Short Take: Will we bump our heads on the debt ceiling?

Treasury Secretary Janet Yellen warned that the U.S. could be forced to default on its obligations sometime in October if Congress fails to raise the debt ceiling. While this is a matter of grave concern, we’ve been here before and survived.

As we dig deeper, there’s unfortunately no way to avoid noting that it has been the sole purview of Republican legislators to periodically take the debt ceiling hostage when not in power.

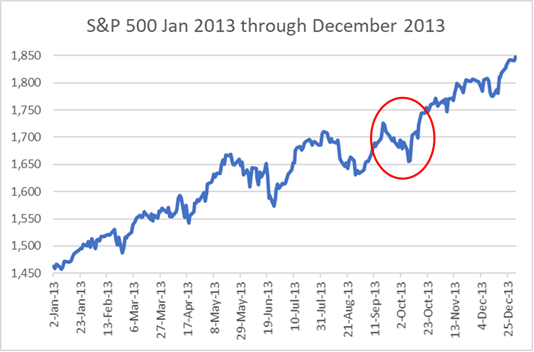

The threat has been made again and again over the past dozen years, most seriously in October of 2013 (following a previous debt ceiling crisis in 2011 that resulted in the first-ever downgrade of US government debt) when it led to a partial government shutdown from Oct 1 to Oct 17. Back then, it was done in an attempt to block funding for the Affordable Care Act (aka Obamacare) and while Republicans ultimately relented and agreed with Democrats to raise the debt limit, it created turmoil in the markets over the preceding weeks (see chart below).

All of which naturally raises the question, should we worry about how the stock market will react this time around as the deadline again looms on the near horizon?

Our short answer is no.

To explain why, let’s return to that 2013 example. If you’d exited the market in advance of the “debt ceiling decline” that year and sat on the sidelines, you’d have ended up worse off than just riding it out. The market was not only up 27% for the year as a whole, even with all the craziness in September and October, but the S&P 500 rose another 8% from the pre-panic highs of September 13. Which is to say that, even with a partial government shutdown that lasted nearly three weeks, the damage was transient and markets resumed their upward march the minute the debt ceiling was raised.

In the current moment, we’re doubtful we’ll see another partial government shutdown but, even if we do, we believe the pain would ultimately be too great for Minority Leader Mitch McConnell and his Republican caucus in the Senate and at worst we’d see a repeat of 2013, with short-term turmoil followed by a rapid recovery.

So, as is nearly always the case when you have a resilient portfolio and stable reserves, the best advice is to Keep Calm and Carry On.

And if you’d like to take a deeper dive into matters legislative and economic, please register for our September 28 live webinar, Financial Markets, The Economy, and Year-End Strategies. And please send us the questions or topics you’d like to be sure we cover.