Our Bubble Rebuttal

We thought this piece – “Wild Market Ride Lifts Everything from Lumber to Stocks to Bitcoin” – that ran in The Wall Street Journal did a nice job summarizing some of the perspectives investors have about current market conditions. We’ve highlighted some of the article’s notable quotes below and share our commentary to add some food for thought.

“Wild Market Ride Lifts Everything From Lumber to Stocks to Bitcoin”

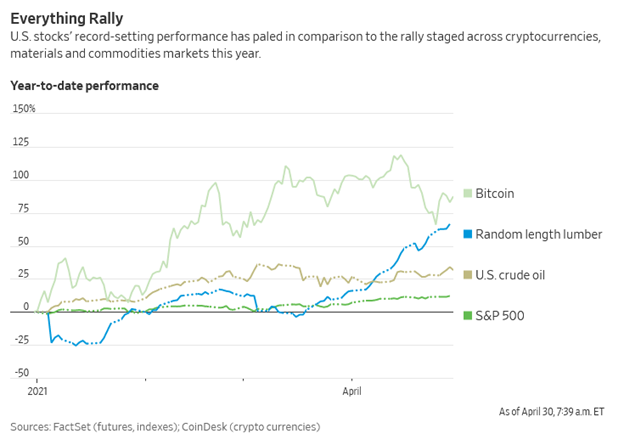

The article opens with an ‘Everything Rally’ chart showing this year’s rise in four assets: Bitcoin (+88%), Random Length Lumber (+67%), US Crude Oil (+32%), and the S&P 500 (+12%):

And this quote immediately follows it:

“This is very different to any other bubble that we’ve had ever,” said Jeremy Grantham, co-founder and chief investment strategist of asset-management firm Grantham, Mayo & van Otterloo. “All of the previous bubbles occurred when economic conditions looked nearly perfect. This has been quite different because the market started its incredible surge in a rather wounded economy,” he said.

To this we reply with a couple thoughts. First, this is how the business cycle works – major growth (“incredible surges”) occurs after the previous cycle ends, and the end of the previous cycle is generally marked by periods of significant decline (when the economy appears to be “wounded”). And second, might the context of the growth we’re seeing be enough of an argument to say we’re not in a bubble? Let’s take a deeper look at each of the (seemingly cherry-picked) asset classes featured in the chart:

- S&P 500: We know that performance of the largest companies in the index have skewed returns in their favor:

- Over the past five quarters (since January 2020), the “FAAMA 5” (Facebook, Apple, Amazon, Microsoft and Alphabet) have seen their stock prices soar by 43%, whereas the other 495 stocks in the index are up 18%.

- If we isolate the first quarter of 2021, however, the FAAMA 5’s stock prices have increased by 6% while the rest of the index is up 11%.

- While there may be bubble-like conditions in some parts of the technology sector, that’s not necessarily the case across the other segments of the markets (see: domestic small and value companies, as well as international companies).

- Commodities/U.S. Crude Oil: While it’s true that oil prices have nearly quadrupled since April 2020 (from ~$17/barrel to more than $66/barrel earlier this year), current prices are just above 2019-levels and 15% lower than in 2018, when oil was trading at more than $70/barrel.

- Random Length Lumber: It’s estimated that record-high lumber prices have added $24,000 to the cost of a typical single family home. And yet that’s only one driver of the price boom we’re seeing in the real estate market; this piece shares experts’ opinions on why the housing market is NOT about to crash and summarizes some of the other factors playing into the dramatic price increases we’re seeing:

- Record-low inventories

- Historically-low mortgage rates

- Stricter lending standards

- Bitcoin: Alright, well, maybe that one is indicative of a bubble!

Later in the piece, we find this definition of a bubble:

“Bubbles aren’t defined only by excessively high valuations. Instead, analysts and investors say bubbles are fed by investors’ willingness to believe stocks or other assets can only go up, ignoring fundamentals such as whether a company will ever be able to generate enough profits to justify its sticker price.”

This excerpt reminded us of a quote from Burton Malkiel’s book, A Random Walk Down Wall Street: “Skyrocketing markets that depend on purely psychic support have invariably succumbed to the financial law of gravitation. Unsustainable prices may persist for years, but eventually they reverse themselves.” And while we’re seeing investors exhibit these kinds of sentiments in the crypto-space (we should note here that we don’t think Bitcoin’s price fluctuations have any real bearing on the economy’s trajectory), it’s simply not part of the conversation when evaluating opportunities in financial markets or making assessments about the prices of major factors of production. These definitions of bubbles just don’t seem to apply in this period of surging economic growth and rising corporate revenue and profits.

And then we find this assessment towards the end of the article:

“Today’s market environment stands in contrast to the boom in asset prices of the 1920s, 1980s, 1990s and mid-2000s, which investors and analysts say was driven by robust economic growth. In most of those periods, the Fed played the role of bubble-popper by raising interest rates to rein in asset prices and, usually, inflation. When the Nasdaq Composite peaked in March 2000, for instance, the Fed had already enacted a series of increases that brought rates to 5.7% in an effort to rein in inflationary pressures. This time around, the Fed has dismissed notions that low interest rates are fueling a bubble in asset prices.”

We recently shared our perspective about inflation here. And we’ll add that the Fed has pledged to not play the role of “bubble-popper” this time, committing to letting inflation rates run past their target of 2% for a while before raising rates or taking other actions to cool down the economy. It’s a refreshing change of direction, one we think is rooted in humility – oftentimes, markets know things we don’t (there’s value in trusting the wisdom of crowds).

We know that there will always be bubbles, and that bubbles always pop. We also know that the broader trajectory of the economy and financial markets trends upward, a reflection of the resilience of the humans that power these complex systems.

If you’d like to connect with us about any of the above, please don’t hesitate to reach out to a member of our Financial Planning Team.