Bitcoin Blues: Sometimes It Pays to Be Boring

We’ve made our position about Bitcoin clear in the past: we don’t think of it as a good fit for our Clients for a variety of reasons, including:

- It has an intrinsic value of zero;

- It’s not the most liquid investment, and it can be challenging to sell your holdings when prices are changing rapidly; and

- It’s extremely volatile (we’ll have more to say on that in the space below).

Recently, Bitcoin has been making headlines for all the wrong reasons. Before we dive into current events, however, we thought it might be useful to look backward at Bitcoin’s historical performance. We’ve organized this piece by themes, with each theme referencing a quote from Warren Buffett, one of the most well-known (and generally regarded as one of the best) investors of all.

“Nothing sedates rationality like large doses of effortless money.”

Bitcoin believers make it sound so simple – buy Bitcoin, get rich. But is it really that easy?

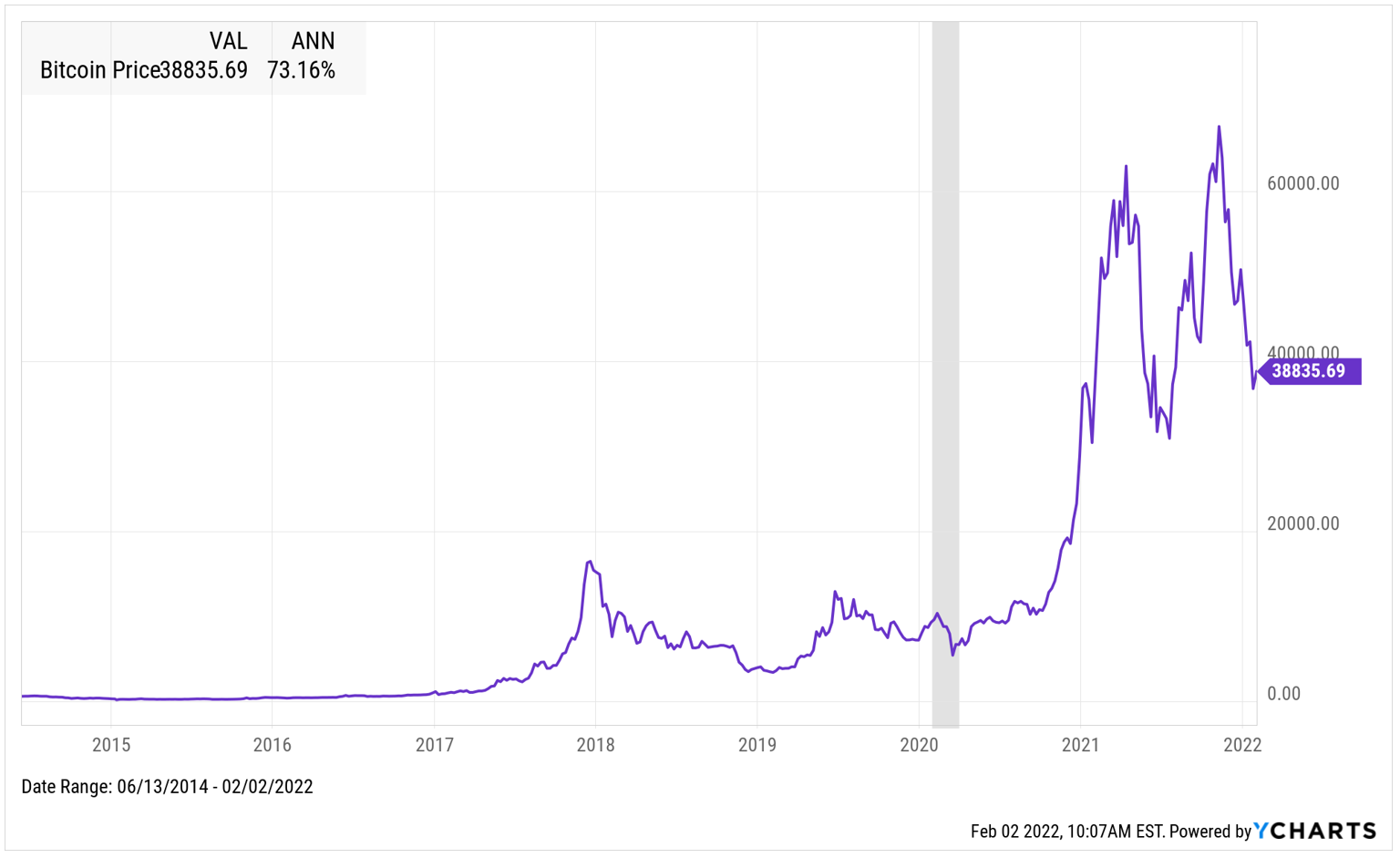

Bitcoin burst onto the scene as a hot alternative investment nearly a decade ago. Our database tracks its price as far back as June of 2014, when a single Bitcoin was valued at less than $600, a quaint sum given what we know now. The price remained relatively steady for years, and then rose dramatically at the end of 2017, peaking at almost $20,000 at the time. A buying frenzy ensued. Shortly thereafter, it all came crashing down, and Bitcoin was trading at less than $7,000 by April of 2018. Its slide continued into the following year – in February of 2019, Bitcoin was trading below $3,400.

It wasn’t until December of 2020, nearly three years after it hit its first peak, that Bitcoin returned to the $20,000 mark. It continued its climb from there, peaking above $63,000 in April of 2021. Three months later, however, it was down by more than 50% (an important demarcation which we’ll return to later) and was trading below $30,000.

Bitcoin would peak again in November of 2021, hitting an all-time high in excess of $69,000. The drop since has been precipitous and difficult to explain (as have been the seemingly random increases in value). But we can say this with confidence: each peak has attracted more and more investors, many of whom buy in at the wrong part of the curve (remember, it’s “buy low, sell high”, not the other way around). What looks like easy money simply isn’t, and investing in something that doesn’t actually have an intrinsic value can be a dangerous gamble. The extreme volatility has left many with fewer dollars than they began with.

