The DFA Approach: Maximizing Return and Minimizing Risk

It has been said time and again: “markets climb a wall of worry”. The world can be an uncertain place, and investors like to be appropriately compensated for assuming the risk of being stock market participants. DFA (Dimensional Fund Advisors), the mutual fund company that serves as the primary source for the building blocks of our Clients’ portfolios, has focused on using the best available science to construct mutual funds designed to maximize return while minimizing risk in an uncertain world – let’s talk about how they do so.

We can begin this discussion by comparing how DFA’s approach differs from both that of Active Management and Index Management:

- Active Management: Investors who apply an active approach try to find mispriced stocks and rely on forecasting to choose “undervalued” companies or time the market; while this type of approach isn’t guaranteed to beat the market, it does ensure relatively higher expenses from additional trading activity and can increase the risk of the portfolio.

- Index Management: Investors who allow commercial indices to determine the strategy of their portfolio can become “prisoners” of the index, as their exposure is limited to the companies listed on a given index’s constitution; this approach limits costs, but in so doing can unintentionally prioritize tracking a given index over higher expected returns.

In contrast, DFA’s approach uses academic research to gain insight into how markets move and where returns come from. They then use those findings to construct mutual funds that aim to add value via the integration of that research with disciplined implementation protocols. The funds are built to be precise and robust, capturing specific segments of the market while reducing their overall risk by diversifying exposure amongst hundreds (if not thousands) of companies that fit their stated objective. DFA has used the findings of Nobel laureates such as Eugene Fama, Myron Scholes, Robert Merton and Merton Miller to develop a philosophy that looks to capitalize on the following premiums:

- Market: Equity Premium – Stocks vs. Bonds

- Over time, stocks are expected to outperform bonds as they have a higher measure of risk and therefore a higher expected return.

- Company Size: Small Cap Premium – Small vs. Large

- Similarly, small company stocks are expected to outperform large company stocks because of a relatively higher risk profile, which carries a commensurately higher expected return.

- Relative Price: Value Premium – Value vs. Growth

- Value stocks, or companies whose stocks are trading at relatively low prices, are expected to outperform growth stocks over time as investors capture the power of human ingenuity and resourcefulness.

- Profitability: Profitability Premium – High vs. Low Profitability

- Given two companies with similar profiles (industry, size, etc.), the more profitable of the two is expected to earn higher returns over time.

Before becoming the principles of DFA’s philosophy, these premiums were tested to meet DFA’s rigorous standards. Each was observed to be accurately defined as

- Sensible: They are substantiated by an economic rationale.

- Persistent: They are validated by historical data over time.

- Pervasive: They are observed across sectors, countries, and time periods.

- Robust: They persist when observed from multiple angles.

- Cost Effective: Applying an approach that seeks to capitalize on these premiums can be done in a way that limits costs.

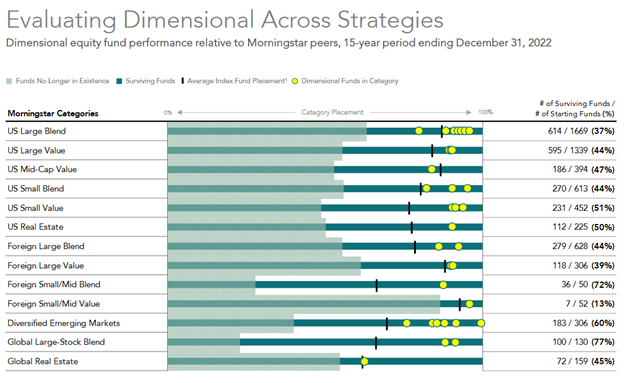

This approach has served DFA and its Clients well for more than 40 years. While short-term performance may not reflect the expectations of the aforementioned premiums, the graphic below clearly illustrates the same point: DFA’s approach has used the best available evidence to generate returns in an ever-more uncertain world.

As always, don’t hesitate to reach out to a member of our Financial Planning Team for a deeper discussion about Dimensional’s funds or otherwise.