Debt, Deficits, and Default: Dancing with Disaster

The government has now been “shut down” for 11 days and we face the further threat of a default if Congress fails to raise the U.S. debt limit within a week. While the former is painful, ever more so the longer it lasts, the latter would be truly disastrous. We’ll detail why a default would be so calamitous below but allow us to say first that we do not believe Congress will allow this to happen. And not just because it has never happened before in the 96 years since the first debt ceiling was enacted. We’re more comforted by the evidence, circumstantial though some of it may be, that congressional leaders are aware of how damaging such an outcome would be to the U.S. and world economy. Even as we write, there are reports that leaders in the House have offered a “clean” short-term extension to the debt ceiling that would carry the Treasury through November 20. The Dow Jones Industrial soared more than 300 points Thursday on the possibility of just such an extension.

To paraphrase Winston Churchill’s observation about Americans in general: we can always count on Washington to do the right thing, but only after exhausting every other possibility!

We thought we would take a few minutes to outline the economic and financial implications of the ongoing government “shut down” and the (hopefully remote) possibility of a government default. Along the way, we will also offer some historical context and cause for optimism with respect to the trajectory of federal deficits, which have been at the heart of Washington’s budget debates.

The Federal Government “Shut Down”

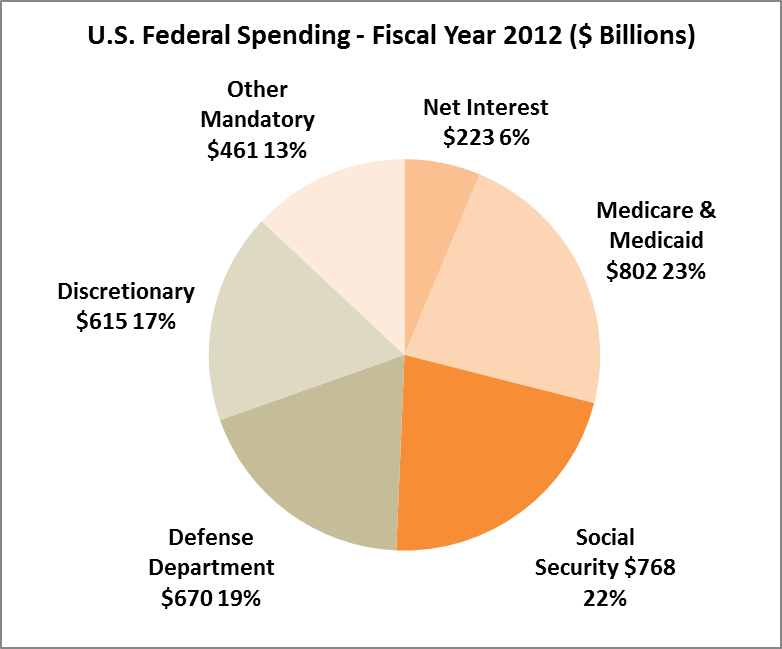

We’ve put quotation marks around “shut down” because it is not the case that all government functions and spending have ceased, only the “discretionary” portion. As you can see from the pie chart below, Medicare, Social Security, interest on the debt, and other mandatory spending made up 64% of the government’s total spending in 2012 and these expenditures will continue in the face of the shut down. It is the remaining 36% of the budget that requires Congressional authorization each year.

The Defense Department and other discretionary spending that remains, however, represents nearly 8% of our Gross Domestic Product on an annualized basis and when this money isn’t being spent, it puts a measurable drag on economic activity. Mark Zandi of Moody’s Analytics estimated that economic growth in the fourth quarter could be reduced by as much as 1.4% on an annualized basis if the shut down continues for three to four weeks. According to the Federal Reserve Bank of Philadelphia, the median forecast for annualized fourth quarter growth was 2.7%, suggesting an extended shut down would have a measurable impact. Among other mitigating factors, however, was Secretary of Defense Chuck Hagel’s decision a few days ago to call back almost all of the Pentagon’s 350,000 furloughed employees.

The bottom line is that the shut down creates an unnecessary drag on the economy, but, unless it persists for more than a few weeks, the impact will be short-lived and shouldn’t create too much disruption in the financial markets.

The Debt Ceiling and the Risks of Default

The issue of the debt ceiling is by far the scarier of the two. This is for a number of reasons, including the following:

- It could lead to a default on U.S. Treasury bonds.

- Interest rates would almost surely spike.