“Speculation is most dangerous when it looks easiest.”

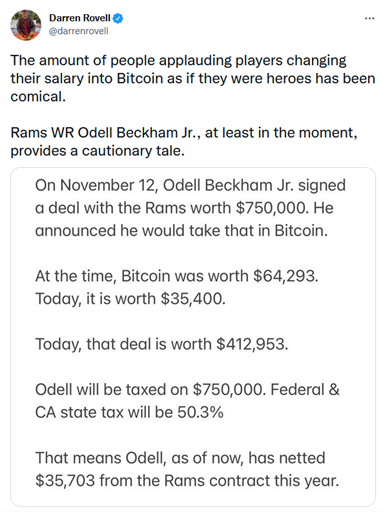

We can turn to an example from the National Football League to paint this picture clearly. Odell Beckham Jr., one of the most recognizable faces in the sport, recently signed with the Los Angeles Rams (Super Bowl LVI Champions). He signed his deal on November 12th, just three days after the price of Bitcoin peaked. Why is this relevant? He opted to have his entire salary paid in Bitcoin. And, so far, he’s getting burned:

And he’s not alone – the Most Valuable Player of the league (Aaron Rodgers), the greatest football player of all-time (we begrudgingly admit that it’s not up for debate, and it’s Tom Brady), and the first overall pick in this past year’s draft (Trevor Lawrence) have all received some portion of compensation in Bitcoin. And the examples extend further in the league, amongst other sports, and of course outside the sports world. Notably, New York Mayor Eric Adams pledged to take his salary in Bitcoin and converted his first paycheck into the cryptocurrency on January 20th, only to see its value drop 10% on the same day.

“Attempt to be fearful when others are greedy and be greedy when others are fearful” . . .

There’s no avoiding the truth: if you got into Bitcoin early (or bought some at the right time in the intervening years), and if you held onto your coins, you’ve done incredibly well. The average annual return since June of 2014 is over 70% per year. And we know there are lots of crypto millionaires out there. We also know there’s no avoiding the rest of the truth: luck played a significant role in the story of anyone who has made money in the crypto arena, as is the case with any speculative investment. Any investor who engages in speculation is trying to capitalize on the Greater Fool Theory, hoping that they’ll be able to sell their “investment” down the line to someone else who, perhaps foolishly, expects the price to keep rising. After all, why sell if you think the price is going up?

