Is it Smart Money or Dumb?

In Jason Zweig’s latest Wall Street Journal offering “The ‘Dumb’ Money Is Bailing on U.S. Stocks. That’s Smart.” he makes the case that “now more than ever, investors need to consider investing in overseas stock markets.”

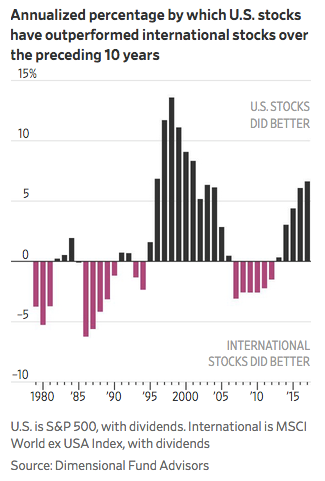

His argument is based on the observation that no country’s markets dominate forever and when it starts to feel that way, it’s usually time to head for the exits.

Markets tend to lose their dominance right around the time it seems most irresistible. The Japanese stock market rose 22-fold over the 20 years through the end of 1989, making it the world’s best major performer.

If you were Japanese, that pinnacle of local outperformance marked the perfect time to diversify outside the country. The Nikkei 225 index, which hit its all-time high of 38915.87 on the last trading day of 1989, remains below 24000 as of this week.

The chart below shows how the U.S. and overseas markets have traded leadership since 1980.

Of course, it’s not time for us/you to head for the exits as we’ve always had a significant, geographically-neutral allocation to international stocks that results in half of each portfolio being allocated outside the U.S.

As always, if you have any questions about any of the funds in your portfolio, we’re always here to talk. And in the meantime, be well!