A Recession is Coming (Right?)

A recession is coming. In fact, it is always true that a recession lies ahead. Economies operate in cycles and, because the economic cycle repeats indefinitely, we can say with certainty that we are always doing one of two things:

- Living through a recession, or

- Anticipating the next recession’s arrival (though we don’t mean to suggest you should spend daily energy on this, even if the news media thinks otherwise!).

We’ve been in a holding pattern for the last couple of years waiting for the impending recession that would follow the COVID crisis of 2020. And we’re still holding. The question is why that’s the case – how is it that despite the issues the world’s economies have faced in recent years we’ve not seen economic growth contract? And it’s not just that growth hasn’t contracted, the economy is chugging along healthily, and financial markets are performing well:

- Estimated GDP growth in the second quarter of 2023 (2023-Q2) is 2.4%, up from 1.5% in the first quarter of this year.

- Rather than fearing another rate cut, some economists are arguing that the Fed is posturing when it says it will raise rates again this year.

- Since September 30 of last year, stocks around the world are up by more than 25%.

- And the Volatility Index (VIX, the market’s “fear gauge”) recently hit its lowest levels since January 2020.

- And although the yield curve has been inverted since March of 2022 (meaning the yields on longer term bonds are actually lower than those of shorter term bonds, which is counterintuitive from a risk-reward perspective), this particular inversion has yet to portend a recession and investors have been able to capitalize on attractive returns on “safe investments.”

- We’ll have more on the yield curve and recessions in our third segment below.

While it is impossible to address all of the variables that play into this discussion, we’re going to focus on the three aspects we think are most relevant to our Clients’ lives.

Inflation

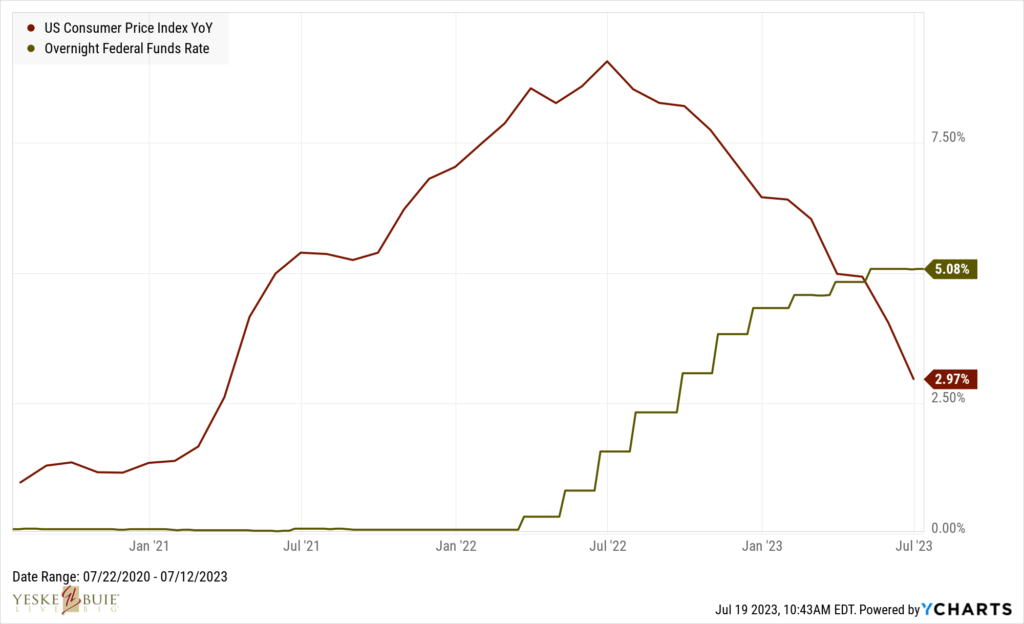

We’re starting to talk about being tired of talking about it, too (that’s a Fed joke). Since inflation popped up to 5% in May of 2021, it has dominated the discussion about the health of the economy and financial markets.

And since it peaked a year ago at 9.1% (just after the Fed started raising interest rates), we’ve gotten nothing but good news on inflation (i.e., decreases in the headline Consumer Price Index [CPI] rate), including last week’s reading of just below 3%, down from 4% in June.

While we cannot pinpoint a singular reason for this, we can make the following assessments confidently:

- Supply chain issues that stemmed from the COVID crisis have abated considerably; this eases the supply-side pressure on price increases.

- Much of the savings glut that consumers accumulated during 2020 has been spent down, so there aren’t quite as many dollars chasing the available goods and services; this turned down the temperature on prices from the demand-side.