- Financial institutions that use Treasury bonds as collateral would be scrambling for alternatives.

- Clearing systems for financial transactions, not being programmed to process defaulted Treasurys — it was always considered a practical impossibility — would freeze.

Some politicians, on the other hand, have suggested that the U.S. government could prioritize the payment of interest, using revenues as they roll in.

To begin with, this may actually be impossible in the short-run. As Tony James pointed out in Wednesday’s Wall Street Journal:

Other than interest on U.S. government debt, which is paid through the Fedwire system, the Treasury makes over 80 million individual payments each month through a computerized payment system.

When a legitimate obligation of the government is submitted, it is paid. Paying all of certain obligations, part of others and none of some would require a massive reprogramming of complex systems in an impossibly short time. Even if this task were technically possible, choosing among claims for special treatment is of questionable legality and would surely be the subject of massive lawsuits for years to come.

Secondly, even if it was possible to prioritize in this fashion, federal spending would be cut by an amount equal to 4% of GDP, which would, in a world where the U.S. economy is growing at a 2.5% rate, throw us back into recession if this state of affairs persisted for an extended period of time.

The U.S. and its citizens have long derived enormous benefits because the dollar was the world’s reserve currency. It would be a tragedy to give that up over issues that are better resolved by other means.

A Note on Spending and Deficits

Although the original impetus for the government shut down was a demand by House Republicans to defund or delay the roll out of the Affordable Care Act (aka Obamacare), much of the dialogue has also centered around the unsustainability of federal spending levels and the additions to the nation’s debt load. Although these are always matters that should be taken seriously, there are a number of developments that suggest this is not our biggest risk at the moment and that the trend of the recent past is rapidly reversing itself.

As the outstanding U.S. debt approached an amount equal to our Gross Domestic Product (GDP), much was made of a study by Reinhart and Rogoff that seemed to suggest that when a country’s debt passed 90% of GDP, there would be a notable slowing in economic growth, with all of the ills that entails. What many people missed, however, was the discovery earlier this year that the Reinhart-Rogoff research was flawed as a consequence of errors in their spreadsheet. Subsequent analysis by other economists suggested that there was, in fact, no relationship between a country’s level of public debt and the level of economic growth. As for high levels of government borrowing leading to higher inflation, we need look no further than Japan to see that this is not a given. In Japan, government debt stands at nearly twice its GDP and yet the country has spent most of the last decade fighting the pull of deflation, not inflation.

