Super Size Me: When Bigger Isn’t Better

Sometimes bigger is better. Bigger paycheck. Bigger responsibilities. Bigger vacation. At Yeske Buie, we talk about having Live Big® goals, which are about having a bigger vision for how you’re going to live your life. When it comes to investing, however, the rules are different.

When it comes to investing, the rule is . . . Small is Beautiful

And when we say “small,” we’re talking about small company stocks, as well as stocks that trade at small prices relative to earnings or assets (also known as value stocks). Why? Because stocks of small companies and stocks that trade at low prices relative to their earnings or assets have been shown to have higher returns.

So, how might one go about building a portfolio where Small is Beautiful? Here’s our approach.

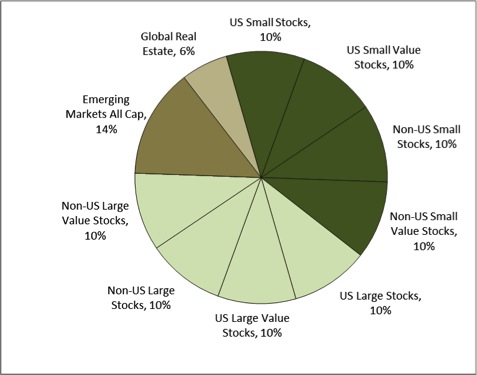

To begin with, we start with a broad, geographically-neutral portfolio, allocated around the globe in a way that is proportional to each country and region’s share of the world market. Which means we try to avoid so-called “home country bias,” a well-documented phenomenon in which citizens of any given country tend to overweight their portfolios with a disproportionate share of stocks from their home country.

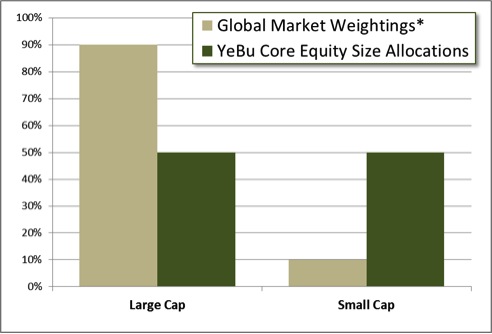

While we may be “geographically-neutral,” however, we’re quite definitely NOT neutral along other investment dimensions. Specifically, we choose to “dial-up” the proportion of small company stocks and value stocks relative to their natural share of the market. For example, while small company stocks represent only about 10% of the value of the market as a whole, we choose to hold small company stocks in equal proportion to large company stocks.

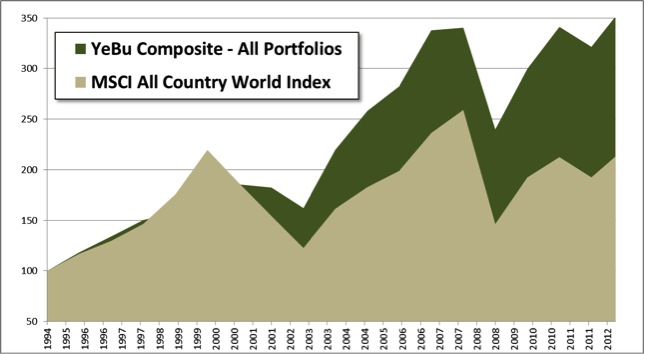

When we compare the performance of our portfolios to a geographically-neutral, but “market-weighted” index of the global market (learn more about our blended benchmark), we assume that some part of the performance of our portfolios is due to our global allocations. To the degree the cumulative performance of our portfolios varies from the geographically-neutral global index, it can be attributed to our decisions to dial up our exposure to small company stocks and value stocks (remember, this latter might be thought of as “small-priced” stocks). As you can see from the chart below, small company and value stock overweighting has had a significant positive impact on the performance of our portfolios relative to the neutral global index (Important Disclosures Related to Performance Reporting and Benchmarks).

So, just as documentarian Morgan Spurlock showed in his 2004 documentary “Super Size Me,” bigger isn’t always better.

When it comes to envisioning the life you want to live, our motto is Live Big®

–When it comes to thinking about your investments, however, Small is Beautiful!

Live Big® – It’s about the size of your life, not the size of your wallet®