Turning Your Portfolio into a Paycheck

As our Clients approach retirement and prepare to begin making distributions from their portfolio to meet their spending needs, we often hear questions like these:

How much can I safely

spend from my portfolio

in retirement?

How will I know if

I’m heading for

trouble?

What will I need

to do to get back

on track?

TheLiveBigWay® Safe-Spending System, backed by the results of some of the best available research, answers the aforementioned questions by identifying a target spending rate and implementing decision rules to ensure Clients remain on a sustainable path.

In this space, we discuss our approach to managing sustainable distributions in retirement and the evidence-based decision rules that act as guardrails to keep spending levels consistent in retirement.

Sustainable Distributions

We work with each of our Clients to create a spending plan that fits their lifestyle, and we manage each Client’s spending plan in the following ways to maximize growth, minimize costs, and build in as much resiliency as we can:

- When possible, we set spending targets below the identified Safe-Spending Policies target so that if a reduction to the spending target must be made, the actual amount distributed from the portfolio may not need to be reduced. Building in additional layers of resiliency in this way creates peace of mind while increasing the portfolio’s capacity to weather the inevitable storms in financial markets.

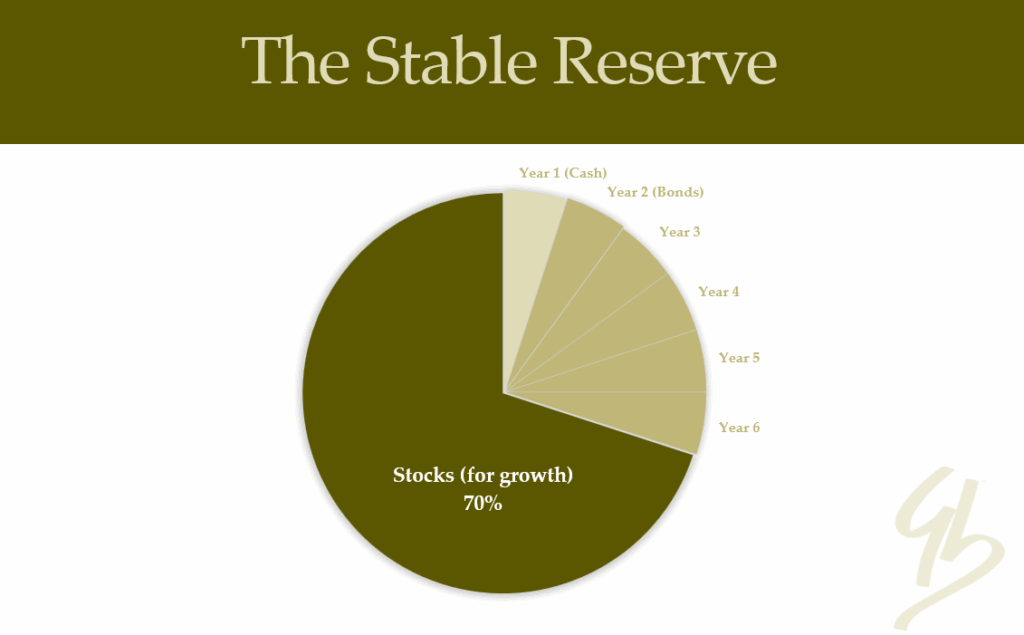

- In general, we keep about two-thirds of the portfolio balance invested in stocks to harness growth and maintain purchasing power throughout retirement. We use a combination of high-quality bonds, money market funds, and cash as a “stable reserve;” assuming a 5% spending target, our portfolios carry six or seven years’ worth of spending in the stable reserve to act as a “bridge” when stocks are down.

- We keep a year’s worth of spending in cash, which is also topped up throughout the year via dividends and capital gains distributions to reduce the taxable gains realized by selling investments.

- Once a spending target has been established, we set up electronic transfers from the portfolio to a Client’s desired account on a cadence that feels comfortable to ensure consistent and reliable distributions.

The Stable Reserve

The nature of markets is that they will fluctuate over time (with a bias for growth over the long run). The purpose of the stable reserve is to provide consistency in our Clients’ spending capacity through these fluctuations. In the chart below, you’ll see a breakdown of our Clients’ portfolios in which 70% of the invested assets are stocks. This portion is invested for long-term growth. The other 30% is the stable reserve. The stable reserve exists as a safeguard for the inevitable downswings in markets. Historically speaking, a reserve of six years’ worth of spending needs would have been enough to weather anything financial markets have thrown at us over the last century. When markets are sliding, the stable reserve provides enough time for stocks to recover, funding spending needs and enabling our Clients to avoid selling stocks at depressed prices.

