How to Pick Hot Stocks: Secrets of a Stock Picker

Many methods have been proposed over the past century and more for achieving superior investment performance through stock picking. Some of the most popular approaches include the following:

- Fundamental Analysis

- Technical Analysis

- Momentum Investing

- GARP (Growth at a Reasonable Price)

- Dogs of the Dow

The idea that one can develop information about a stock that isn’t already reflected in its price, thus allowing one to “beat the market,” is at the heart of all of these techniques. In his most recent Wall Street Journal Weekend Edition column (“Huge Returns at Low Risk? Not So Fast”), Jason Zweig offers up a couple of additional systems, starting with the Graham and Buffett Portfolio. As many of you will know, these famous names refer to Benjamin Graham, legendary value investor and author of Security Analysis and The Intelligent Investor, and his most famous student, Berkshire Hathaway chairman, Warren Buffett. The Graham and Buffett Portfolio, notes Zweig, produced a 12.5% annual return over the past 20 years, easily beating the S&P 500’s average rate of 9.2%. This might not seem surprising to you, as any approach based on the techniques of such legendary value investors must surely give one a leg up on the broader market. If such performance still isn’t enough for you, Zweig offers up another approach that he calls the Presidential Political Party Portfolio (PPPP for short). The PPPP has not only beat the market for the past one, five, and 10 years, it produced more than double the market’s return for the 20 years just ended.

There’s just one thing wrong with the Graham and Buffett and Presidential Political Party portfolios, they aren’t based on a brilliant approach to analyzing the unrevealed value hidden in superior stocks, they’re entirely a product of data-mining. This is a technique that involves analyzing historical data looking for patterns, any patterns, associated with higher returns. In the case of the Graham and Buffett Portfolio, it was constructed by picking stocks with ticker symbols that contained letters drawn from the two names. The PPPP, meanwhile, contains stocks with ticker symbols containing letters from the words Republican or Democrat. The portfolio holds only “Republican” stocks during years when a Republican president is in office and only “Democrat” stocks during years when the Democratic Party controls the White House.

Of course, we all know that correlation does not equal causation, something nicely demonstrated thirty years ago by economist David F. Hendry, who produced an elaborate econometric model of the relationship between a variable he identified only as “C” and the rate of inflation in the UK. At the end of his water-tight proof, however, he reveals that “C” is simply the cumulative rainfall in Britain (“Econometrics: Alchemy or Science?” 1980).

We’ve never liked “atheoretical” models: it’s not enough to simply rely on historical data when developing or proposing any technique for investing, though many investing approaches, including “technical analysis,” do just that. Though we’re quick to note the higher returns historically associated with small company and value stocks, we don’t rely on that alone but look to an underlying economic theory for why these market sectors should perform as they do. Only then can we have some faith that the phenomenon might persist into the future.

