One Big Beautiful Bill Act – Part 2

As you’ve read and seen from us the last couple months, the One Big Beautiful Bill Act (OBBBA) continues to be a big part of our ongoing work as we continue with year-end tax planning season. It’s hard to believe we’re already using the phrase “year-end,” but time is flying and we pride ourselves on bringing the Yeske Buie standard to our Client-centric tax planning reviews and collaboration with the other experts on our Clients’ team of professionals.

The OBBBA introduced a range of provisions that may shape how your 2025 and 2026 tax returns look and how we help you plan ahead. We reviewed many of these provisions in detail in our piece titled One Big Beautiful Bill Act – Part 1, and you may find it helpful to revisit this piece for a full refresher on what’s changing.

Here in Part 2, we’ll take things a step further by exploring how a few of those updates might play out in real life. Some of the most notable provisions include increases to deductions for state and local taxes (SALT), changes to charitable giving rules, and new benefits for seniors. Each comes with its own nuances and income phaseouts, so let’s look at a few real-world illustrations of how they might apply.

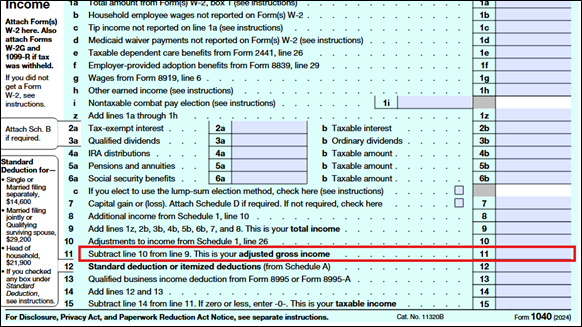

Before we dive into the examples, let’s take a quick moment to define what kind of “income” determines where the phaseouts begin. In most cases, it’s Adjusted Gross Income, or AGI. AGI is your total gross income, which might include:

- Wages

- Investment income

- IRA/pension distributions

- Self-employment income

- Rental income

- A portion of your Social Security benefits (up to 85% based on your other income)

MINUS any adjustments from Schedule 1. These are referred to as “above-the-line” deductions and include things like:

- Deductible IRA contributions

- SEP IRA contributions

- Deductable portion of self-employment taxes

- Premiums paid for self-employed insurance

With that foundation in place, let’s see how these provisions might play out in practice.

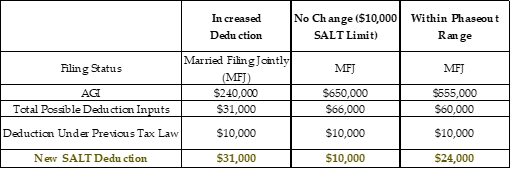

Example 1: Increased SALT Deduction

a. Increased Deduction – Scenario 1

-

- SALT Deduction – this is for state income taxes and state/local real estate and personal property taxes. This deduction on the Schedule A (itemized deductions) has been limited to a maximum of $10,000 until OBBBA. The maximum is now up to $40,000 subject to income phaseouts.

- For a married couple with AGI of $240,000 who paid about $5,000 in state income taxes and $26,000 in property taxes, the SALT deduction previously was limited to $10,000.

- But now, this couple will be able to deduct the full $31,000 on their Schedule A.

b. No Change to $10,000 SALT Deduction – Scenario 2

-

- If, on the other hand, a couple has AGI of $650,000, state taxes paid of about $40,000, and property taxes of $26,000, the total SALT paid is $66,000, but this couple will only be able to deduct $10,000 (income above the maximum $600,000 AGI threshold for phaseout).

c. Within Phaseout Range – Scenario 3

-

- If the couple instead had AGI of $555,000, state taxes paid of $34,000, and real estate taxes of $26,000, the total SALT paid is $60,000, but, because this couple is within that $500,000-$600,000 income phaseout, they will only be able to deduct about $24,000 on the SALT line.

d. A summary:

