Short Take: Is the Stock Market Expensive?

Ever since the Dow crossed the 20,000 mark, we’ve been hearing from various quarters that the party is, most assuredly, over. As we noted at the time (Market Note: Dow 20,000), that milestone is just a number. And, of course, the Dow represents just 30 stocks in a world in which 50,000 stocks are publicly traded, so it’s a bit of a stretch to use it as a proxy for “the market.”

More important is the notion of valuation, which is to say, how much do you have to pay to lay claim to a dollar of assets or a dollar of earnings? That’s a better predictor of future returns than the price of an index. And, perhaps unsurprisingly, the cheaper you can buy those assets or earnings, the higher the return you can expect. Those stocks that trade at low prices relative to earnings or assets are called “value” stocks, and we like them. A lot. So much so that we strongly tilt all of our portfolio allocations toward “value,” whether we’re talking about US Large or Small Company Stocks or the same categories in overseas markets. As a consequence, our portfolios don’t look like “the market,” especially if your idea of the market is the Dow or the S&P 500.

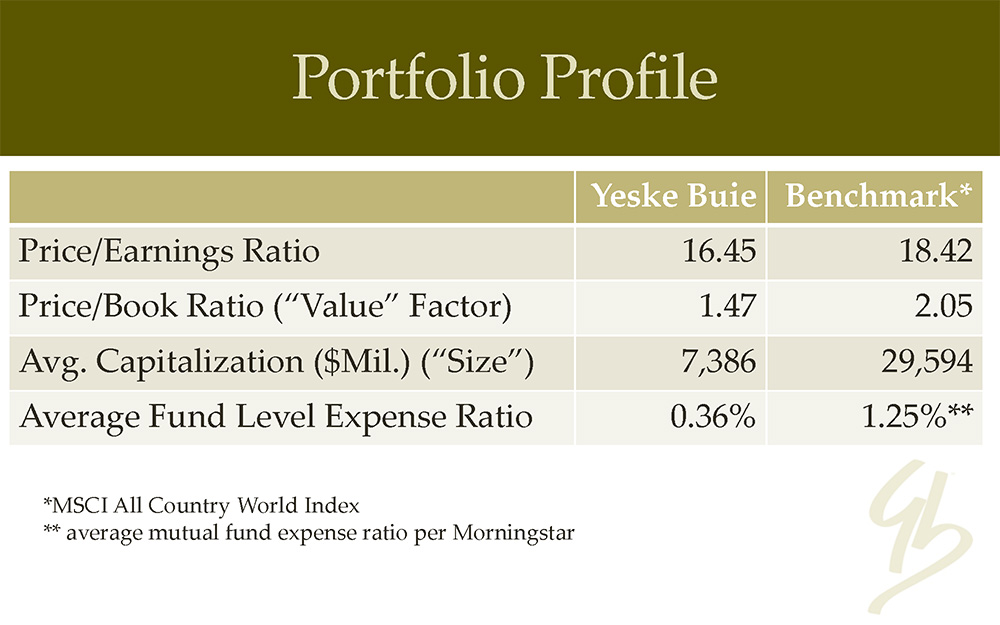

That the S&P 500’s current price-to-earnings (P/E) ratio (how much you have to pay to claim a dollar of earnings) is above 26, compared to a long-run average of 15, is one of the reasons some are suggesting that things may be getting a bit frothy. As we’ve previously noted, comparing the current P/E to the historical average isn’t something that should be done in a vacuum. That average is the result of periods like the late 1970s, when high interest and inflation rates drove the P/E to single digits, and periods like the present, where we’re still enjoying low interest and inflation rates. Having said that, let’s take a look at the current valuation levels of the average Yeske Buie portfolio.

One of the first things to notice is that the All Country World Index, our global stock market benchmark, sports a much lower P/E than the S&P 500, a level of 18 versus 26. This is reflective of the fact that stock markets outside the US have been slower to recover from the Great Recession and are not trading at above-average levels. The second thing to notice is that the Yeske Buie portfolio has a P/E that’s lower still at 16. This reflects our intentional tilt toward value stocks. You’ll also see that the average size of the stocks in our portfolio is much smaller than the benchmark as a consequence of our other intentional focus on small company stocks, which, like value stocks, are expected to produce higher returns over the long run. A final point worth noting is that the low costs associated with the institutional class mutual funds we use results in aggregate weighted fund level fees that are are much lower than the average mutual fund’s fees as reported by Morningstar. It’s important to control what you can control when investing and expenses are one of those things.

So the next time someone says to you that the “market” is expensive, be sure to ask them, “which market?”