2024 Thus Far – Early Returns Are Encouraging

Readers of this digest know that the Financial Planning Team at Yeske Buie keeps a close watch on economic indicators and financial markets – aside from the fact that it’s our fiduciary responsibility, we simply find it fascinating to watch these complex systems process information in real time. And observing how things unfold in markets and economies around the world ultimately tells the story of how these systems digested the issues of the day and how the people who comprise these systems charted a path forward.

It’s a cycle, and cycles repeat, and the stories of these cycles become our history.

We know this, and yet we feel a bit crazy saying to you that, yet again, uncertainty around interest rates due to stickier-than-expected (but not-really-troubling) inflation rates has put a damper on returns in financial markets – after a fast start to the year, April put an end to the party that ran through Q1. It’s not the first time we’ve written about this in recent years (not even the first time this year), and yet the dominant story of the past three years remains the dominant story of the day.

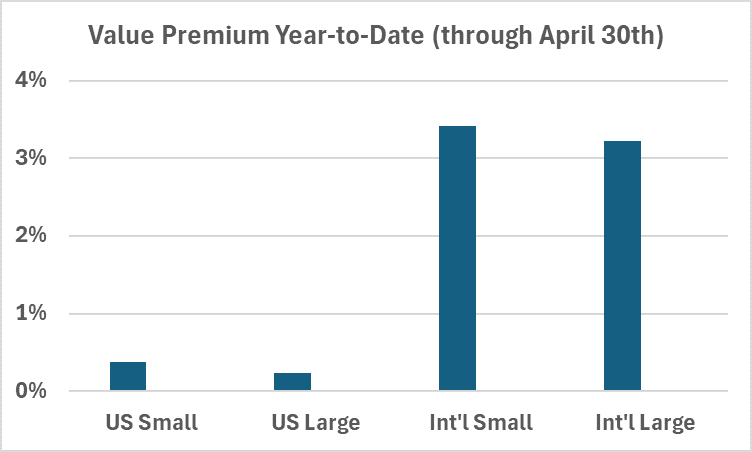

So how’s that been working out for our Clients’ portfolios? We’re gratified to report that it’s working out the same way it’s been working out for the past few years: in a world in which interest rates are rising (or remaining higher than expected, as is currently the case), investors would expect to see value stocks outperforming growth stocks (and our readers know our Clients’ portfolios are tilted in favor of value stocks). See the chart below:

A few notes regarding this illustration:

- In every “quadrant” of our portfolio, the value-tilted fund is outperforming the broader index in each respective asset class. The chart is illustrating the amount by which each value fund is outperforming, this is the “value premium” at work; i.e. the excess returns from investing in value stocks.

- We are even seeing the value premium in the performance of US large company stocks, where the value fund is outperforming the record-setting S&P500 index YTD (through April 30).

- Not the S&P493 or any other subset, mind you, but all 500 stocks, including the whatever-you-want-to-call-them-however-many-there-are Big Tech stocks.

- This is especially true amongst international stocks, where we’re seeing value stocks both small and large strongly outperforming their more expensive counterparts.

This is what we observed over the two-year period from the beginning of 2022, when markets last peaked, through the end of last year, when markets hit new highs. This has also been what we’ve observed over the past six months, when markets hit their most recent low point before taking off at the end of 2023. And it’s what we’ve seen year-to-date, as the Fed continues to manage investors’ expectations, with their most recent guidance providing a lift for markets as they’ve reiterated that, even though interest rates aren’t coming down (yet), they’re not going up, either.

On the topic of interest rates, and given that short-term rates have yet to be lowered, the yield curve is still “inverted” (meaning long-term interest rates are currently lower than short-term rates; while counterintuitive, what this really means is that bond investors expect rates to be lower in the future). That’s been just fine for our bond portfolio, where the two primary funds we employ (the one-year and five-year portfolios) are currently invested in bonds with maturities averaging fewer than three months; we’ll note here the current annualized yield on a three-month treasury bill is 5.4%, so seeing year-to-date returns of ~2% (which annualize to ~5.7%) aligns with expectations.

So, in short, the portfolio is performing as expected, and although modestly so, the portfolio is up year-to-date and positioned well given the current environment. Tune in to our webinar in a couple weeks to hear the story of how markets have performed over the first quarter of this century under the leadership of the past few presidents, and our thoughts on the implications of this year’s election. And for a deep dive on some economic data from a voice that doesn’t belong to one of our team members, see Paul Krugman’s most recent breakdown about inflation and interest rates in the New York Times. In the meantime, keep your eyes on inflation and interest rates (or don’t, but trust that we will, as ever).