Inflation Frustration: Then and Now

What was intended to be financial advice quickly became a cultural flashpoint: “Stop buying avocado toast if you want to buy a home.” The driving idea behind this infamous title of a Time Magazine article in May 2017 was that young people around the world spend exorbitantly on luxury goods. Much has been made of this comment since then, with millennials (and now Gen Z) being criticized for their spending habits, and Baby Boomers (and now Gen X) being labeled as “out of touch.”

Ultimately, conversations around this topic reveal a deeper truth: the way we experience money has changed dramatically across generations. This piece explores how inflation has shifted the cost of living over time and how you can make intentional choices to stay financially steady in a changing world.

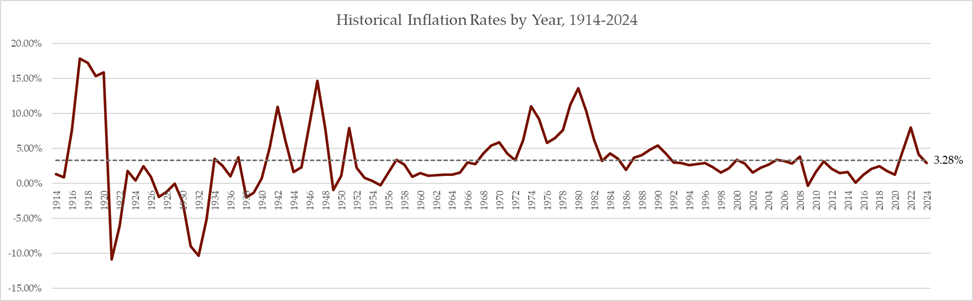

The History of Inflation

“Inflation,” according to the International Monetary Fund (IMF), is the rate of price increases over a given period of time. It is most commonly measured over a period of one year, representing how much more expensive a set of goods or services has become over that period. According to data from the Bureau of Labor Statistics (BLS), inflation over the past century-plus has varied widely, from a peak of 17.8% during WWI to a low of -10.85% (commonly referred to as deflation) during the Great Depression. The long-run average from 1914-2024 is just shy of 3.3%.

We can make a couple of observations from this historical data. First, history doesn’t repeat itself, but it often rhymes. Each of the peaks in this graph can be attributed to a supply shock – WWI, WWII, the Vietnam War and oil crises of the 1970s, and the COVID-19 pandemic. In each case, a global disruption led to reduced output of consumer goods, resulting in higher costs. Second, we have not seen a prolonged period of inflation above the long-term average since the 1980s, which is why this particular moment feels so acute.

How Spending Has Shifted

So, what does all this historical inflation data have to do with avocado toast? Well, despite relatively low inflation compared to historical peaks, the world is quite different today than it was 40 years ago. In the 1980s, luxuries were relatively expensive, but life was relatively cheap. Today, basic necessities are expensive, but luxuries are cheap. Consider this example.

1980s

A television cost about

$500

A CD player would run you

$1,000

A cellphone went for

$2,000

A computer might cost

$4,000

A microwave cost about

$250

If you purchased all of these, you would have spent $7,750 (or about 3.25 years’ rent) on luxury goods. In 1980, the median home price was also only $47,200, meaning you could just about afford a 20% down payment on a new home if you chose to save that money instead of spending it. In other words, just 45 years ago, it was irresponsible if you didn’t budget correctly to buy all these luxuries because it could be holding you back.

Today, the relationship between luxuries and necessities is flipped. The biggest expense today is rent at about $2,000 per month, and when it comes to luxuries:

TODAY

You can now buy a television for

$200

You now have access to Spotify, so let’s say you spend

$100

on music

A new cellphone costs

$1,000

A quality computer may cost you

$500

Microwaves cost about

$200

Altogether, these luxuries cost $2,000, or only one month’s rent. And today, the median home costs about $418,000. A 20% down payment on that home is $83,600. If you gave up all $2,000 of those luxuries, you would still be $81,600 short. The luxuries wouldn’t even cover the closing costs on that average home.

