Russia Invades Ukraine – What It Means For You

Like you, we’re watching closely as Russia continues its invasion of Ukraine and noting that global markets are not taking the news well. While there’s little direct economic connection between Ukraine and the US (or most of the rest of the world, for that matter), and even though your exposure to Russian financial markets is virtually nonexistent (~.008% of your portfolio), there are global implications.

Foremost among them is that Russia is a major oil producer and the inevitable sanctions that are coming may disrupt oil markets. However, we think these effects will be temporary, not least because other oil producers have the capacity to step up production and fill the gaps (and will be incented to do so with the price of oil hitting $100/barrel!).

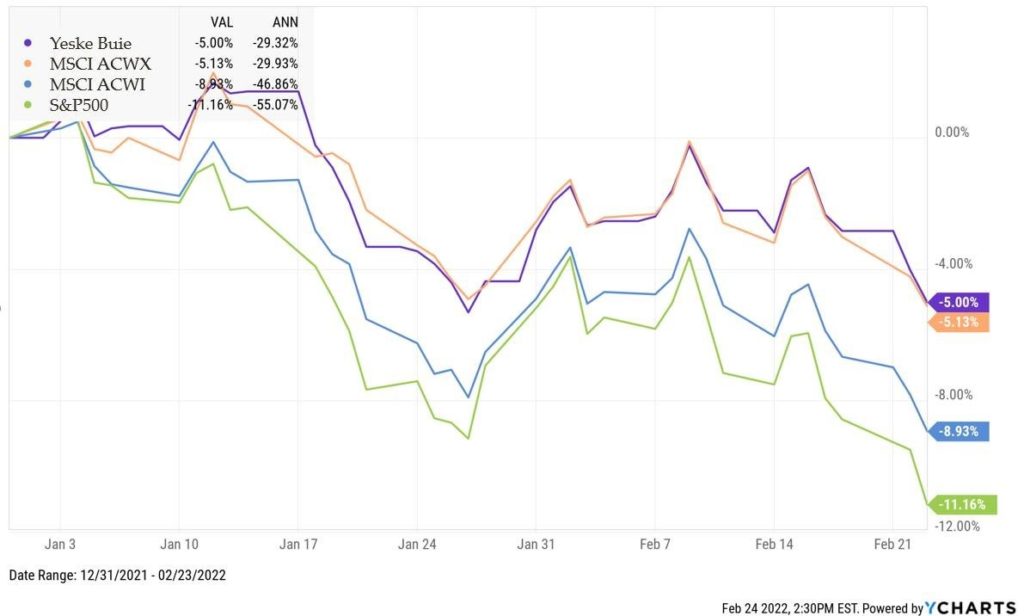

Beyond today’s dramatic events, we wanted to note that your globally diversified stock portfolio has performed significantly better than its benchmark, MSCI’s All Country World Index (by nearly 4%) and other major indices during these first few tumultuous months of 2022. And we remain confident that you’re positioned well for whatever may happen in the coming weeks and months.

As always, please don’t hesitate to connect with us if you have any questions. And in the meantime, be well!