The Three Rs of IRAs

Using savings tools like Traditional and Roth IRAs can be a great way to put money away towards your future retirement, and deciding which tool to use is an important decision as there are a number of tax related implications to keep in mind. We use this space to discuss the three Rs of IRAs:

Traditional vs. Roth IRAs: The Basics

One of the main questions that we think about when determining whether someone should contribute to a traditional IRA or Roth IRA is what tax bracket is your current and anticipated future tax brackets. A typical rule of thumb (though it isn’t always the case) is to favor contributions to a Roth IRA if you anticipate that your current tax rate is lower than what you anticipate it to look like when you need the funds. This is because you are gaining a bigger tax benefit by paying taxes now on Roth IRA contributions (which grow tax free) when you are in a lower bracket, compared to deferring that tax to retirement. Traditional IRAs typically are most attractive in your highest earning income years as they provide the benefit of deferring taxes into the future.

The key difference in choosing a traditional vs. Roth IRA is whether it makes more sense from a financial standpoint to take advantage of tax benefits today, or to have tax-free distributions in the future.

Restrictions on Contributions

For 2023, individuals under the age of 50 can contribute up to $6,500 to a Traditional or Roth IRA per year. If you are over the age of 50, you can contribute an additional $1,000/year for a maximum of $7,500 in 2023. You are allowed to contribute to both a Traditional IRA and Roth IRA in the same year, but the combined contribution can’t exceed $6,500 for those under 50 or $7,500 for individuals 50 years and older.

So, who is eligible to make contributions to these accounts?

Traditional

For traditional IRAs, anyone with earned income is eligible to make contributions, though not all contributions qualify a contributor for a deduction on the tax return (we will discuss this more in the next section).

Roth

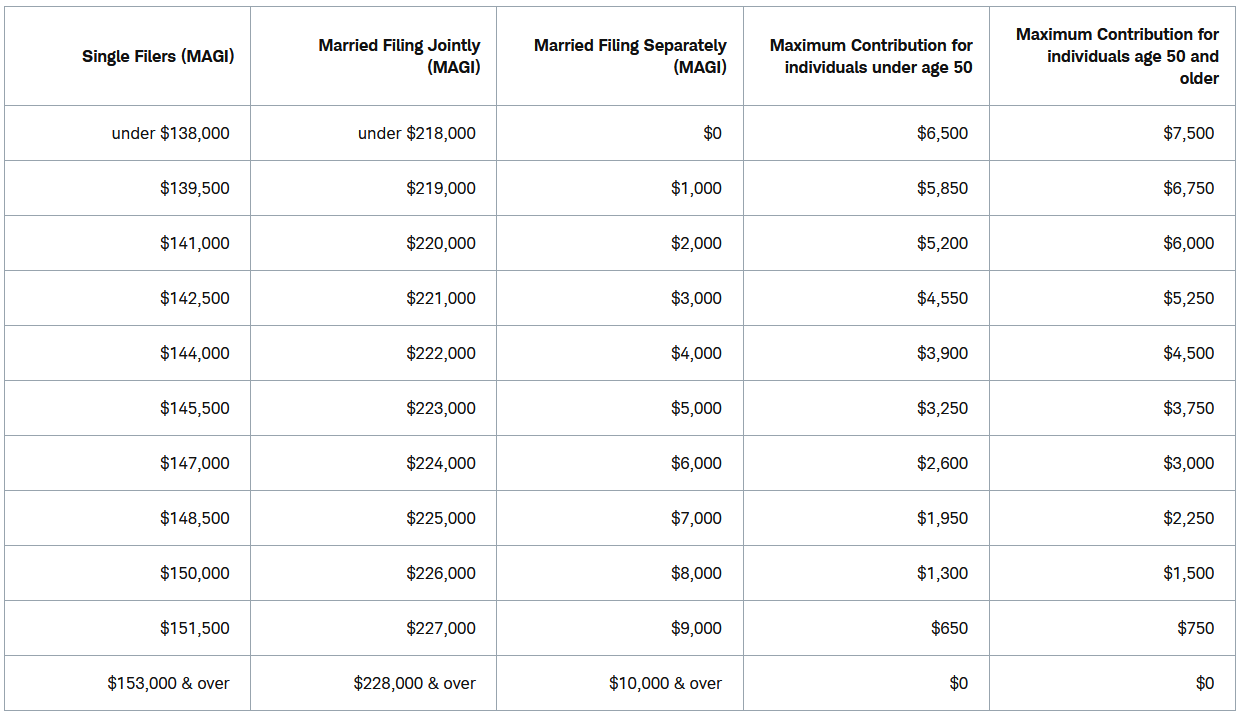

Eligibility to contribute to a Roth IRA is limited to individuals under a certain earned income level. For 2023, a single filer is eligible to make a $6,500 contribution if their Modified Adjusted Gross Income (MAGI) is below $138,000 and a married filing jointly couple can contribute $6,500 (or $7,500 if 50+) if their MAGI is below $218,000. For those with MAGI between $138,000 and $153,000 for a single filer (and between $218,000 and $228,000 for those filing MFJ) the maximum is reduced on a pro-rata basis. Those earning more than $153,000 (or $228,000) aren’t eligible to contribute to a Roth IRA. For a visual representation, check out this chart courtesy of Charles Schwab.

