2023 – A Year of Ups and Downs (and Ups!)

Investors went for a ride on the stock market roller coaster in 2023, and what a ride it was. Three facts about the Yeske Buie equity portfolio sum this up succinctly:

-

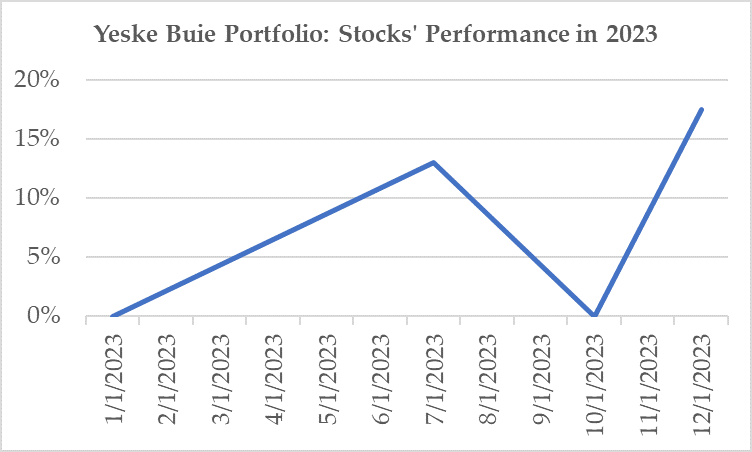

- As of July 31st, 2023, the stocks in our portfolio were up 13% through the first seven months of the year.

-

- As of October 27th, 2023, the stocks in our portfolio were up 0% on the year (i.e. they’d receded so much the gains from the first seven months had evaporated completely).

-

- As of December 31st, 2023, the stocks in our portfolio closed the year up 17.5%.

This is what that looked like (one can guess at what it felt like…):

While we can observe that there is a clear upward-trending line from start to finish, we also appreciate that dramatic movements like this can be tough to stomach. And yet, this is an example of why we always recommend staying the course: while you never know what might happen in the short run, we’re confident that markets will sort themselves out in the long run.

So what were the drivers behind this see-saw action? While we’ll reserve some of our comments and further context for our webinar in a few weeks, we’ll make a few quick notes about the headlines you no doubt consumed last year:

-

- Inflation continued to cool through the first half of 2023, and those encouraging reports coincided with the positive market performance we observed through July.

- Note that the Consumer Price Index reading in July 2023 was 3.0%, a massive improvement from the peak of over 9% just a year before.

- Inflation continued to cool through the first half of 2023, and those encouraging reports coincided with the positive market performance we observed through July.

-

- In an effort to calm the burgeoning exuberance amongst investors, Fed Chairman Jerome Powell issued his now infamous comments about interest rates remaining “higher for longer.”

- Almost instantly, we began to observe a selloff in markets that would continue for three months as investors and analysts worked to update their projections with more conservative assumptions about interest rates and growth in the near term.

- In an effort to calm the burgeoning exuberance amongst investors, Fed Chairman Jerome Powell issued his now infamous comments about interest rates remaining “higher for longer.”

-

- Finally, as we moved into November and December, the good news about inflation continued to flow in with each passing review of the Consumer Price Index (and the Personal Consumption Expenditures index, which is the Fed’s preferred measure of inflation), all leading to the Fed’s announcement in December that, not only were rates not going up any further, but that they’d also begun discussing how rates might come down in the new year. And markets reacted, well, exuberantly.

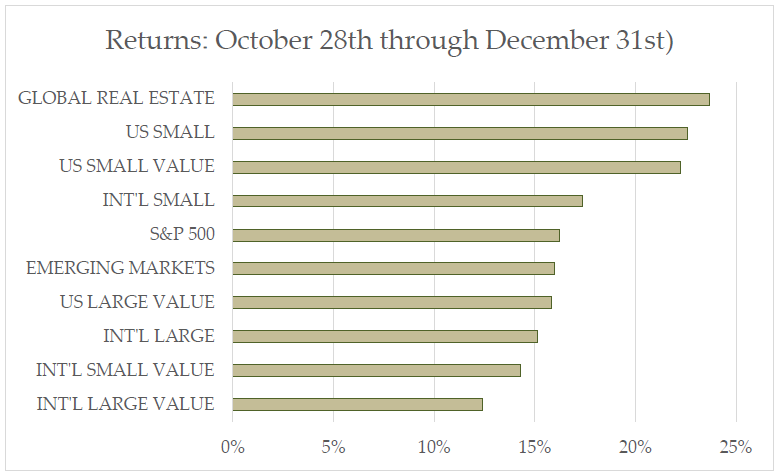

So how good were those last two months of the year? This good:

We’ve been joking internally that November and December were good years unto themselves (and we fully recognize that they are, in fact, months). To summarize, every single component of our stock portfolio was up by double digits. Small company stocks powered the rally, as three of the top five performing investments were small company stock funds (and, of course, our Clients and readers of this digest know that our portfolio tilts in favor of small company stocks relative to the proportion of the market they comprise).

So, all in all, a good year. Has inflation been vanquished? The trends look good, but we’ll reserve final comment on that for another day. Has the Fed achieved the mythical “soft-landing” and cooled the economy without causing a recession? Time will tell, but we’re encouraged by what we’ve observed thus far.

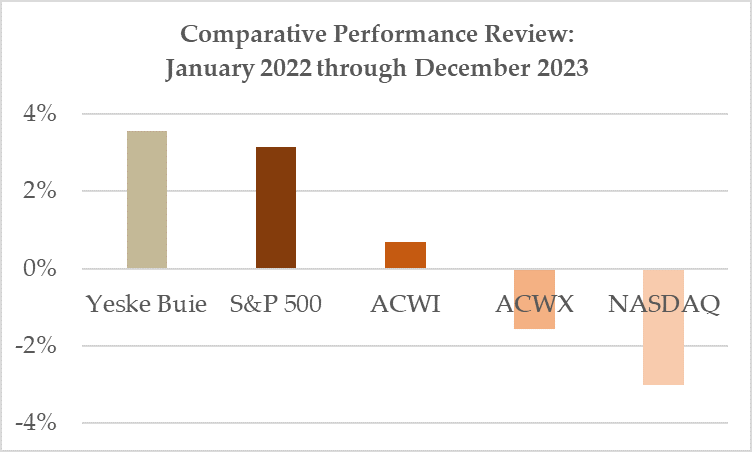

We’ll close with one more bit of good news – if we zoom out just a bit further, we’re gratified to report that, since markets last peaked at the end of 2021, our portfolio weathered the ups and downs of the markets over the past two years better than any of the indices against which we compare our performance:

You may be asking yourself wait, what? Haven’t I been hearing about record-breaking numbers in the markets as of late? (Yes, you have.) But how are the relatively muted returns on the chart above possible given that returns were so good in 2023? Because 2022 was rough for the first three quarters of the year. And our portfolio rode the roller coaster as well as could be expected.

Stand by for our next post in a couple weeks, which will focus on the other side of our portfolio: bonds. In the meantime, we wish you and yours a Happy New Year!

The Yeske Buie Team