- The Fed’s aggressive rate increases have helped to achieve the stated goal of bringing down the inflation rate; higher interest rates make things more expensive and curb spending, which further reduces upward pressure on prices.

The chart below tells the story of the past three years efficiently – you can see the trend of the red line (CPI) moving downward as the green line, representing interest rates, has been rising incrementally.

And for what it’s worth, we, too, are skeptical of another rate increase coming out of the Fed’s meeting at the end of the month (but we don’t make predictions!). The data just doesn’t seem to warrant another hike, even if it’s only 0.25%. What feels like a better fit is that the Fed is posturing to set investors’ expectations appropriately about what’s to come – although inflation is trending in the right direction, the Fed is likely trying to avoid irrational exuberance taking over financial markets and sending prices upward too rapidly. We’ll see how things play out over the next couple weeks.

Which brings us to the other half of the Fed’s dual mandate…

The US Labor Market

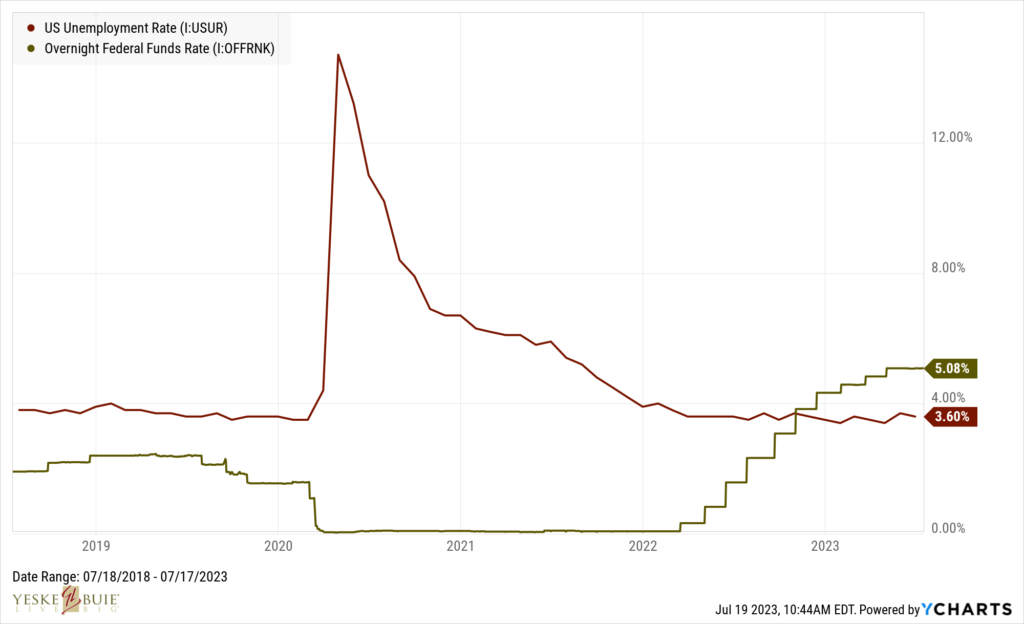

As of the most recent readings, we can make the following observations:

- There are just under 6 million unemployed workers at present.

- There were close to 23 million unemployed workers in the spring of 2020.

- There are currently just under 10 million job openings.

- This figure was running near 4.5 million in the spring of 2020.

- The unemployment rate is 3.6%.

- Since July 2018, the unemployment rate has decreased by an average annual rate of 1%, despite the fact that the unemployment rate spiked to nearly 15% in the spring of 2020.

So, given these statistics, we can make the following statements:

- Since the height of the COVID crisis, the number of unemployed persons has decreased by ~75%;

- We’ve doubled the number of available jobs; and

- The unemployment rate is sitting at its lowest level in 50+ years.

But wait, why are we focusing so much on the labor market?

Because the Federal Reserve has a dual mandate, and Chairman Powell has said time and again the Fed will continue to use the labor market as an indicator in determining whether to raise interest rates. Again, the chart below tells a punchy story: even though the Fed has worked aggressively to stem the effects of inflation, it hasn’t killed the job market – in fact, although the number of new jobs created has slowed, we still added more than 200,000 jobs as of this month’s report and the economy is running at full employment (the Fed’s target is an unemployment rate at or below 4%). This time, the red line represents the unemployment rate (yes, the unemployment rate has actually decreased as rates have increased).

And so that just leaves us with one more bit to review – what’s been going on in financial markets and the economy?

