Navigating California’s Insurance Market Crisis

California’s insurance market is facing a crisis, driven by rising wildfire risks and increased costs to rebuild after disaster. Many homeowners are seeing their policies non-renewed, leading to limited and costly insurance options. In this piece, we explore the root causes of the crisis, from environmental factors to legislative impacts, and offer practical steps for those affected.

What Is the California Insurance Market Crisis and How Did This Happen?

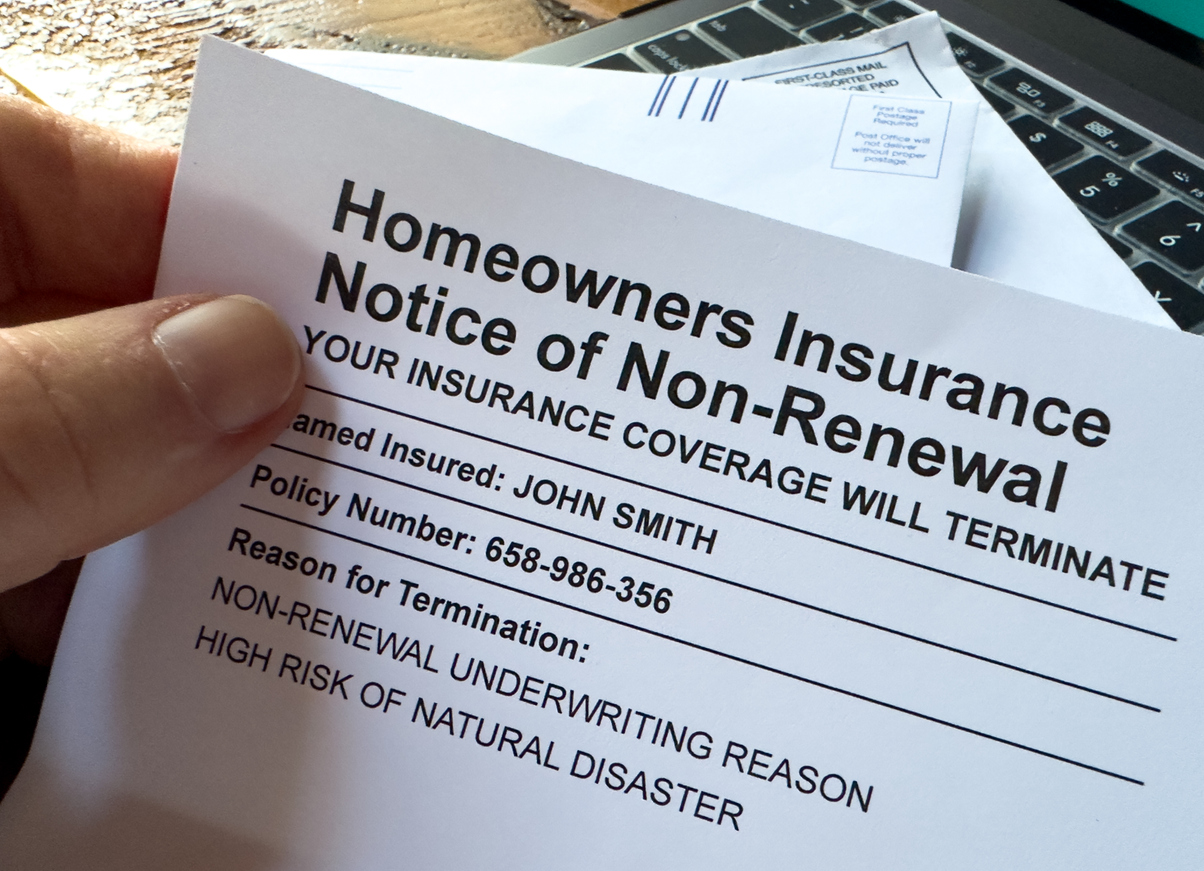

As many Californians know, we are currently in the midst of a home insurance crisis throughout the state, which has led to many homeowners being non-renewed on their policies. This situation not only creates frustration but also puts homeowners in a tricky position where their only insurance options are often more expensive and provide limited protection, potentially leaving them underinsured.