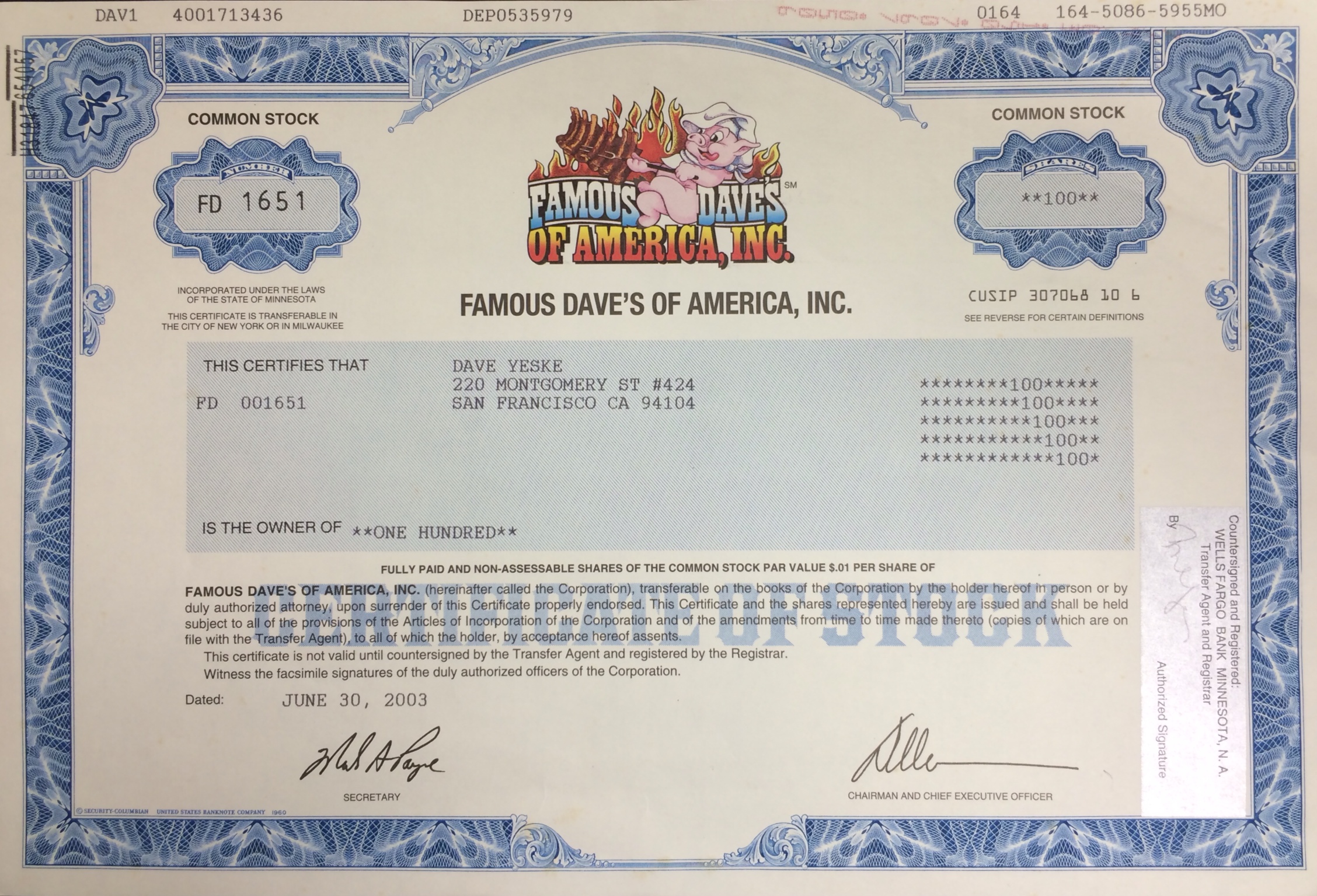

Coming back to the question of stock picking, we feel impelled to reveal a shameful secret: our firm harbors someone who has a history of picking hot stocks. We’re talking about none other than Elissa Buie herself. Her best investment, acquired in May of 2003 has since increased in value by seven-fold compared to the S&P 500 which did little more than double over the same time. What was the secret of her success?

She chose this particular stock because the ticker symbol was DAVE and she was buying it as a birthday present for husband Dave.

It seems like Elissa might be on to something, a technique we’ll call the “First Name Portfolio.” A quick look reveals that one could assemble quite a diversified portfolio using this method, one that, in addition to DAVE, could include MARK (Remark Media), DAN (Dana Holding Corporation), TED (Ted Baker), SAM (Boston Beer Co.), TOM (Tomco Energy), ANN (Ann, Inc.), PHIL (PHI Group, Inc.), KIM (Kimco Realty Corporation), and PAM (Pampa Energia, SA), among others.

When we have a little more free time on our hands, we might back-test that portfolio. And if your name is a ticker symbol, send it to us and we’ll add it to the First Name Portfolio and include it in our test. Stay tuned!