‘Inflation is Coming! Inflation is Coming!’ How Yeske Buie has Positioned Clients’ Portfolios to be Protected

Well, as we said a month ago, everyone’s talking about it, and that’s certainly still true today: inflation is seemingly on everyone’s mind.

Writing for the Wall Street Journal last week, James Mackintosh is one of many in the media ringing the inflation alarm bells (for our reader’s sake, we think it’s important to note that we’re not particularly alarmed and agree more with the perspective shared by Paul Krugman in the New York Times a day later, and that’s true even after digesting this week’s release indicating the inflation rate over the past 12 months is 4.2%).

As Mackintosh promised in the aforementioned piece, this week he provided his thoughts about how a portfolio should be structured in the face of inflationary concerns. Because many of our Clients have been asking us how we might be adjusting our portfolio given the current circumstances in financial markets and the economy, we thought this would be a timely piece to review; in so doing, we found an opportunity to explain why we feel confident about how our Clients are positioned.

In the article, Mackintosh outlines five approaches investors can take in times like these. We’ve listed them below, and share our take on each.

- Golden Rule

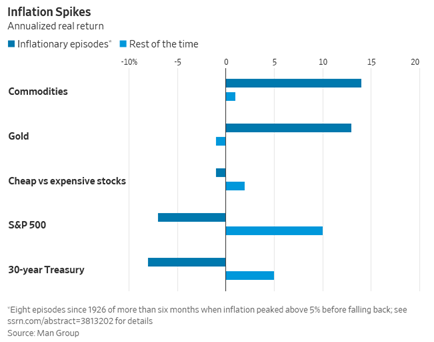

The traditional thinking is that gold can serve as a good hedge for inflation. But the beginning and end of inflationary episodes are hard to predict, and gold doesn’t do well when inflation isn’t spiking (per the chart included in the article):

In fact, over the long run, stocks do much better than gold; as a matter of fact, researchers have found that the long term real return on gold (after adjusting for inflation) is barely more than 1%. All in all, we find these points to be compelling support of our decision to leave gold and other precious metals out of our Clients’ portfolios, even in times like these.

- Commodities as Classic Inflation Hedge

We’ve always maintained that it doesn’t make sense to include commodities in our Clients’ portfolios given that the long-run real return is 0%. And Mackintosh makes the case against commodities pretty clearly, noting that if you’re using commodities as a hedge against inflation, but “the market correctly anticipates inflation, there is no extra money to be made betting on that inflation.”

- Stocks with Low Pricing Power

Our investment philosophy is one that seeks to capitalize on the premium that comes with investing in value stocks by tilting the portfolio in that direction. Value stocks, over the long run, generally outperform their more expensive counterparts (albeit not without periods of underperformance, which is why our Clients’ portfolios carry both value and growth stocks).

In times when inflation is spiking upward, value stocks tend to outperform growth stocks, in part because you’re less likely to overpay for the future growth you’re hoping to capitalize on. Warren Buffett, perhaps the world’s most famous value investor, has shared his insights on this topic a number of times – we thought this piece did a good job summarizing his thoughts (with which we’re in agreement – pay specific attention to items 5 and 6).

- Treasury Inflation Protected Securities

We have very little to add here, as TIPS aren’t part of our Clients’ portfolios – Mackintosh captures the rationale behind that decision perfectly: “Unfortunately they are expensive, with 10-year TIPS paying 0.9% below inflation. Inflation needs to rise at least that much over the decade just to maintain purchasing power. If inflation fears pick up, TIPS prices are likely to rise as more people buy them. But for investors who hold them to maturity the best return they can get is inflation, minus 0.9%.”

- Assets with Short Duration

Yet again, we’re aligned with the points Mackintosh is making in this space. Our primary choice for bond exposure in our Clients’ portfolios is DFA’s 5-Year Global Bond Fund, and although it’s billed as a fund that targets average maturities of five years, the fund managers actively monitor economic and market conditions to maximize returns. As such, the current weighted average maturity is 2.67 years, and the duration is 2.62 years. All of that is to say the bonds in our Clients’ portfolios are the kinds of bonds investors want to be holding given current circumstances.

- Putting It All Together

Our portfolio is designed to be one for all seasons, and we think that’s true in the face of current concerns about inflation. Aside from the points made above, we’d be remiss if we didn’t note that half of our Clients’ portfolios are invested in non-US stocks (both in the developed world and in emerging markets). That’s of critical importance in a time like this, because the mutual funds we use for exposure to international stocks are not hedged for currency rate risk. What that means is if the dollar decreases in value relative to other currencies, which could happen if the US has a spike in inflation, the returns from the non-US portions of our portfolio get an additional bump when converted from the respective non-US currencies back to dollars.

And we’re gratified to share that over the past six months, the trends we’ve been seeing in financial markets and our Clients’ portfolios have been encouraging. Domestic small company and value stocks have led the way, followed by all non-US small and value stocks. The most expensive stocks (captured by the S&P 500 index fund and the Vanguard international large company fund we employ) have done well, too – just not as well as the types of stocks towards which the portfolio is tilted.

So, in sum, we’re not concerned about inflation in the long-run, and yet we feel that our Clients are positioned well to ride out a protracted period of inflation should that reality come to bear. In the meantime, as always and above all else, it’s better to be resilient. And our Clients’ portfolios are designed to be just that.