Diversification: Around the World in 10,000 Stocks

Being globally diversified amongst a broad array of asset classes helps to shield your investments from some of the downside risks and is an important part of ensuring that your portfolio has the staying power to ultimately support your Live Big® goals. Diversification has become a well-accepted idea, but how exactly does it work? Let’s take a deeper look into this concept.

To start, what does diversification mean for us? The following is a summary of how we diversify our Clients’ investments across several dimensions, which you can read about more here:

- Globally: The stock portion is split amongst domestic and international investments in the same proportion as the world market capitalization.

- Investment Types: We spread our Clients’ assets among various types of investments including small and large company stocks, value and growth stocks, bonds, real estate securities, and both developing and emerging markets’ stocks.

- Within Categories of Investments: To capitalize on opportunity to invest in the aforementioned categories, we use mutual funds to ensure our Clients’ investments are broadly diversified by spreading your investments across more than 10,000 stocks around the world

- Across Currencies: Our portfolios are not hedged against exchange-rate risk. This means that our Clients’ international investments are denominated in those countries’ respective currencies, ensuring that our portfolios are not “prisoners” of a single currency’s strength.

Understanding what diversification is sets the foundation, and today we want to take that a step further and explore…

“How does diversification work?”

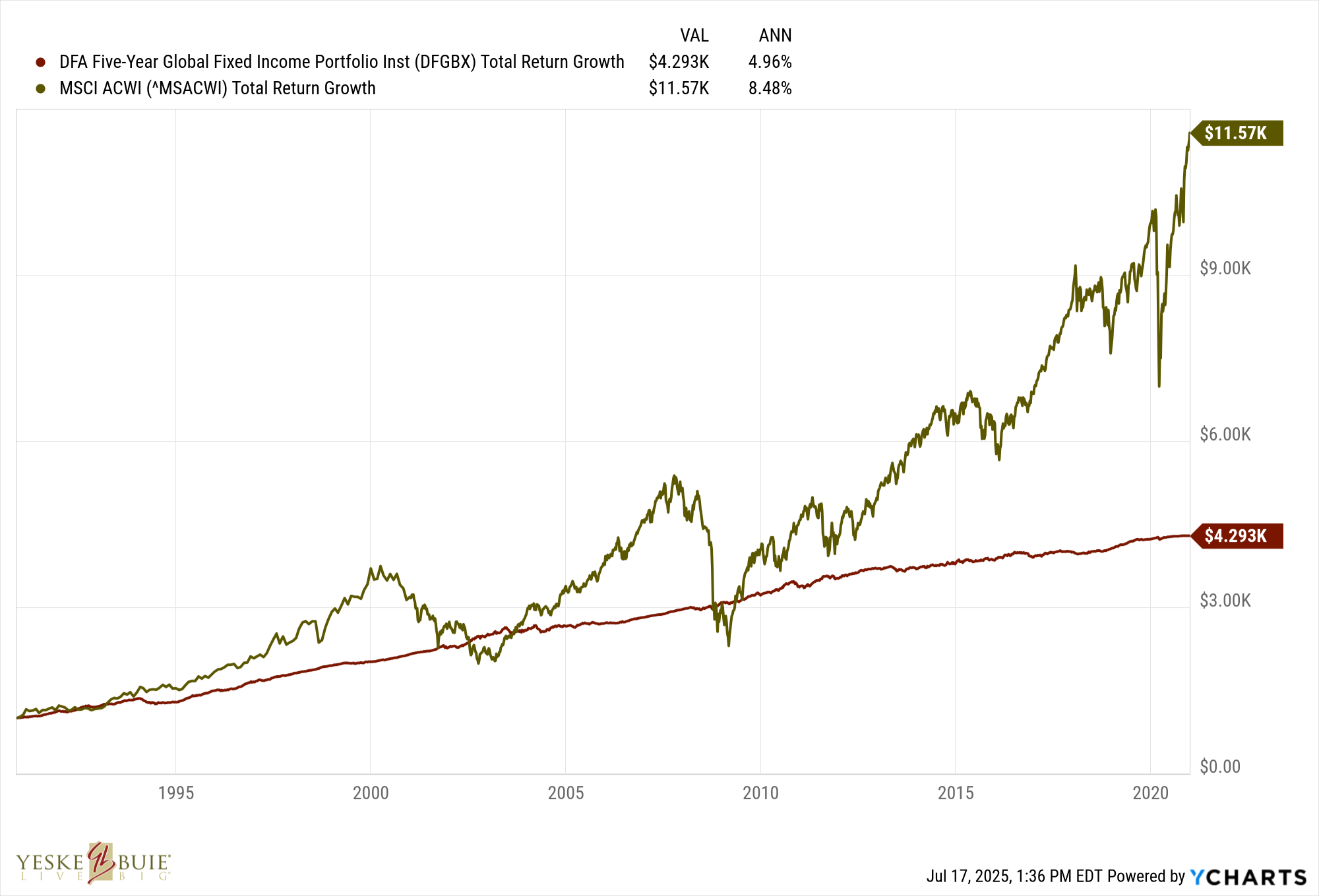

One of the benefits of diversification can be shown by looking at how individual stocks have performed over a 30-year period. In a study conducted by Bessembinder et al., the authors tracked the performance of 17,800 U.S. stocks and 46,700 international stocks month by month from 1990 to 2020 to specifically determine how much value, if any, each stock contributed to wealth creation above short-term U.S. bonds at the end of the period. Over that period, we know the global stock market performed well, as visualized below. A long-term buy-and-hold strategy would have rewarded an investor for holding a globally diversified basket of stocks, but the results of the study speak to one of the core reasons why we are such big believers in diversification.

