Risky Business: When Bonds Act Like Stocks

Clients sometimes ask us why we don’t recommend carrying municipal bonds in their portfolios, often in response to learning about the tax advantages of owning them or perhaps after hearing about relatively higher yields in the municipal bond market.

Before sharing our rationale, let’s first define what a municipal bond (or “muni”) is: a loan made by an investor to a local government (state, county or municipality) to finance its spending initiatives (ex. building roads, bridges, and schools). They can be attractive investments in some instances because the income an investor earns by holding these bonds is exempt from federal taxes (and most state and local taxes, too).

It’s in the word “local,” however, that we find one of the reasons muni’s aren’t included in our Clients’ portfolios. As with our approach to building stock portfolios, we seek to be as broadly diversified as possible with our Clients’ bond investments. Municipal bonds are subject to the local risks of a given municipality, which doesn’t align with the global approach we prefer; when those municipalities struggle, there’s a higher risk of default (which would decrease the value of the investment).

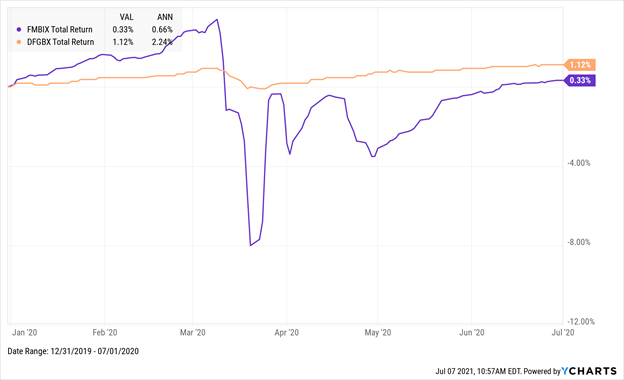

For example, during the pandemic, many states were under duress while experiencing decreases in tax revenue and simultaneously paying out more in unemployment benefits. The chart below shows the significant drop in value in municipal bonds in the wake of the economic shutdown last spring:

This brings us to another reason we don’t include municipal bonds in our Clients’ portfolios – sometimes, their behavior can be overly “stock-like.” As a general rule, bonds carry a lower risk profile than stocks, and one of the primary roles that bonds play in our Clients’ portfolios is to curb volatility. In other words, the relatively-higher-risk stocks are meant to drive growth, while the bonds provide stability. Although the muni’s ultimately made a comeback, we can only make that observation in hindsight. In the midst of the worst part of the downturn, muni’s weren’t providing stability.

For our retired Clients, we actually refer to their portfolio of bonds and cash as their Stable Reserve, or the bridge that will get them through a market downturn. We target an amount that will provide six or seven years’ worth of their spending needs and invest that sum in high quality, low risk bonds that they can count on in a crisis.

In the chart below, you can see the performance of the primary bond fund we use, DFA’s Five Year Global Bond Fund (DFGBX) against a Municipal Bond Index Fund from Fidelity (FMBIX). Through the worst of the downturn last spring, we spent much of our time reminding our retired Clients about the reserves they had in bonds and cash and were able to provide a sense of comfort by showing them that while the stocks were swinging wildly, their bonds had done exactly what they were supposed to do: maintain their value. In so doing, they gave our Clients confidence that they would be able to continue to live off that part of their portfolios while giving the stocks time to recover (and that they did!):

And for our Clients who are still working and saving, the stability of our bond portfolio provided a different kind of opportunity. Because the bonds had held steady while the stocks fell dramatically, we were able to dip into the bond portfolio and sell off a portion of those investments to buy stocks while they were “on sale.” Doing so supercharged the returns in our Clients’ stock portfolios, as we were able to buy more shares at relatively low prices, which were then positioned well to ride the wave upward as markets recovered. We wouldn’t have been able to take advantage of this kind of opportunistic rebalancing if we’d been in muni’s, as they dipped and recovered on the same timeline as the stock market.

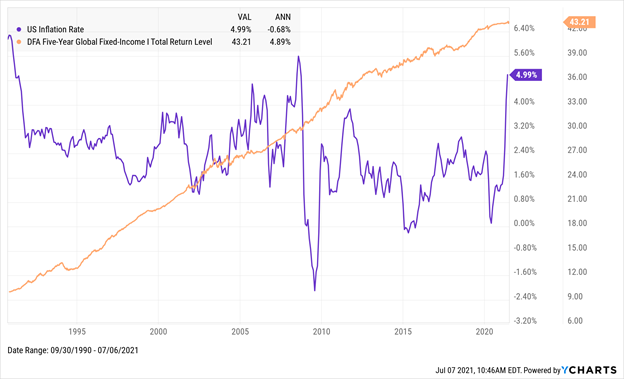

We’ll close with a final point about performance in the context of our bond portfolio’s purpose. While we intentionally give up some potential yield by staying away from relatively riskier bonds like muni’s, and in spite of the primary objective of providing stability for the overall portfolio, the bonds we use in our Clients’ portfolios have performed well. Since its inception in 1990, DFGBX has an average annual return of nearly 5%. And while the most recent inflation reading was 4.99% for the past 12 months and the curve bounces around the 2% level targeted by the Federal Reserve, you can see that the average annual inflation figure for the past 30 years is actually slightly negative. In other words, the bonds we employ in our Clients’ portfolios have grown at a consistent rate, and that growth has not just maintained the purchasing power of our retired Clients’ assets, but increased the value of their portfolios (along with the portfolios of our Clients who are still accumulating assets).

For more information about our investment philosophy, or for further commentary on our approach to building our bond portfolio, contact a member of our Financial Planning Team.