2019 Market and Portfolio Snapshot

While the calendar year is a somewhat arbitrary yardstick for measuring progress, we all naturally organize our thoughts this way. With this in mind, we use this space to share a quick snapshot of what happened in the markets and in our Client portfolios during the year just ended.

While every client portfolio is different, containing different amounts of bonds and cash based on individual needs and circumstances, the stock portion of our portfolios – the main engine of growth – is the same, so we’ll focus on that.

For the year just ended, the stock portion of our Client portfolios had a gain just shy of 22%.

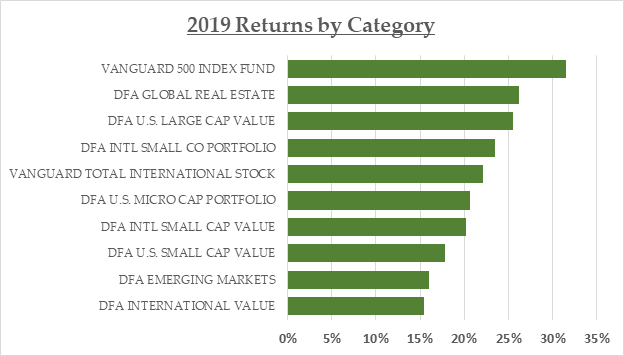

That stock portfolio performance represents a blend of 10 distinct asset classes that we’ve assembled, including both U.S. and International stocks, as well as small company and value stocks. Here’s a breakdown by category.

While U.S. large company stocks as represented by the S & P 500 continued to dominate other categories with a 32% return for the year, Global Real Estate and US Large Value stocks were not far behind at 26%. Overall, seven of our 10 major investment categories returned more than 20% in 2019 and the remaining three all came in north of 15%. For all of the many ups and downs we experienced during the year, markets in general finished quite strong.

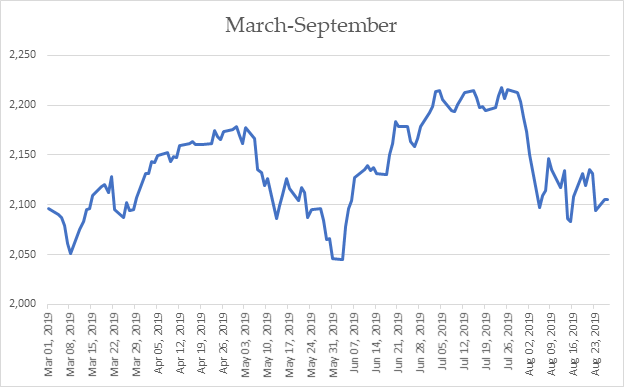

This is another example of how hard it is to judge what’s going on deep beneath the surface of the economy based on market activity over any six or 12-month period, which tends to be dominated by the “noise” created by the daily news cycle. In fact, if you just looked at the middle six months of last year, the All Country World Index looked like it was going nowhere on a roller coaster.

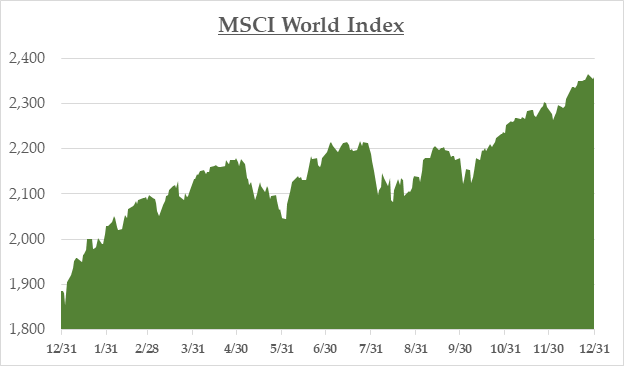

As you can see below, all of the action took place at the beginning and end of the year.

That’s it for our snapshot, but we’ll be conducting a more expansive tour of the economy and the markets during our live webinar on Wednesday, January 15th at 11:00am PT / 2:00pm ET and we hope you can join us then. Register today!