Market Check In

You’ve no doubt noticed the downdraft in global stock markets this week, which are currently entering “correction” territory with a cumulative 10% decline. Although it’s never possible to precisely identify the causes of any given market decline, the current consensus is that investors are worried about the impact that a spreading Coronavirus will have on global economic growth and corporate profits. And, if for no other reason than the documented impact on the Chinese economy, such concerns are not unwarranted. Global growth will undoubtedly be slowed in the first part of this year as a consequence of global supply chain interruptions.

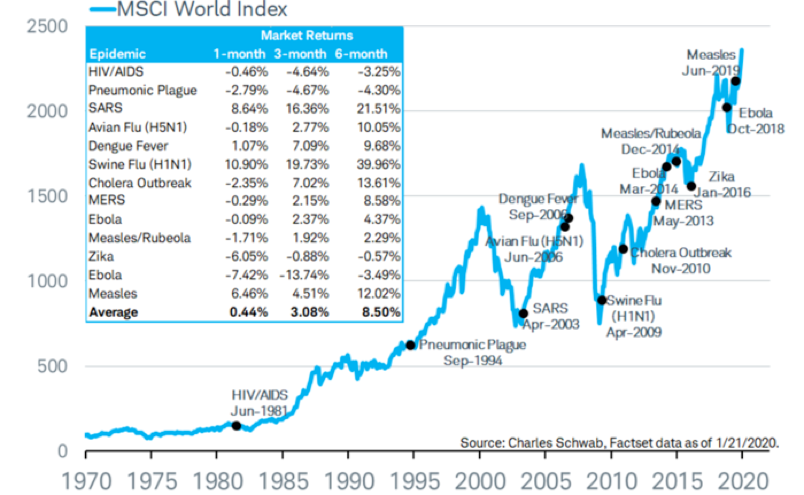

No one knows how bad the Coronavirus will be before it stops spreading but prior epidemics tell us one thing: the impact on the economy and markets will likely be transient. As always, resilience is the most effective strategy, including broad diversification and adequate cash and bond reserves. In the meanwhile, here’s a chart courtesy of Charles Schwab & Co. showing the visible short-term and lack of long-term impact of global epidemics over the past 50 years. The action we’re currently recommending: wash your hands at every opportunity.