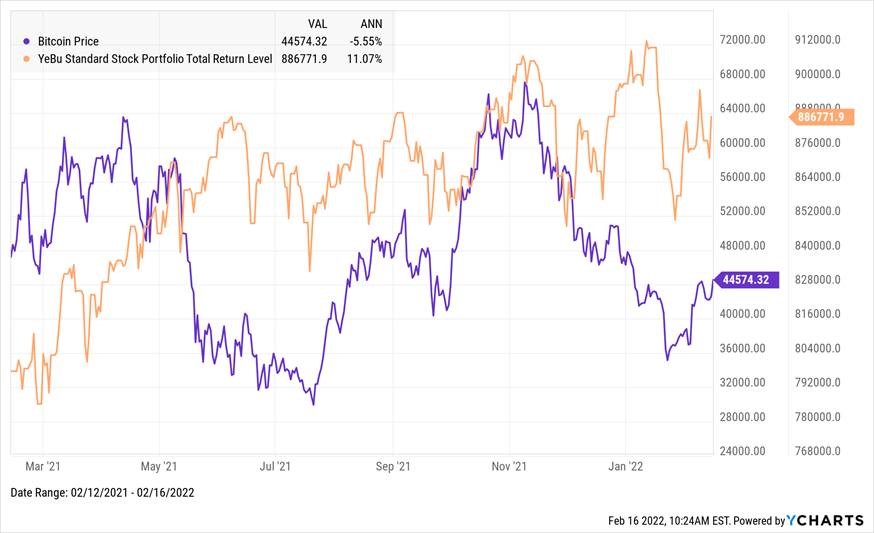

We recommend a more prudent approach to investing, one that relies on fundamentals and evidence to make grounded, disciplined decisions. It may not be the most exciting approach, but it works. Consider this: since June of 2014, our stock portfolio has earned an average annual return of 7.44% (in spite of the fact that this time period includes the bear market at the end of 2018, as well as the COVID crash in 2020). And while Bitcoin’s returns have exceeded that figure by a factor of 10, we also note that it’s SEVEN times riskier than our portfolio (as measured by the standard deviation of its price fluctuations). We think the chart below tells a story that’s a bit too scary for our taste:

Although our database only goes back to 2014, this quote from Ross Mayfield, Chief Investment Strategist at Baird Private Wealth Management, notes that Bitcoin’s volatility “is well above more traditional investments” and that it “has seen seven drawdowns of 50% or greater since 2012 alone; the S&P500 has had fewer over the last century.” (emphasis ours).

Which brings us to another of our most favorite market-related quotes: “Bulls make money, bears make money; pigs get slaughtered.”

“What the wise do in the beginning fools do in the end.”

As readers of this digest know, our stance is that taking a diversified approach to investing is the approach that best serves investors in the end (and also at the beginning, middle, and every other part of their investment horizon). And how has that approach done as of late? Over the past 12 months, which includes Bitcoin’s most recent peaks, our portfolio has outperformed Bitcoin by a considerable margin (more than 16%):

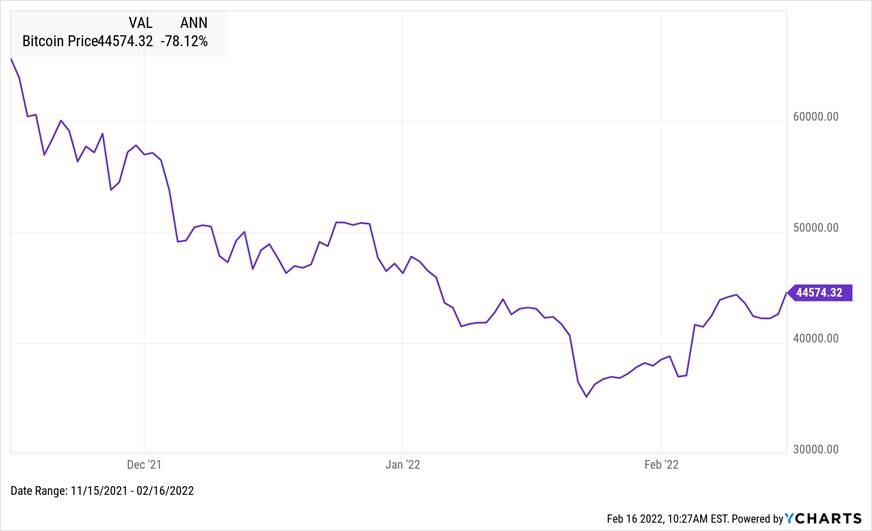

We’ll conclude with this, harkening back to our post from a few years ago: if you watch the funny video we’ve linked at the bottom of our piece, the actor makes a claim that you should have bought in three months ago (and that you’d have tripled your money had you done so). We find that fascinating and too convenient to not highlight. Fast forward to the present, and if you’d actually bought in three months ago (through February 16th), you’d have lost your shirt – more than a third (35%) of the value has evaporated, and the annualized return is -78%. Sometimes it pays to be boring.