The California housing crisis, which isn’t limited to CA—similar situations are occurring in states like Florida due to hurricanes—is the result of several factors. The most obvious factor is wildfires. Of the ten largest wildfires in California history (based on acres burned), eight have occurred in the past ten years. As a result, the cost of claims has significantly impacted insurers. The premiums being received don’t cover the sheer number of claims; there is a common misconception that insurance companies are profiting off your home insurance premiums. Additionally, the net profit margin of property and casualty insurance is only 5%. Data also shows that over the last decade, in California specifically, insurers are paying out $1.13 for every $1 taken in (and we all know that isn’t sustainable!).

While the climate itself plays a role, the rise in inflation and the cost of construction are also contributing factors. As the cost to repair damaged homes from fires or other claimable events increases, it adds to the burden on insurers.

Due to California state law, insurers are limited to increasing premiums by no more than 7% annually. Any increase above 7% must be approved through a public hearing, which historically takes two years to complete. By comparison, California construction costs have increased as follows:

- 2021: 13.4%

- 2022: 9.3%

- 2023: 9.4%

The law, which was designed to prevent predatory pricing, also plays a role in the current crisis. The devastation from the fire in 2017 and 2020 wiped out most profits for California insurers and without legislative change, there isn’t a way for carriers to be compensated for the amount of risk being taken on.

As a result of these factors, major insurance companies are implementing tighter standards during the underwriting process and are limiting new policies or, in some cases, not writing new policies at all and leaving the state altogether. For policies that are renewed, we are seeing premiums rise significantly as the government has stepped in to allow for a temporary increase above 7% to companies who are willing to stay within the market.

Before we get into what to do if you’re affected by a non-renewal, let’s look at the different types of carriers for homeowners insurance.

Types of Carrier

- Admitted Carriers: Admitted carriers are insurance companies that have been approved by the state’s Department of Insurance. These carriers must meet all state regulations and adhere to state-approved rates. The policies they write must also be approved by the state and are backed by the state, meaning if a disaster struck and they went “belly-up”, the government would step in and cover unresolved claims. Most of the insurance companies you hear about in commercials are admitted carriers. Examples include:

-

- Allstate

- State Farm

- USAA

- Travelers

- GEICO

When you hear about insurers leaving the state, they are referring to the admitted carriers.

- Non-Admitted Insurers: Non-admitted carriers are approved by the state to do business but are not subject to the same regulatory restrictions as admitted carriers. Non-admitted carriers can adjust rates based on the risks they are taking on, such as those in high fire zones.

Policies through non-admitted carriers are typically much more expensive, may provide less coverage, and often have fewer endorsement options. Rest assured, however, being with a non-admitted carrier doesn’t affect the quality of the insurance policy you received. Many of these carriers have been in business for a long time and have strong reserves to weather a storm.

So What Do You Do If You Are Non-Renewed?

If you receive a non-renewal letter, there are a few steps to take. First, immediately connect with your insurance broker (or ask your financial planner for a referral) to explore other options or action you can take. While it’s rare, you may be able to reverse the non-renewal if you immediately remedy an issue that caused it like replacing the roof or wood siding or removing overhanging limbs.

If that isn’t an option, the broker’s first step will be to look at admitted carriers in your area. As of the writing of this article, if you are non-renewed by your admitted carrier, there is a near-zero chance that you’d be able to find another admitted carrier willing to write a policy for you. On that same vain, the option to shop around for cheaper policies doesn’t exist in the current market.

If an admitted carrier isn’t available, they will then explore the non-admitted market. These policies are the next best option and, as stated above, provide great coverage, albeit at higher premiums.

