How to Invest When Your Crystal Ball is on the Fritz

If you could see the future, diversification would be a bad idea. It’s simple logic: if you knew which assets were going to outperform all the others in the coming year, you’d simply put all your (nest)eggs in that one basket and reap the rewards of perfect foresight. Of course, the world is a bit messier than that, though it can be hard to remember sometimes, especially when it feels like someone’s throwing a party and you weren’t invited. This is especially true when we’re talking about the Dow Jones Industrial Average or the S&P 500 Index, which seem to have filled the news this year with frequent reports of the indexes hitting new highs.

This can be a bit misleading, however. Notwithstanding all the new highs, as we write the Dow is up only 7.25% year-to-date (two days ago, the Dow was up a mere 3.64% for the year). A broad measure of global real estate securities, meanwhile, is up nearly 27% so far in 2014. But that doesn’t fill the airwaves, just as the dominance of small company stocks and emerging market stocks in prior years failed to have the same headline value.

Notwithstanding all the new highs, the Dow is up only 7.25% year-to-date.

But let us return to that cracked crystal ball of ours . . .

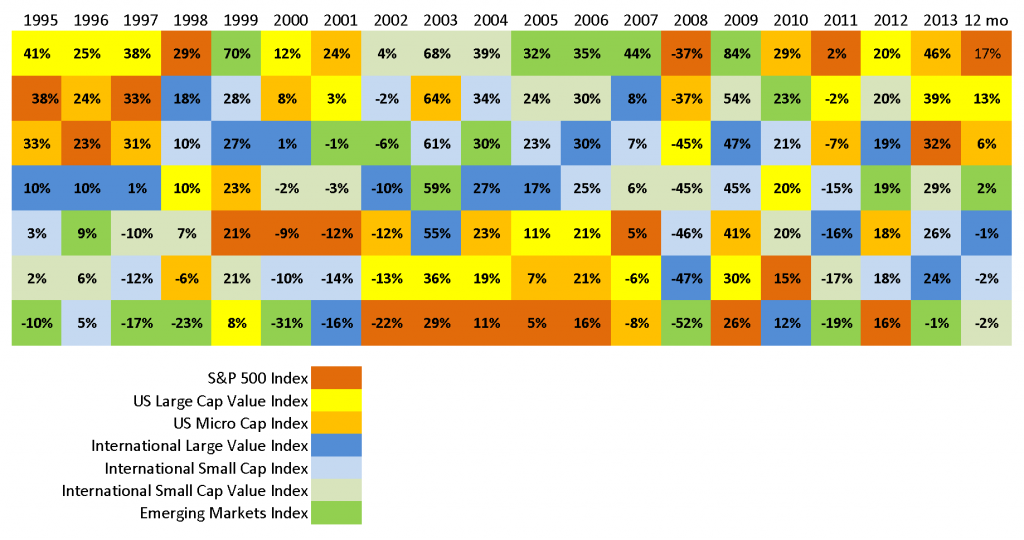

Consider the color coded chart below, which shows the relative performance of seven stock asset classes over the past 20 years. As you can readily see, no asset class — no single color, if you will — remains on a straight path, neither at the top, the bottom, nor the middle. They dance about and change places in random fashion, illustrating the challenge facing anyone who would predict next year’s winners from yesterday’s or today’s (click on the chart for a larger version).

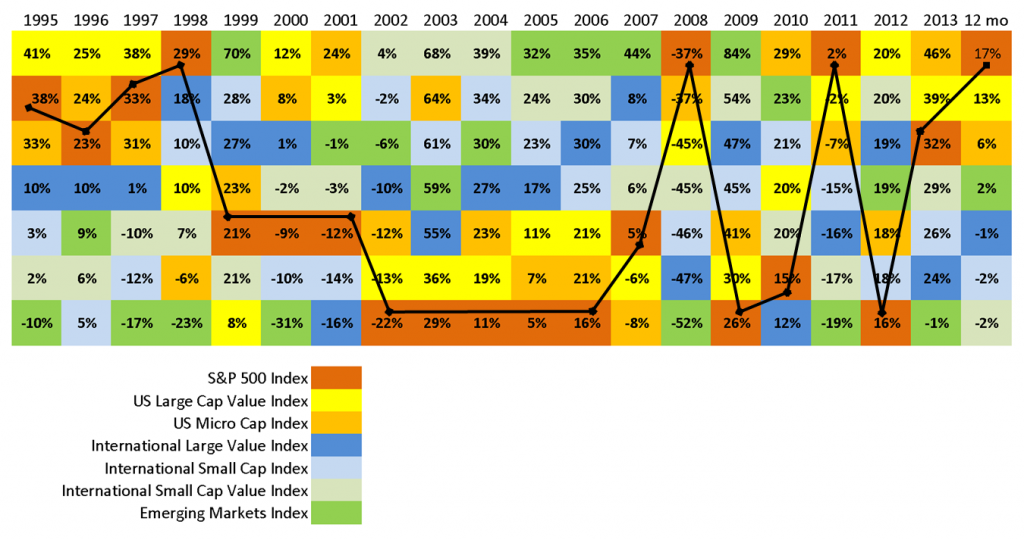

In many ways, this past year puts us in mind of the late nineteen nineties, when the dot-com boom was in full swing. Back then, the S&P 500 was also the Belle of the Ball, dominating most other categories, especially non-US stocks and especially international small company stocks. We recall many difficult conversations as the boom was reaching its peak and out-of-favor asset classes were increasingly being called into question. Now consider the same chart, this time with the path of the S&P 500 plotted with a line to make the pattern (or lack thereof) easier to follow.

As you can see, many of the laggards of the late nineties came to the forefront and dominated the domestic Blue Chips for the next eight years. Since the end of the Great Recession, it’s been more of a back and forth kind of thing, with no single asset class taking the lead for long. Which, of course, brings us back to the whole notion of diversification: when you diversify, you’re guaranteed not to do as well as the single best performing asset class in any given year; however, you’re also guaranteed not to do as poorly as the worst performing asset class. Absent a working crystal ball, bridging the highs and the lows and harvesting the long-run returns from all asset classes is as good as it gets. And for long-term investors, as good as it needs to be!

Index Data Source: Dimensional Fund Advisors