Markets/Economy

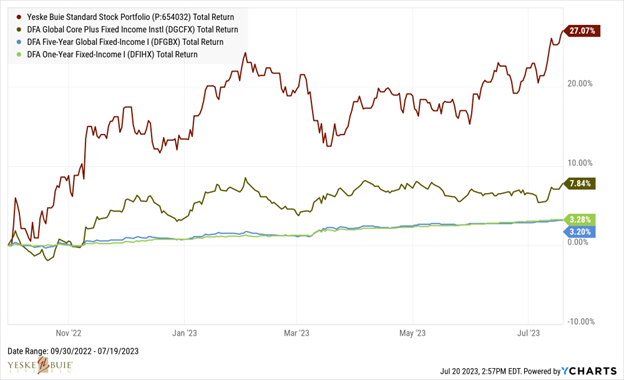

As we’ve mentioned, markets have been on a tear since the beginning of the fourth quarter of last year. Over the past 10+ months, stocks around the world are up by more than 25%; the Yeske Buie stock portfolio is up 27% since then and has returned 12% year-to-date.

And it’s not just stocks – the bond market has been performing well, too. Our shorter-term bonds are up 3% since last October, and longer-term bonds in our portfolio have returned more than 7% over the same period.

Of course, as our readers are aware, financial markets and the economy are related beasts, but not the same animal. So how has the economy been performing?

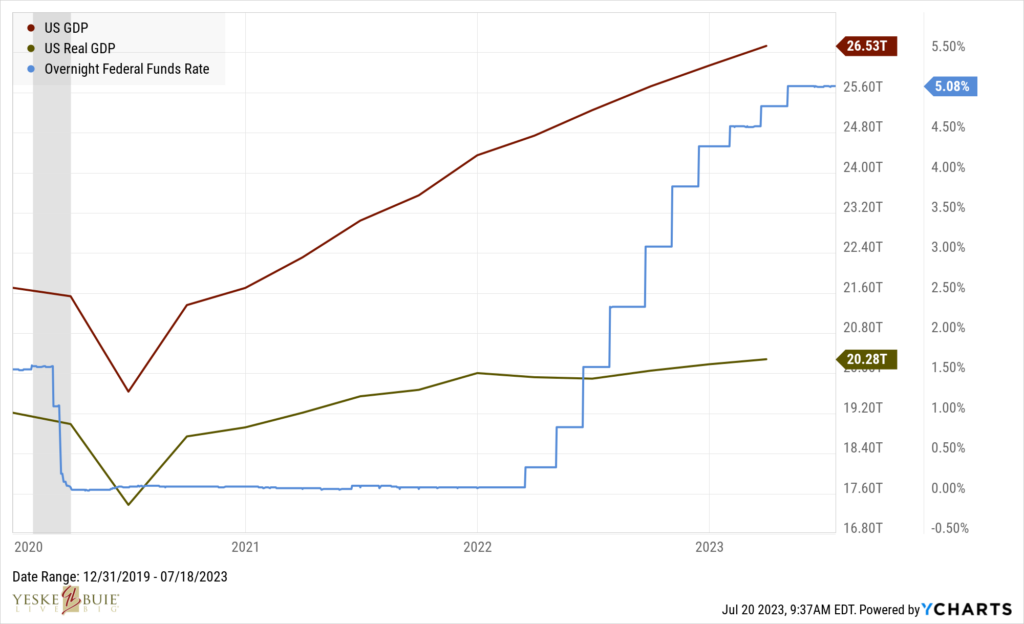

The final chart in this piece demonstrates the following:

- GDP has been growing at an average annual rate of 6.4% since the beginning of 2020.

- And that includes the dip in 2020-Q2 when economic activity ground to a halt.

- Real GDP (inflation-adjusted) has been growing at an average annual rate of 1.7%

- And that includes both the dip in 2020-Q2 and two consecutive quarters at the beginning of 2022 when growth actually contracted – note that while this period has yet to be called a recession, it meets the classic definition of one and coincides with the timing of the yield curve’s inversion.

- Interest rate hikes haven’t dampened economic activity over the past year.

So, to recap: a recession is coming. When? No one really knows, as evidenced by the countless prognostications about a recession coming in the next six months for the past two years. And it’s possible one slipped right under our noses a year ago.

What’s more important to focus on is that the evidence suggests the economy is performing well, and we can observe that financial markets are recovering well from the first three quarters of 2022. And that’s encouraging news considering what we were told to expect in the first half of this year.

Onward into the second half of 2023!