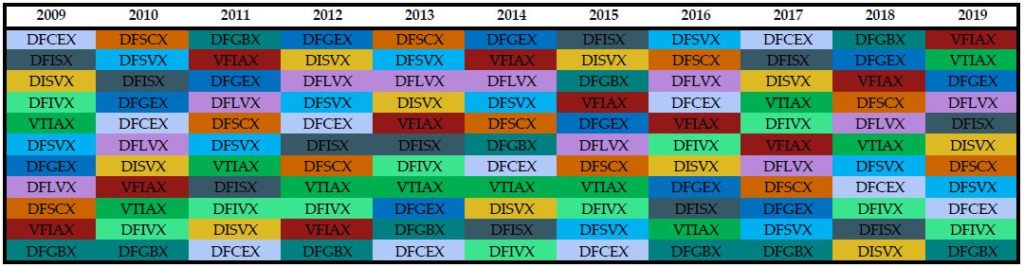

Periodic Table of Returns

As we’ve mentioned time and again, diversification is one of the most powerful strategies an investor can employ when implementing their investment philosophy. At Yeske Buie, that philosophy translates to a globally diversified portfolio tilted towards small company and value stocks. The majority of the mutual funds we use to build this portfolio come from Dimensional Fund Advisors (DFA), (as described in a recent digest post).

DFA publishes resources that explain why diversification is so important. One such example is their “periodic table of returns” that ranks the performance of various countries’ market returns year over year. We’ve used this chart as inspiration to build our very own chart using the components of the Yeske Buie portfolio.

Can you spot a pattern? No? Neither can we! This chart demonstrates exactly why diversification is so important. As you can see, none of the funds were the leader in any two consecutive years. In some cases, the previous year’s leader actually became the next year’s laggard. For example, check the rank of DFGBX in 2011, then again in 2012. While we can’t make any observations regarding how a fund will rank in any given year, we can make other observations, such as:

- The S&P 500, represented by ticker “VFIAX”, has been one of the top performers over the last 10 years. However, it was not the leader in any single year, until last year (2019). This comes after the “lost decade” (2000-2009), during which the S&P 500 produced no net return and members of the media wondered if poor performance in the markets was the “new normal”.

- Bonds (“DFGBX”) often find themselves in either the top position (2011 and 2018) or bottom position (2009, 2010, 2012, 2016, 2017, and 2019). In years that bonds were the worst performer, we can conclude that stocks performed well. For example, look to 2009, when stocks experienced a huge recovery after the Great Recession. In years where bonds were the best performer, we most likely experienced a downturn in the stock market, as happened during the Greek debt crisis in 2011 or the 4th quarter pull-back of 2018.

- Emerging Markets (“DFCEX”) have been volatile over the past 10 years, which is expected for less established economies. In addition to serving the purpose of ensuring our portfolios are geographically neutral, this fund also serves as a powerful diversifier and, volatile as it may be, its presence reduces the risk of our overall portfolio.

Given the randomness of returns from year to year and our lack of a functioning crystal ball, we include all of these various slices of the market in our portfolio to curb the volatility inherent to investing while maximizing the aggregate growth captured along the way. So, the next time the performance of a certain market sector is giving you a headache (a phenomenon we sincerely hope you don’t experience) remember that the same sector could well be the cause of elation in the future.