The Two Week Look: Systematic Rebalancing

As financial planners, managing client accounts and investments is a major component of the work that we do. We take on a number of responsibilities in this sphere, one of which is the process of rebalancing. The rebalancing process is the quintessential application of the strategy, “buy low, sell high.” Traditionally, investment advisers rebalance portfolios fairly infrequently – on a quarterly, semiannual, or annual basis – to account for the natural rise and fall of the markets, and to bring portfolios back to their original target allocations. Due to our core beliefs and our evidence- and policy-based approach to financial planning, however, our rebalancing process is a bit different than most. Let’s take a deep dive into this process, internally known as The Two Week Look.

Our Worldview

Our firm is built around our core values, one of which is Think Big. This means that we seek out and lean on the best available science to help us best serve our clients. Our grounded approach to clients’ portfolios begins with our Worldview, which Co-Founder Dr. Dave Yeske explains in this 19-minute webinar on the Yeske Buie Investment Philosophy. Concisely stated…

We believe that human beings are fundamentally growth-seeking and resilient.

Because the global economy is comprised of businesses in countries around the world (which themselves are comprised of resilient human beings), the economy is ultimately biased toward growth. Therefore, the stock market, which mirrors the real economy, is also biased toward growth over the long run. All of our investment decisions and recommendations stem from this fundamental worldview.

Opportunistic Rebalancing: The Research

From there, we turn to a compelling 2007 research paper published by Gobind Daryanani, CFP®, Ph.D., in The Journal of Financial Planning. In it, Daryanani proposed a system of opportunistic rebalancing which posited that the frequency with which you rebalance is a function of how often you look. Yeske Buie derives three simple rules from this research which allow us to make grounded, policy-based decisions:

- Use wider tolerance bands for rebalancing,

- Evaluate client portfolios biweekly, and

- Only rebalance the asset classes that are out of balance.

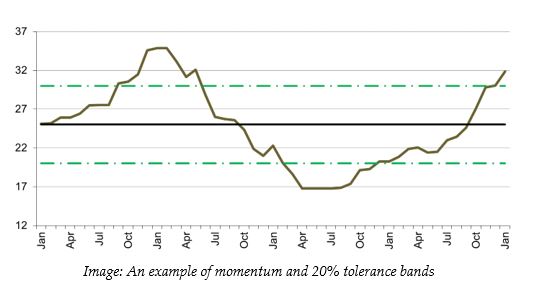

In concert with Yeske Buie’s Worldview, this disciplined, policy-based approach to rebalancing provides two major benefits. First, we are more effectively able to capture momentum, increasing investment returns. Before the release of this groundbreaking research, Yeske Buie had relied on a 10% tolerance band for its rebalancing. If a position grew to be 10% larger than its target, it would be sold back to its target, and if a position fell to 10% below its target, then it would be purchased back up to its target. However, it is often the case that positions that are rising will continue to rise, and positions that are falling will continue to fall. So, a 10% tolerance band could choke off momentum, leading us to sell a position that was still rising or to buy a position that was still on its decline. As a result of Daryanani’s research, Yeske Buie transitioned to using a 20% tolerance band for rebalancing.

Second, wider tolerance bands result in fewer trades. Daryanani’s research found that, on average, a 20% tolerance band would generate 2-3 trades per year, whereas a 10% tolerance band would generate 5-10 trades per year. By comparison, rebalancing on a quarterly or annual basis requires you to place trades every time you look. Therefore, by rebalancing according to tolerance bands, you can reduce the number of trades per year, which can result in fewer trading fees and lower tax costs.

iRebal: The Software

To implement Daryanani’s research, Yeske Buie employs the help of iRebal, a robust portfolio management software which was actually founded by Daryanani himself. iRebal allows us to group accounts by size, portfolio model, whether a client is spending, and much more. The system also automates the trade generation process according to our customized set of rules, including the aforementioned 20% tolerance bands. In its trade generation process, iRebal has several goals, listed below in order of priority:

- Achieve the target level of cash in each account,

- Sell positions that are above their tolerance band & buy positions that are below their tolerance band, and

- Reduce cost by minimizing the number of trades proposed and the taxable gains generated by those trades.

Two Week Look: The Process

Internally known as the Two Week Look, Yeske Buie’s rebalancing process is completed every two weeks by each member of the Yeske Buie Financial Planning Team.

To enhance the level of discernment around rebalancing a client’s account, each planner is responsible for reviewing between 100-150 accounts, corresponding with the clients whom each team member supports. Each of us has an understanding of our clients’ context when rebalancing, and we take into account a client’s potential spending needs, regular contributions or withdrawals, and anything else on the horizon when determining whether trades need to be placed or adjusted.

While most Two Week Looks result in a handful of trades, the unique nature of each client’s circumstances dictates that not all accounts will require action at the same time. Thus, while we’re looking at all accounts every two weeks, any one account may only be traded once or twice per year (excluding instances of extreme volatility, like the COVID cliff in March 2020). Every two weeks, each member of the Financial Planning Team follows the same basic steps, and our Client Services Team sends an email notification to any clients whose accounts were rebalanced.

In Summary

Our approach to assembling and managing client portfolios begins with our Worldview – that human beings are fundamentally growth-seeking and resilient – and is supported by the best available science. Our systematic approach to rebalancing is only one piece of the financial planning puzzle, but the value of a disciplined, evidence-based rebalancing process cannot be overstated. If you have questions or would like to learn more, we encourage you to reach out to a member of our Financial Planning Team.