So, it’s easy to understand why someone who grew up in the 70s and 80s would have the mindset that just foregoing a few luxuries should be enough to catapult one’s financial journey forward. And, hopefully, this sheds light on why younger folks are often jaded with today’s economic system. It’s not the cost of luxuries like avocado toast, coffees, or new cell phones that’s holding people back; it’s the cost of necessities like housing, daycare, college, and health care.

Staying Financially Steady in a Changing World

If inflation has flipped our financial lives upside down, how do we stay grounded? While there’s no magic fix, there are four intentional actions you can take to help your money go further today and in the future.

- Re-evaluate your emergency fund.

- As your cost of living increases, your safety net may need to grow, too. An emergency fund isn’t a “set it and forget it” tool. Revisit your monthly expenses and consider whether your 3–6 month cushion still holds up.

- Use time as an opportunity rather than a constraint.

- During inflationary periods, timing matters. Typically, you may decide to buy something because you feel ready to upgrade and you can afford it. But if prices are going up universally, you may want to add a third component to the decision matrix: Do I need to buy it now? Identify your timeline and then proceed accordingly. If you aren’t in a hurry to act, then hang tight and wait for the right opportunity. (And if you are on a time crunch, then be careful not to rush into a bad deal or get caught up in a bidding war!)

- Focus on what you can control.

- You can’t control gas prices or grocery store markups, but you can choose where and how you shop. Small decisions, like opting for generic brands or limiting delivery services, can add up. Even lifestyle choices, like the type of car you drive, can influence how inflation affects you.

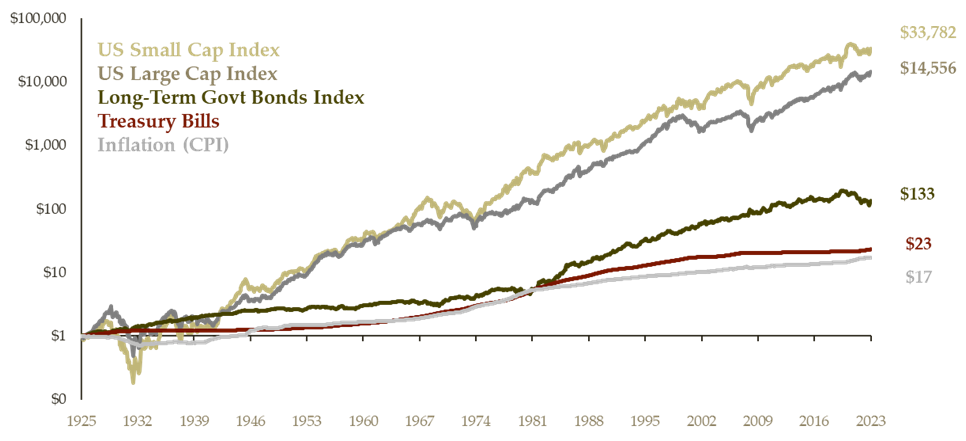

- Invest for the long term.

- Perhaps the most powerful way to combat inflation is by putting your money to work. Over time, stocks – investments in real companies – have proven to outpace inflation by harnessing the resilience and ingenuity of people working hard to solve problems all across the globe. While markets can be volatile in the short term, history has shown that stock investments (the top two lines in the above below) are a consistent and reliable way to outpace inflation over a long period of time. And, notice the scale on the image below is logarithmic (increasing by a factor of 10) so the stock returns can fit on the same graph!

Looking Ahead

While rising prices are a reality for all of us, they don’t have to derail your financial goals. With a thoughtful plan, a steady mindset, and a focus on what you can control, it’s possible to stay grounded even in an unpredictable environment. And if you’re wondering how to put these ideas into practice, we’re here to help. At Yeske Buie, we’re always happy to be your partner in building financial confidence.