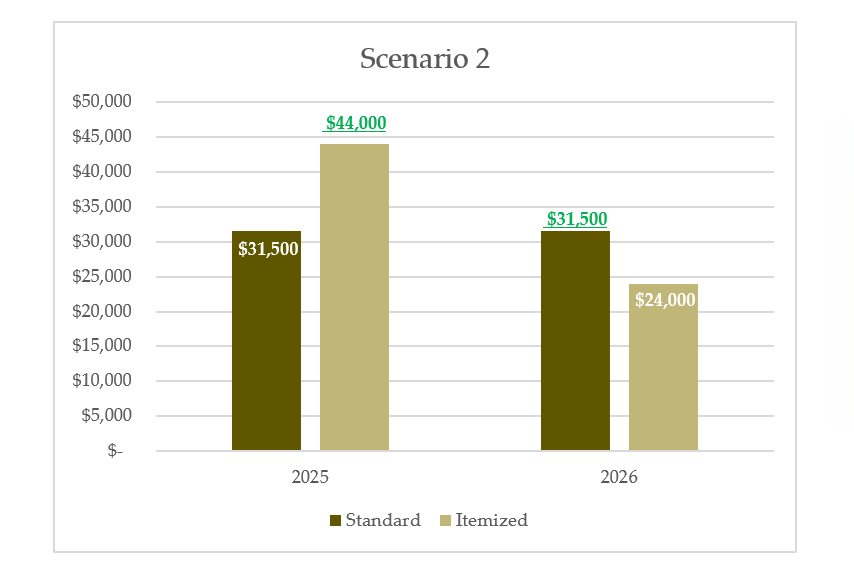

Example 2: Charitable Bunching

a. Charitable bunching refers to making a few years’ worth of charitable contributions in one year to take advantage of a higher itemized deduction this year, then skipping charitable donations the next couple years and taking advantage of the now-permanent (until the next big tax bill!) higher standard deduction.

b. With the 0.5% AGI floor for charitable contributions coming in 2026, it could make bunching this year a bit more powerful.

c. We’ve included a visual depiction of what this looks like, here:

d. As an example, take a couple with AGI of $300,000 who generally gives $10,000 to charity per year, pays $14,000 in state income taxes, and pays $5,000 in property taxes and $5,000 in mortgage interest.

-

- Currently, their total deductions are $34,000, which is above the standard deduction so they will itemize deductions (and get to take the full $19,000 in SALT deductions based on AGI).

- And, for this Client couple in 2026, the charitable deduction will be reduced to $8,500 (the 0.5% AGI floor on $300,000 AGI is $1,500, so only contributions above $1,500 can be deducted).

e. In this case, it could make sense to front-load a few years’ worth of charitable giving into 2025 (perhaps into a Donor Advised Fund where the grants can then be doled out to charities at the usual annual cadence as the Client desires but the charitable deduction is all brought into 2025).

-

- For example, the Client could put $30,000 into a Donor Advised Fund this year, take the itemized deductions of $54,000 in 2025, then plan to take the standard deduction in 2026 and 2027.

f. If this Client is taking Required Minimum Distributions (RMDs), it’s likely we’ve already recommended taking advantage of Qualified Charitable Distributions (QCDs) to maximize the tax benefit, but if we haven’t yet or they just started RMDs, it could make sense to shift almost all charitable giving to QCDs.

-

- In this case, if the Client shifted most giving to QCDs and would be taking the standard deduction, we’d recommend they give up to $2,000 in cash to charity each year starting in 2026 to take advantage of the reinstated deduction for non-itemizers.

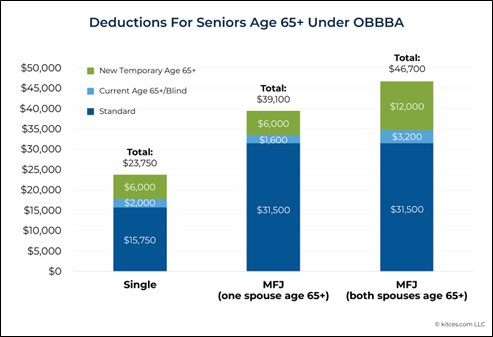

Example 3: Enhanced Senior Deduction

a. The enhanced senior deduction is an additional $6,000 per senior over the age of 65 that can be taken by itemizers and nonitemizers alike.

b. This new deduction is in place for the 2025-2028 tax years and includes income phaseouts – the deduction is phased out for incomes between $150,000 – $250,000 for joint filers ($75,000 – $175,000 for single filers).

-

- Because the tax code can’t ever be simple(!), this deduction phases out on income known as Modified Adjusted Gross Income, or MAGI. This MAGI adds back in income that is otherwise excluded under the Foreign Earned Income Exclusion, so, for most households, MAGI is the same as AGI.

c. In this case, take a single Client with AGI of $125,000 who is 66 years old. This person will qualify for a portion of this new enhanced deduction (about $3,000 of it) in addition to other deductions (which, for those taking the standard deduction, already includes an additional deduction of $1,600 for those over 65 or $2,000 for those over 65 and not married).

-

- So, assuming the standard deduction, this person would have the $15,750 standard deduction plus the existing $2,000 additional deduction for those over 65 and not married, and now $3,000 more from this enhanced senior deduction for a total of $20,750.

d. Assuming Clients fall under the income thresholds for phaseouts of this senior deduction, here’s a visual showing possible deduction totals from one of our favorite resources, Kitces.com:

As you can see, it can get quite nuanced by personal situation which is why individualized tax planning and projections are so important (and why we request your tax returns each year!).

As noted, we’re deep in reviewing Client situations for potential action to be taken based on the OBBBA and our usual year-end tax planning reviews. If we think you need to act, we’ll reach out individually with our ideas to then run by your tax preparer for their expert input. We love collaborating with the other experts in your life to be sure the whole team is on the same page and has the appropriate advice from the appropriate players in support of empowering you to pursue your LiveBig® life.

Read more about OBBBA in our article, One Big Beautiful Bill Act – Part 1. As always, please reach out with any questions you have on your tax situation or this most recent tax law change.