The Great Reboot: A Market Story in Two Charts

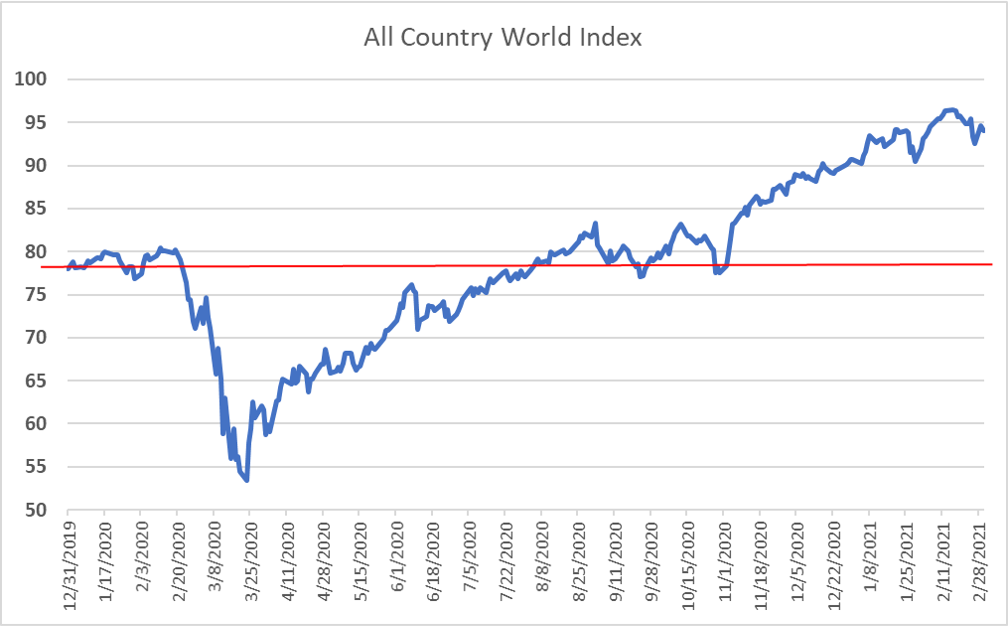

The impact of the global Pandemic was dramatic in terms of immediate job losses, the collapse of entire industries, and a dramatic fall in stock prices. The first chart below illustrates both the dramatic fall and equally – and to some degree surprisingly – dramatic recovery. What isn’t obvious in this first chart, however, is what can happen in the markets when the economy is “rebooted.” The steep drop in economic activity, accompanied by an equally steep drop in employment, created enormous slack in the U.S. and global economy and essentially reset where we were in the business cycle.

The “business cycle” refers to the tendency of the economy to expand and contract based on changing conditions. Sometimes a contraction is caused by a financial crisis like the Great Recession of a decade ago. Sometimes it’s caused by a policy change at the Fed when it raises interest rates to quell incipient inflation. Sometimes it’s caused by an external shock like the Pandemic. Whatever the cause, a recession eventually ends when the forces depressing economic activity begin to subside and production and employment start to rise again.

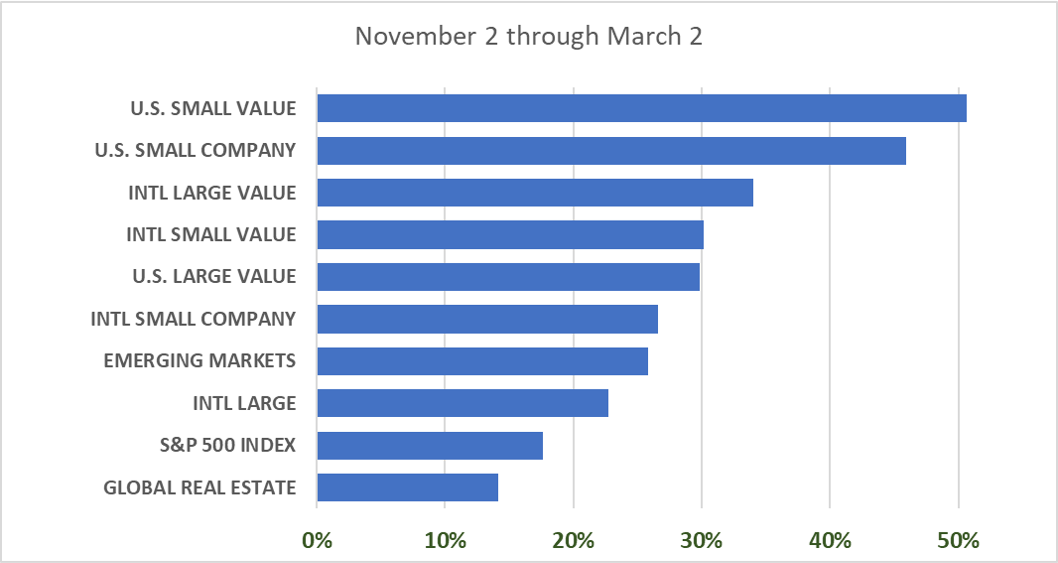

But different kinds of companies tend to do better in the early stages of a recovery than in the later stages. These include small company and value stocks, which are stocks trading at a low price relative to their earnings or assets.

What we have seen since the middle of last year as the markets have risen in anticipation of vaccines, economic opening, and a return to more robust growth (the IMF projects both global and U.S. growth in excess of 5% this year) is a shift toward these more cyclical stocks. This is seen quite dramatically in the chart below, which shows performance by category over the past four months, beginning with the week leading up to Pfizer’s big vaccine announcement.

We just finished a meeting with David Booth, founder of Dimensional Fund Advisors, who expressed his pleasure at seeing small company and value stocks dominating the rest of the market this year, “as God intended.” All we can say is, amen to that!