If a non-preferred carrier also won’t insure your home—often the case with homes at very high risk of fire—the final option is to turn to the California FAIR Plan. The California FAIR Plan offers the most basic insurance coverage for high-risk properties and is deemed the absolute last resort for homeowners. Unlike preferred or non-preferred carriers, which cover at a minimum 12 different perils, this plan only provides coverage for damage created from fire, smoke, lightning, and internal explosion. This program is also struggling financially and is not currently able to charge what is necessary to build their reserves to support their liability exposure, but they’re not getting sufficient premium increases approved by the Insurance Commissioner either. To give you a sense of the current state of the California FAIR Plan’s situation, they currently have $396B in exposed liabilities, but only have $2.9B in reserves to pay out claims. Contrary to what the name may suggest, this is not a government-backed insurance program, meaning the state of California will not step in if the program goes belly up. We don’t share this to insight fear, but to drive home the fact that the California FAIR Plan is the absolute last resort and if you have the option to be insured with an admitted or non-admitted carrier, it is always a better option than the California FAIR Plan.

For homeowners on the FAIR Plan, working with an insurance broker to find a Difference in Conditions (DIC) policy is necessary. This policy supplements the FAIR Plan by providing coverage for liabilities, water damage, theft, and other issues. While the combination of the FAIR Plan and a DIC policy can be expensive and not fully comprehensive, it is better than bearing the entire out-of-pocket loss if you were to go uninsured (which is not recommended).

What’s on the Horizon?

From the government and the Department of Insurance side, there have been legislative pushes in Sacramento to encourage insurance companies to offer coverage in distressed areas. This strategy, called the Sustainable Insurance Strategy, aims to have private insurers write 85% of new business in historically underserved areas.

This is getting pushback from insurers as they are unwilling to continue writing policies in California. Insurers are pushing for the approval of catastrophe modeling when determining rates. Every other state in the United States has this modeling available. As things currently stand under state law, rates must be determined by the average of the last 20 years. As you will recall from earlier, eight of the 10 largest fires have happened in the past 10 years. By looking back the full 20 years, insurers aren’t able to price realistically based on current risk.

From the government and the Department of Insurance side, there have been legislative pushes in Sacramento to encourage insurance companies to offer coverage in distressed areas. This strategy, called the Sustainable Insurance Strategy, aims to have private insurers write 85% of new business in historically underserved areas.

This is getting pushback from insurers as they are unwilling to continue writing policies in California. Insurers are pushing for the approval of catastrophe modeling when determining rates. Every other state in the United States has this modeling available. As things currently stand under state law, rates must be determined by the average of the last 20 years. As you will recall from earlier, eight of the 10 largest fires have happened in the past 10 years. By looking back the full 20 years, insurers aren’t able to price realistically based on current risk.