Researchers found that 1,500 companies accounted for all — not some — all net wealth creation! If we zoom in even more, 10% of all net wealth created by global markets could be attributed to five companies. The overall returns of this small subset of stocks throughout the period are what helped globally diversified investors reach their goals. Maybe equally as surprising, the study shows that the value created by the majority of stocks failed to outpace the returns of short-term U.S. Government bonds, let alone a relevant stock comparison. Still, the global “haystack” performed quite well, meaning your portfolio could afford to hold the underperforming stocks in the market as long as it held all the winners, too.

Ownership and Mitigating Risk

There’s no telling how the next 30 years will shake out, but if the next great market-moving companies are already out there, your globally diversified portfolio probably already owns them. And, if they haven’t been established or aren’t yet publicly traded, you’ll likely own them when the opportunity arises.

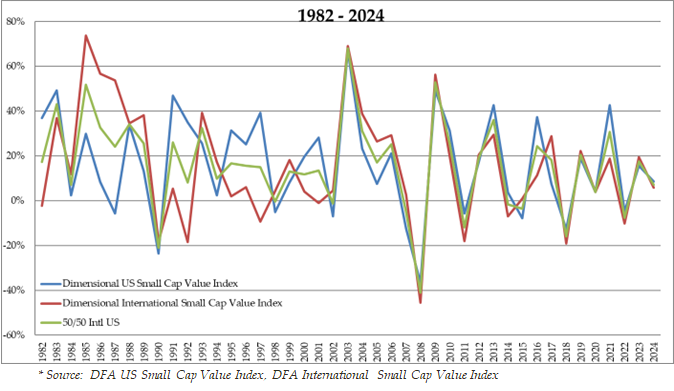

The study showed stocks at the individual level can be risky, even if stocks in the aggregate were well-worth their risk. Still, understanding the payoff doesn’t negate the risk found in aggregate stocks. Just ask anyone who has watched the wild day-to-day swings that can happen in the market. Diversification can, again, play a starring role in affecting better investment outcomes.

As the graph above shows, when you start blending risky assets, you start seeing a “smoothing” effect — that’s the green line. Even though stocks share characteristics, they don’t always move in the same way or at the same magnitude; some stocks zig when others zag. This smoothing may not only make it easier to sleep at night — it actually improves performance!

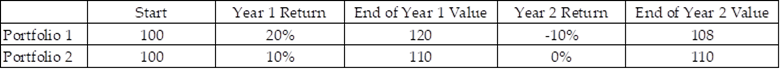

We can compare two simple portfolios to illustrate the point in another way:

What you’ll notice is that, despite having the same average return of 5%, Portfolio 2 ended with a higher value. A diversified portfolio will never do better in any given year than its best performing component, but it will also always do better than its worst performing component. Don’t discount a smoother ride.

Diversification is a powerful concept, and, at times, it works in understated ways. It rarely makes headlines but, over time, it helps to ensure that your portfolio has the staying power to ride out the ups and downs and, ultimately, support your Live Big® goals. If you’d like to have a deeper conversation about any of the content in this piece or otherwise, our investment gurus are just a message away!