The Wisdom of Crowds – YeBu Style

In his 2004 book, The Wisdom of Crowds, James Surowiecki explored the many situations in which the collective wisdom of a group will surpass that of its smartest individual members. Surowiecki opens with an example reported by statistician and polymath Sir Francis Galton in 1906. Galton was attending a country fair and observed a weight-guessing lottery in which fair goers were invited to guess the weight of a dressed and butchered ox. About 800 people participated, with the person producing the closest guess winning a prize. Galton managed to talk the promoter into giving him the jar full of everyone’s guesses and proceeded to analyze it. What he found was that the average of all the guesses was within one pound of the actual weight of 1,198 pounds, far closer than the actual winning guess.

This same wisdom of crowds manifests itself in the economy as a whole and stock markets in particular. The many “guesses” of stock market investors, all arriving with their non-overlapping bits of information, push prices up and down to arrive at a consensus price representing the collective wisdom of the market. It has been shown time and again that this consensus price is more likely to be right than the best judgment of any given individual. This is why our investment approach is designed to harness that consensus – that wisdom of crowds – rather than trying to outsmart it.

Which brings us to the little experiment we conducted on March 14 at our Virginia office client event. We filled a large container with M&Ms and invited each of our attendees to submit a guess as to the true number contained therein.

Everyone in attendance contributed a guess using various methodologies. Some googled the weight of a pound of M&Ms and then tried to estimate the weight of our collection, minus the weight of the container itself. Others tried to estimate the width and height in units of M&Ms and multiply their way to an answer. Others plucked an estimate from thin air, so to speak. All in all, we collected 24 estimates of the total number.

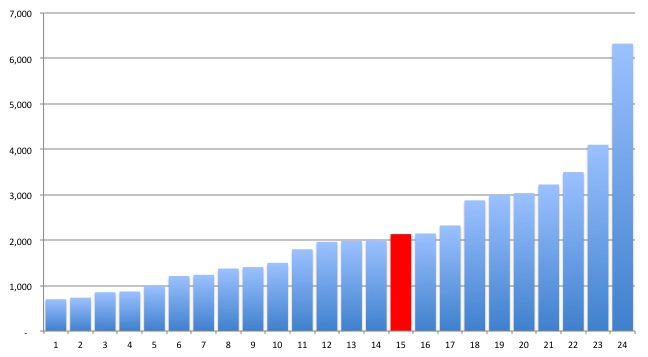

An analysis of those estimates showed that they ranged widely, from a low of 700 to a high of more than 6,000. The actual number was 2,133.

The average of those wide-ranging guesses was 2,137, within 4 of the actual number of 2,133. The amazing part is that it took just 24 guesses to converge on a point that close to the actual.

Which leads us to the somewhat unexpected. Below is another graphical representation of the guesses made, with the red bar showing the closest individual guess.

That closest guess was EXACTLY correct at 2,133. Which leads us to ask: is there such a thing as true skill in M&M counting?

That closest guess was EXACTLY correct at 2,133. Which leads us to ask: is there such a thing as true skill in M&M counting?

We discussed the matter with our own Jennifer Micieli, who was responsible for this amazing feat. Here was her “scientific” methodology:

“I thought the number was somewhere in the neighborhood of 2,000, but I don’t like zeros, so I decided to round up to 2,100. My favorite number, meanwhile, is three. But I didn’t want to guess 2,130 because, again, I don’t like zeros. So I doubled my favorite number, arriving at a final guess of 2,133.”

In the same way, there are always so many active stock pickers in the world that someone is “guessing right,” whatever their methodology. It’s replicability that matters, and every systematic study of “persistence” among successful stock-pickers shows that today’s success is no predictor of tomorrow’s. We’ll be interested to see how well Ms. Micieli performs the next time we attempt a “wisdom of crowds” experiment.

Frankly, the early results of her March Madness bracket are not encouraging . . .