment in a broad set of stocks, and you bet on the human resiliency factor, over the long-term there is a very reasonable expectation your investment will grow. If you’re thinking about changing investments, or if you would like to discuss your current investment choices, we’d love the opportunity to discuss our investment philosophy and explain more about how we help Clients achieve their financial goals.

CITATIONS:

- Resilience. (n.d.). Retrieved May 06, 2019, from https://www.merriam-webster.com/dictionary/resilience

- CBE, S. W. (n.d.). Is resilience written in our DNA? Retrieved May 06, 2019, from http://www.bbc.co.uk/guides/z2qxfrd

- The Most Important Investment Tool In Your Lifetime. (2018, August/September). Retrieved May 06, 2019, from https://lcvadvisors.com/blog/the-most-important-investment-tool-in-your-lifetime

- Carlson, B. (2018, January 23). 180 Years of Stock Market Drawdowns. Retrieved May 06, 2019, from https://awealthofcommonsense.com/2018/01/180-years-of-stock-market-drawdowns/

- Carlson, B. (2015, November 15). Playing the Probabilities – awealthofcommonsense.com. Retrieved May 06, 2019, from https://awealthofcommonsense.com/2015/11/playing-the-probabilities/