Decision Rules as Guardrails

TheLiveBigWay® Safe-Spending System framework is designed to address a Client’s spending concerns in explicit terms via a set of decision rules. These three rules – the Inflation Rule, the Capital Preservation Rule, and the Prosperity Rule – act as guardrails, keeping Clients’ spending levels consistent year after year even as markets digest the latest news. It’s also important to note that, while Safe-Spending targets are re-established annually, our Clients’ distributions only change upon request. So, with that in mind, how do these decision rules work?

The Inflation Rule

This decision rule is triggered the most frequently and allows a Client to increase their withdrawal target by the amount of inflation over the past 12 months as long as the portfolio value is greater than or equal to the balance when the Client began spending.

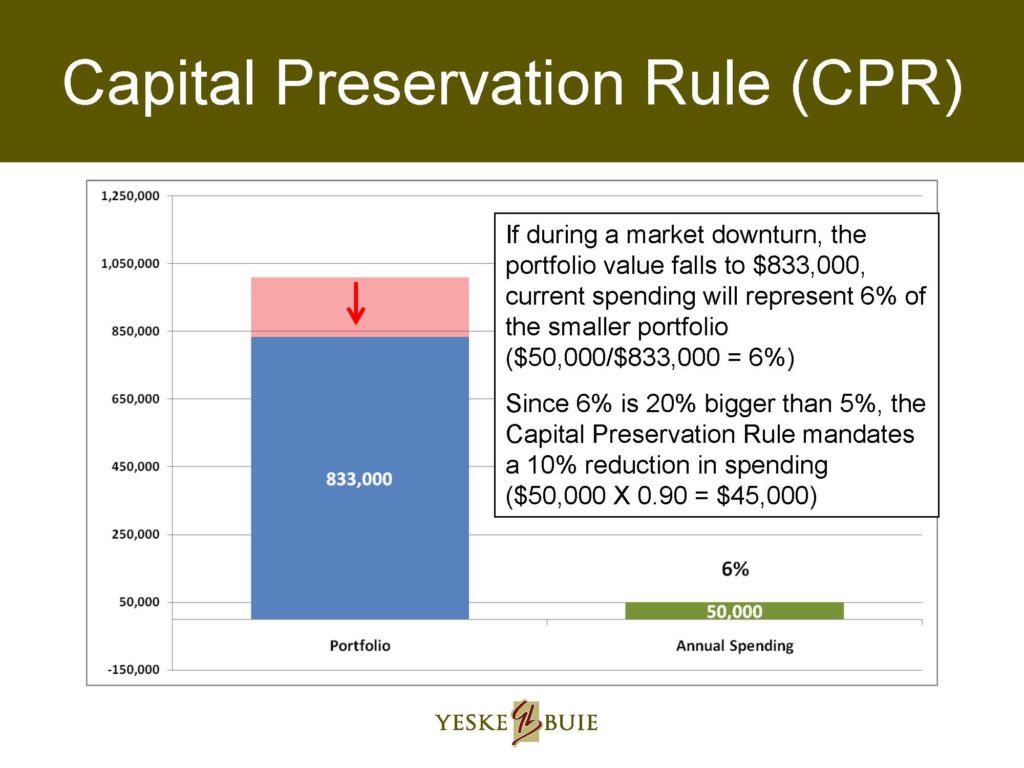

The Capital Preservation Rule

The Capital Preservation Rule is used to adjust the withdrawal amount when a portfolio balance decreases by enough that the current spending target is 20% larger than the initial target. When this happens, the Client’s spending target is reduced by 10% to reduce the strain on the portfolio and give it a better opportunity to recover.