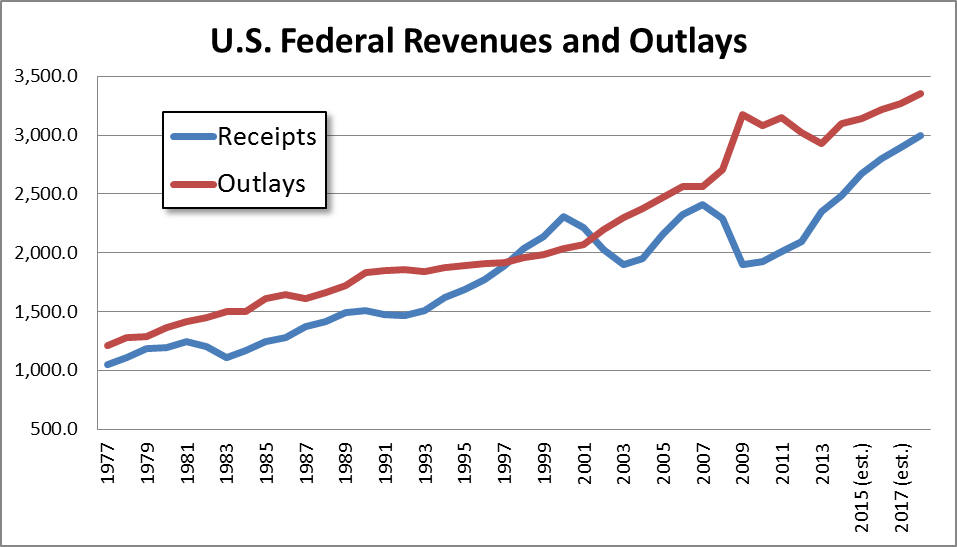

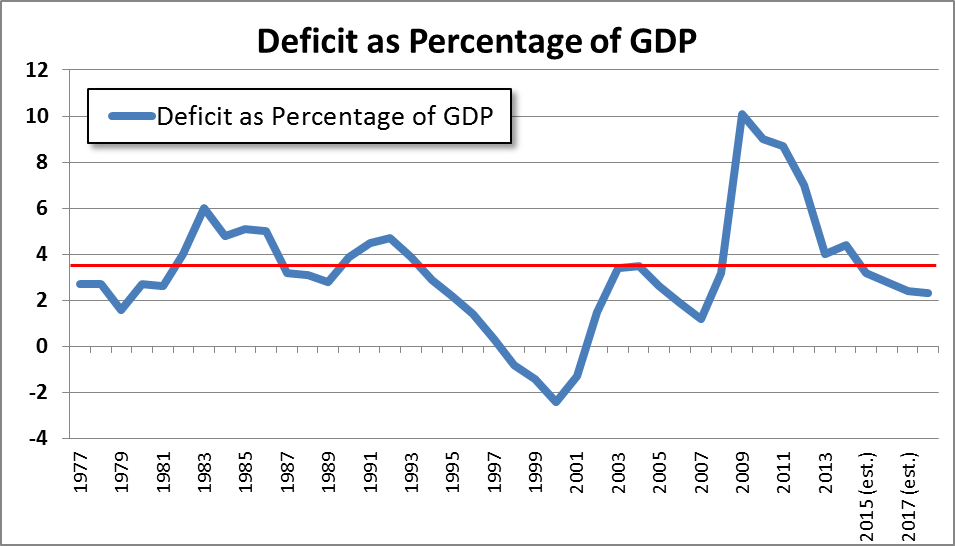

Most importantly, as a consequence of continued economic growth, the natural winding down of the stimulus packages passed in 2008 and 2009, and the further impact of the “sequestration” cuts, the federal government’s budget deficit has been rapidly falling. The Congressional Budget Office (CBO) earlier this year dropped its estimate for the deficit in fiscal year 2013, which closed on September 30, to $642 billion. This compares to a 2009 high of $1.4 trillion at the worst of the financial crisis. Of course, those trillion dollar deficits were a direct result of the crisis and accompanying recession. During recessions, deficits are almost invevitable since government tax revenues fall even as automatic stabilizers, like unemployment benefits, are kicking in. If we look at the history of government deficits since 1977, we can see that the government has almost always run deficits. Nor is it necessarily harmful to do so! As long at the federal government’s deficits as a percentage of GDP don’t exceed the rate of overall economic growth, the debt burden remains constant as a proportion of GDP. The charts below show both revenue & spending (in constant 2005 dollars), and the deficit as a percentage of GDP from 1977 through 2018 (future years are CBO estimates). The red line on the second chart shows the average deficit as a percentage of GDP over the full period, which was 3.22%.

As you can see, in the near-term, the trends are all in the right direction. It’s true that the CBO also projects growing deficits in later years due largely to rapidly rising Medicare expenses, projecting that the deficit will rise to 6% of GDP by 2038. However, these are problems that can and should be addressed as the long-term issues they are, rather than crises that require immediate and draconian cuts. Especially at a time when the U.S. economy is still recovering from the after-effects of the economic meltdown of 2008/2009.

How to Navigate the Political Uncertainty

In the end, we’re left with the question of what to do as individuals to safeguard our financial well-being in the face of possible economic turmoil that may arise from policy fights in Washington. It was interesting to note that right up through the first day of the shut down, the stock markets were rising, only beginning to slip as it became clear that the shut down might persist for more than a day or two. Talk of a possible short-term compromise sent markets soaring today, but we can anticipate more volatility in the coming days and weeks as the politics work themselves out. We believe there will ultimately be a resolution to the current budget impasse. We also believe that the “nuclear option” — failing to raise the debt ceiling and opening the possibility of a federal default — is highly unlikely, notwithstanding the rhetoric of the moment. Meanwhile, we can hope for a grand bargain that combines desperately needed infrastructure investment in the short-run with prudent entitlement reform aimed at bending the government’s cost curve in the long-run . . . but we aren’t holding our breath.

One of the most heartening things we’ve seen throughout this recovery is the fundamental resilience of the U.S. economy. We believe that the U.S. and world economy will continue on the path of recovery, faster or slower, depending on government policies, but upward in any case, and that prudent, long-term investors will be able to harness that growth and reap the rewards that go to the far-sighted.

Wishing you a peaceful weekend.

The Yeske Buie Team