Uncle Ben’s Converted Price: Fed by the Fed

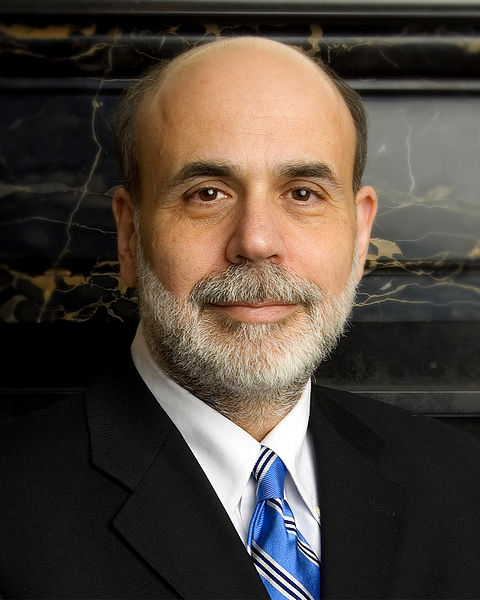

We haven’t failed to notice the stock market declines of the past few days, universally attributed to Fed Chairman Ben Bernanke’s suggestion that the end of extraordinary Federal Reserve action to boost the economy may be in sight. We think this reaction, if indeed it can be attributed to that cause (such things are not as easily explained as the media might suggest) is a little surprising.

We haven’t failed to notice the stock market declines of the past few days, universally attributed to Fed Chairman Ben Bernanke’s suggestion that the end of extraordinary Federal Reserve action to boost the economy may be in sight. We think this reaction, if indeed it can be attributed to that cause (such things are not as easily explained as the media might suggest) is a little surprising.

OK, not really surprising. In fact, downright predictable.

Fed governors in general, and Chairman Bernanke in particular, have been very evidence-based and flexible all through the economic crisis and subsequent recovery. The Chairman’s comments about reducing bond buying by the end of this year and scaling back further when unemployment falls below 7% were all predicated on an optimistic assessment of the fundamental strength of the current recovery. We share that optimism. It seems that every new round of economic reports beats the “consensus” of professional prognosticators. And while we believed that allowing the “sequester” to take effect was bad for the economy, we’re not surprised to find that the underlying strength of the recovery appears great enough to overcome that headwind. Obviously, the Fed feels the same way.

In the short run, hot money will drive prices up and down based on rumor, sentiment, and fear, but in the long run, fundamentals will determine the outcome. And the Fed’s Board of Governors focuses on the fundamentals. And they’re ever more optimistic. We should pay attention to that.

So, feel free to ignore those who are convinced that the rise in the market was “fed by the Fed” and look instead at the growing evidence that our current recovery is as robust as Uncle Ben tells us it is.