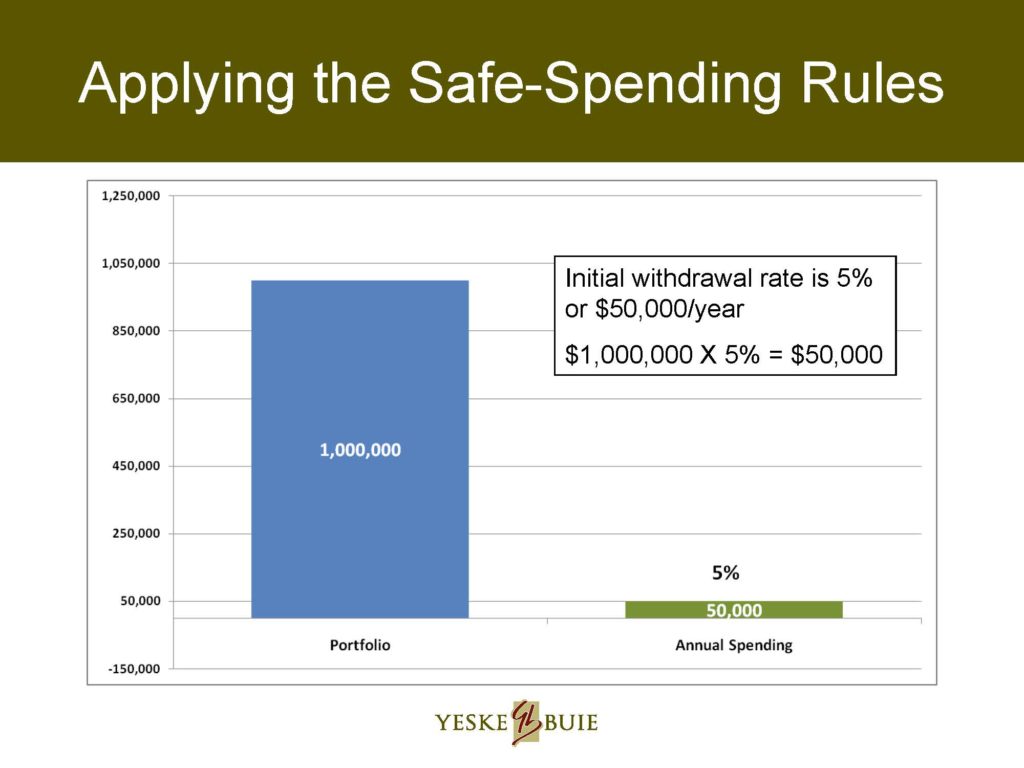

As an example, let’s assume a Client has a portfolio of $1,000,000 and is applying a 5% withdrawal rate against that balance, meaning they have an annual spending target of $50,000. The withdrawal rate is assigned a 20% threshold, meaning that if the portfolio shrinks to the point that the withdrawal target becomes 6% of the portfolio’s new balance, the spending target will be decreased to $45,000.

This is because 1% (the difference between 5% and 6%) is 20% of the initial 5% spending target. Essentially, if the portfolio shrinks because of a market downturn — down to $833,000, as shown — $50,000 now equates to 6% of the current portfolio value. When we reassess the spending target in the following year, the new anchor is $45,000. In this way, the reduction, while modest in scale, is robust in effect because it carries through into subsequent years.

