How Low Will Stocks Go?

It was only a few short weeks ago that we got together for our webinar on April 21st (Russia, Inflation, and Oil – Oh My!), and since then financial markets have had an ugly run. Through May 11th, both the S&P500 and the MSCI All Country World Index (a global index of stocks that we use as our benchmark) are down more than 17% year-to-date, with both indexes falling by ~10% in the past three weeks.

While we’re gratified that our portfolio of stocks has outperformed both indexes by nearly 4% thus far in 2022, we acknowledge that it’s a scary time for our Clients and investors around the world. And although financial markets are constantly trying to digest the latest news, the topics we focused on in our webinar continue to dominate the headlines. Given that, we thought we’d spend a few moments addressing each of those same topics, providing an update and a reason to be encouraged about what might lie ahead:

The COVID Economy

- Update: While daily cases have been rising as of late, COVID-related hospitalizations and deaths continue to remain relatively low as compared to other periods of the pandemic. Also, lockdowns in China continue to present challenges to economic growth by contributing to supply chain disruptions, which have been a driver of higher inflation.

- Looking Ahead: Despite rising case numbers for the first time since the conclusion of the Omicron wave, the following statements are true (not to mention encouraging):

- US GDP (Gross Domestic Product, the measure of all economic output) is still on track to grow by 3.5% year-over-year (the 10-year average growth rate is ~4%).

- The unemployment rate remains at 3.6% after the economy added another 428,000 jobs in April (the fourth straight month of adding >400,000 jobs).

Inflation

- Update: Earlier this week, the Bureau of Labor Statistics released the most recent inflation reading, noting that the CPI (Consumer Price Index) had increased by 8.26% over the past year.

- Looking Ahead: While this figure is still relatively high, it’s down from 8.5% at the prior reading (this is the first time the rate has decreased in eight months). And there’s a growing sense that inflation may have peaked:

- Oil prices, which have been a major driver of inflation as of late, seem to have stabilized for the time being.

- Lockdowns in China notwithstanding, supply chain issues are easing in many other parts of the world; shipping costs are falling and congestion at ports is dissipating.

- Housing costs have been a major driver of inflation, and with interest rates going up the costs of borrowing money are increasing, too (mortgage rates are exceeding 5% for the first time in a decade). This may cool the housing market and have a positive effect on inflation going forward.

- Lastly, although inflation is currently >8%, Treasury Inflation-Protected Securities (TIPS) are currently yielding ~3% over the next 5-10 years, meaning the outlook for inflation over that time period is much lower than the current figure.

Russia/Ukraine War

- Update: The conflict has continued for nearly three months, inflicting significant stress on energy and food prices globally, not to mention the tragic loss of lives and the displacement of millions of refugees.

- Looking Ahead: There is a growing sense that Russian President Vladimir Putin does not think Russia can win the war with Ukraine and may be looking for a way to back out; last week’s UN Security Council meeting called for a peaceful resolution and, for the first time since the invasion, the Russians did not respond with a veto. Perhaps peace talks are on the horizon.

The Fed/Interest Rates

- Update: As expected, the Fed raised the base interest rate by 0.5% at its last meeting and plans to continue with a series of rate hikes through the end of the year.

- Looking Ahead: Thus far, it appears the Fed is striking a balance between tightening its monetary policies without handicapping economic growth. The Fed continues to project that inflation will be below 3% by the end of next year.

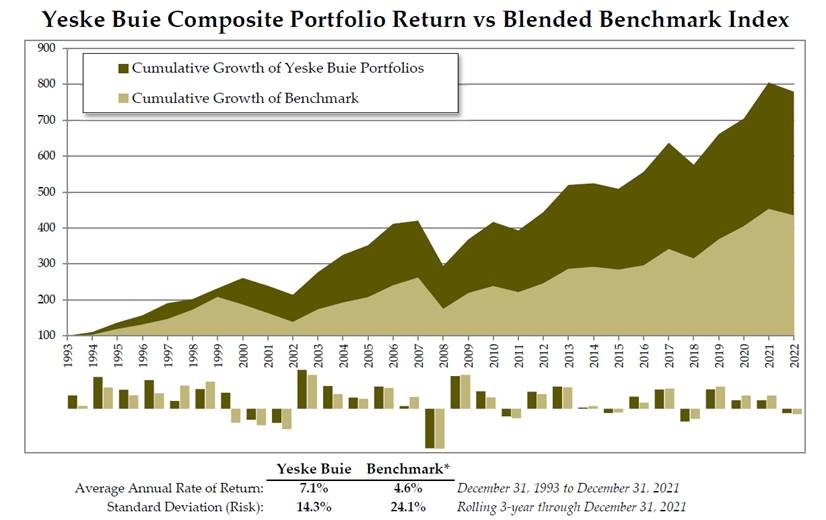

As readers of this Digest know, the Yeske Buie Team is constantly working in service of our Clients’ needs and seeking to capitalize on the opportunities provided by the ever-changing circumstances the world throws at us. Given how volatile markets have been, we’re looking for rebalancing opportunities daily, and we’ve been taking advantage of opportunities to harvest losses in many Clients’ portfolios to offset income and reduce their taxes. And we’re constantly surveilling the landscape to ensure our Clients are best positioned for what comes next. It’s an approach that’s worked for nearly 30 years (we’ve outperformed our benchmark by 2.5% annually since 1993), and one that’s seen our Clients through several periods that felt similar to what we’re currently living through.

So while no one knows how low stocks will go, we do know this: while it’s true that what goes up must come down, with stocks the opposite has also held true throughout every downturn in economic history. And our Clients will be positioned to harness growth wherever it emerges when things ultimately turn up (as they always do).