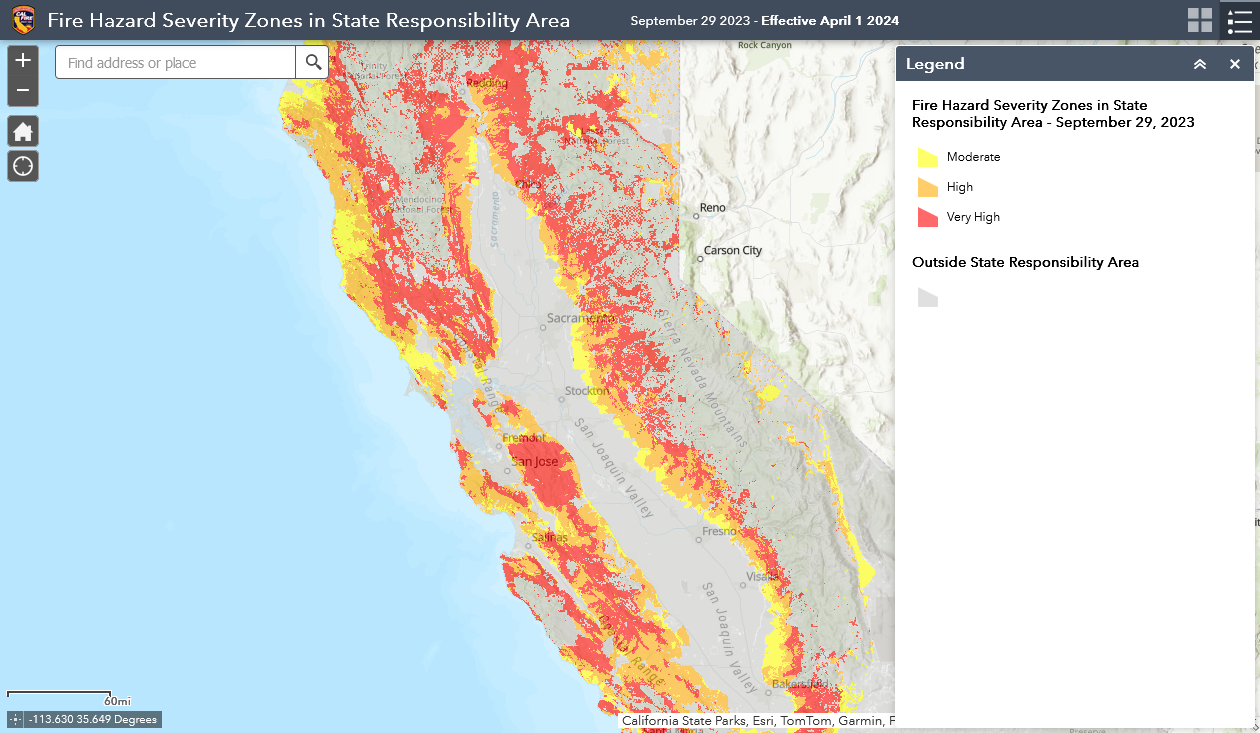

If you are a California resident who hasn’t received a non-renewal letter yet, it is imperative that you keep your home as attractive as possible before your policy approaches its expiration date, especially if you live in a fire zone (you can discover active fire zones here). In previous years, insurance companies have allowed you to submit proof of inspection or upgrade after you received a non-renewal and were lenient with reversing that notice. It is very unlikely that a reversal will be issued in this insurance market, which is why you should be proactive in your planning. Here are some suggestions for keeping your home as attractive as possible to insurance companies, shared with us by a respected insurance broker and expert:

- Maintain the condition of your roof. Remove algae and debris, and confirm that there isn’t any deterioration of the materials.

- Some insurance companies have been using drones and other technology to review the condition of roofs to determine whether they will renew a policy.

- Hire an inspector to look at your roof if it is older than 20 years old. Roofs older than 25 years old (unless made of tile or metal) are often catalysts for a non-renewal.

- Consider getting an assessment completed by a fire-hardening specialist. At the very least, trim tree limbs that are hanging over the roof of your home. Additionally, be certain there is clearance of at least 100 feet from the home for all unmanaged vegetation.

- Install ember-resistant vents.

- Enclose eaves with non-combustible materials

- Replace wood decking with fire-resistant decking and wood siding with non-flammable siding.

- Electrical service panels and breaker boxes cannot be more than 25 years old, without exception.

- If you live in an older home, replace any knob & tubing wiring that remains.

- As for plumbing, pipes, lines, fittings, connectors, valves, drains, and hoses in visible areas should have been updated in the last 25 years. Water heaters should be no older than 15 years old.

- Heating systems, even those in good condition, can be no older than 25 years old.

- Increase your deductible to $10,000 and avoid submitting claims for smaller sized issues.

- An expert we spoke with recommended against filing any water damage claims as these often cause a nonrenewal. She also recommended against filing more than one claim of any specific type or in any amount in a five-year period.

- Continue to pay premiums on time and in full.

In addition to the above suggestions for all homes, especially those in fire zones, here are additional recommendations for dwellings valued at more than $2,000,000:

- Install automatic seismic gas shut-off valve.

- Install automatic water leak detection system.

- Maintain alarm monitoring service for both burglary and fire protection.

We know that the current state of the insurance market can be frustrating and concerning. While we don’t have control over much of this current crisis, California homeowners do have the ability to make their properties more attractive to avoid the California FAIR plan.

Reach out to us and/or your insurance broker if you have questions about action you should take or if you receive a nonrenewal notice. We’re here to work with you and your insurance expert to ensure you’re adequately protected.