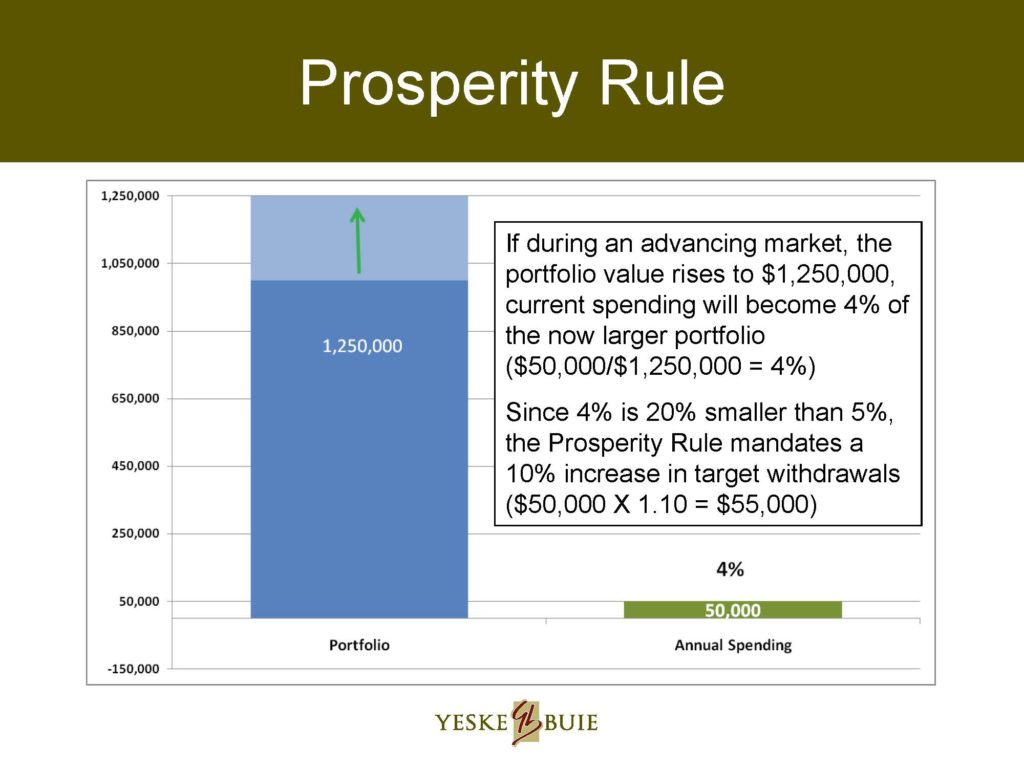

The Prosperity Rule

The Prosperity Rule works in the opposite way. If the portfolio’s value increases by enough that the target becomes 4% (or less) of the portfolio’s new balance, the withdrawal target is increased by 10%.

Evidence-Based Application

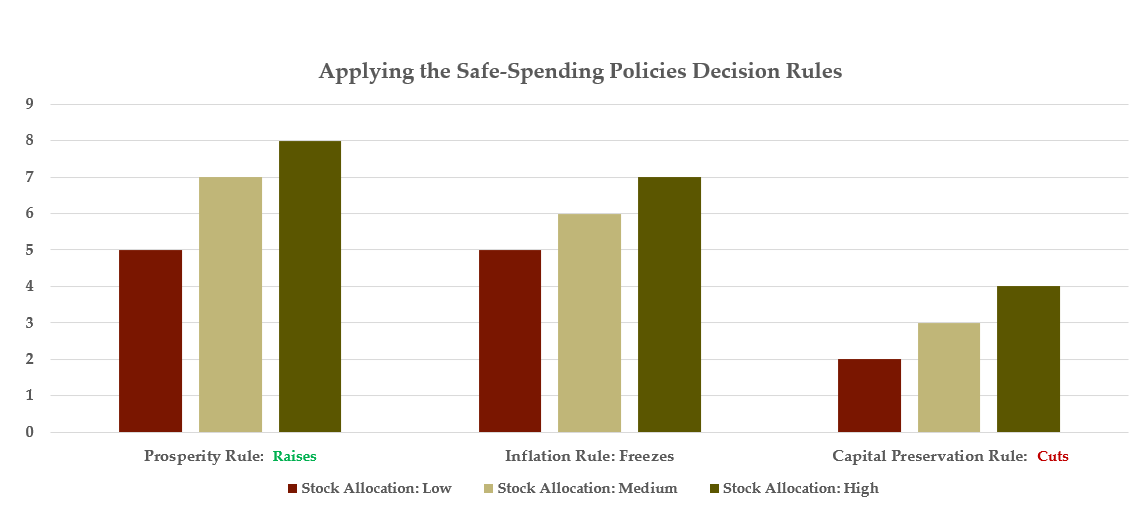

The researchers who developed these decision rules analyzed every 40-year retirement period from 1928 to 2004 (meaning the period from 1928 to 1968, and from 1929 to 1969, and so on) and ran 14,000 scenarios for each period to stress-test the application of the rules. They found that, depending on the aggressiveness of their portfolio, Clients applied the decision rules in the following ways:

- They increased their spending via the Inflation Rule between 33 and 35 times in retirement (or to put it another way, a Client’s spending target experienced an inflation freeze between five and seven times); and

- They received an average of five to eight Prosperity Rule raises; and

- In contrast, they only had to take two to four Capital Preservation Rule reductions.

- The fact that Clients experienced twice as many Prosperity Rule raises relative to Capital Preservation cuts makes sense intuitively, as we expect markets to rise in the long run, paving the way for larger portfolio values that can support greater distributions as time goes on.

The following chart illustrates the number of times each of the decision rules is applied (on average) over a 40-year retirement (the aforementioned bolded ranges correspond to the bars below).

The research also aligns with our anecdotal experience. We began applying this framework before the Great Recession. While a few of our Clients who retired before or during 2008 and 2009 had to make Capital Preservation Rule adjustments, none had to do so more than once. Most of our Clients didn’t even have to apply the rule as their portfolios recovered quickly enough from the worst part of the downturn to continue to support their distributions at the same level. Even as they continued to spend at their normal rate, virtually all of our Clients’ portfolios returned to their pre-recession highs within three or four years.

Do you have questions about our Safe-Spending Policies or what a holistic financial plan might look like for you? We’ve put together a summary to help you identify important factors when constructing a financial plan. And, if you’d like to discuss how our Safe-Spending Policies work in greater detail, please contact a member of Yeske Buie’s Financial Planning Team at ThinkBig@YeBu.com.