Restrictions on Deductions

Traditional

Traditional IRAs can be both deductible and non-deductible. The determination of whether a contribution can be deductible is dependent on whether you (and/or your spouse if married filing jointly) are considered active participants in an employer sponsored retirement plan (like a 401(k) or SEP-IRA). If any contributions (employer, employee, or both) are being make to an account, you would be considered an active participant. If neither you (nor your spouse, if applicable) are active participants, then you can make a full deduction.

For single individuals who are active participants in employer sponsored plans, your entire contribution is deductible if you make less than $73,000 in 2023. A partial deduction is available for those earning between $73,000 and $83,000 in 2023, and no deduction is eligible for those earning more than $83,000.

For married individuals, where only one spouse is an active participant, contributions are fully deductible if MAGI is less than $218,000. A partial deduction is available is MAGI is between $218,000 and $228,000 and no deduction is available if MAGI is above $228,000.

If both spouses are active participants in employer sponsored retirement plans, the deductibility limits are as follows:

- Full Deduction – MAGI below $116,000

- Partial Deduction – MAGI between $116,000 and $136,000

- No Deduction – MAGI above $136,000

So, if you are ineligible for a deduction for your traditional IRA contributions, what happens? Your contributions will be after-tax and the growth in the account will tax deferred. When withdrawing funds in retirement, the contributions will be tax free, and the growth will be taxable as ordinary income.

Roth

Because the purpose of Roth IRAs is to save after-tax dollars, there are no deductions associated with these types of accounts.

Withdrawals

Because the purpose of Traditional and Roth IRAs is to save for future retirement needs, the IRS puts restrictions on when you must begin taking distributions.

Traditional

Traditional IRAs require that you begin distributions starting the year that the owner turns 73. Distributions are required to be taken by December 31st of every year. You are allowed to defer the first RMD to April 1st of the year following when you turned 73, but you would then be required to take two RMDs in that year. For example, if you turn 73 on September 1st, 2023, you will have until April 1st, 2024, to take your 2023 RMD. But by December 31st, 2024, you will still need to take the 2024 RMD, resulting in two distributions in the first year.

Roth

The purpose of Required Minimum Distributions (RMD) is to force the owners to begin paying taxes on accounts that have grown tax deferred for years. Since Roth IRAs consist of after-tax contributions that result in tax-free withdrawals, there are no RMDs for these accounts.

Early Distributions

As discussed above, these accounts are intended to not be touched until retirement, but in the event that funds are needed before age 59 ½, what can be done? If you need your funds, you are able to take a distribution from your accounts, but you will be subject to penalties and tax. Early distributions, unless they are one of the qualified exemptions listed below, will be subject to a 10% penalty and will be taxed as ordinary income.

Here are some qualified reasons to distribute from an IRA prior to 59 ½ that will avoid the 10% penalty.

Traditional

- Medical Expenses in excess of 10% of your Adjusted Gross Income

- Medical expenses that were out-of-pocket (and unreimbursed) that exceed 10% of your adjusted gross income (AGI)

- For Example, if your AGI is $200,000 and you have medical expenses of $30,000, you could distribute $10,000 (the amount above 10% of your AGI) from your IRA without penalty or tax consequences.

- Total and Permanent Disability

- If you “can’t do any substantial gainful activity because of your physical or mental condition,” you may qualify for a penalty-free distribution.

- Qualified Higher Education Expenses

- You can use your IRA for qualified higher education expenses (tuition fees, books, supplies, and equipment) for you, your spouse, or your child.

- Buy, Build, or Rebuild a First Home

- You are eligible to take up to $10,000 for the purchase or building of a first home. The IRS defines a first-home homebuyer as someone with no interest in a home during the prior 2-year period.

- You can use this penalty-free homebuyer for yourself, your spouse, parent, child, or grandchild.

Roth

In addition to all of the specified penalty-free IRA withdrawals listed above, Roth IRAs also allow for you distribute your contributions (but not investment growth) at any time or age without penalty or tax. Once you have exhausted the basis of your contributions, additional distributions before age 59 ½ will be taxed and subject to a 10% penalty (if they aren’t for a qualified distribution mentioned above).

Please note that Roth IRAs have an additional requirement other than age 59 ½ for withdraws to not be considered an early distribution. Roth IRAs must be open for at least 5 years before you begin taking distributions.

Live Big Today and in Retirement

Overall, both types of IRAs serve as great mediums for saving towards your retirement, and knowing the rules and requirements can help you make the best decision on which type of account is for you at the current time. The team at Yeske Buie can assist you in deciding what’s best for you and your financial future. Whether you’re in need of a San Francisco or Northern Virginia financial planner, we can help you with the investment answer you need. Contact us to learn more.