YeskeBuie’s Financial Literacy Program

At YeskeBuie, we believe that money doesn’t buy a successful life, but an understanding of money is crucial to one. And the earlier we can start imparting that understanding to our children, the better.

Financial Literacy is a subject that is not covered enough in the education of today’s youth. Many students progress through their entire education and graduate from college without some of the most basic financial knowledge required for them to succeed. Because of the lack of financial classes provided in formal education, the responsibility of teaching children about financial basics falls on the student’s parents and family.

Understanding the pressure you may feel to ensure your children and grandchildren are set up for financial success, we’ve built a Financial Literacy program to help you and the ones you hold dear. We’ve put together a series of tools that can help educate and facilitate conversations about money and finance.

Money Savvy Pig

We start at around three years old with the Money Savvy Pig. It’s not just any ordinary piggy bank, as it has four slots to put money into – Save, Spend, Donate and Invest.

YeskeBuie’s Simple Tips:

- Start early! This does not mean you need to try teaching a three-year-old about retirement accounts and mutual funds. However, the simple gift of a Piggy Bank can be a great introduction to money and give the child a sense of ownership.

- Teach money choice

Cash Cache

A few years later when the child is entering third or fourth grade, they receive a Cash Cache. This binder is filled with personal finance tips and builds on the foundation of the piggy bank, going into more detail about the money choices they face. It provides resources for setting goals and budgeting.

YeskeBuie’s Simple Tips:

- Set goals

- Make smart decisions

OMG: Official Money Guide

In middle school, we introduce the book O.M.G Official Money Guide for Teenagers. The chapters cover introductions to investing, credit cards, insurance, identity protection and more. It also includes tips to help teens avoid “awkward money moments.”

YeskeBuie’s Simple Tips:

- Take ownership of your money

- Talk about it

What Color is Your Parachute?

As students begin thinking about what their next steps will be after high school, our financial literacy program shifts focus to an interactive book that is developed to help teens define their interests and unique passions. It is aimed at providing big-picture advice about college, the potential costs associated with it, and how it can translate into a successful career path.

YeskeBuie’s Simple Tips:

- Prepare for the future

- Life is about decisions and trade-offs

Where Will You Be Five Years from Today?

High School graduation is a celebration of a student’s future. To congratulate high school graduates, we send the students a copy of 5: Where will you be five years from today? It contains thought-provoking questions and real-life examples that we hope will be a spark in helping the student become more knowledgeable about themselves and where where they are headed.

YeskeBuie’s Simple Tips:

- Graduation is a time of celebration of all the things you want to do, choose to do, and can’t wait to do

- You are the hero of your story and we hope this tool helps you on your journey

Generation Earn

Last, but certainly not least, we provide college graduates with the book “Generation Earn” in order to equip them with the practical information that may have been lacking from their studies. This guide to “real world” knowledge covers “every major decision they’ll have to make to create a successful life.”

YeskeBuie’s Simple Tips:

- Time is money

- Knowledge is power

Intergenerational Wealth Planning: The Transfer of Trillions

Whether you will be passing assets along to your heirs or if you are set to receive an inheritance, clear communication is the key to ensuring the transfer is successful.

In 1999, John J. Havens and Paul G. Schervish of Boston College’s Social Welfare Institute published a report in which they estimated that at least $41 trillion would pass from older to younger generations in the US between the years 1998 and 2052. They estimate over $16 trillion of that number will be paid out in estate taxes and charitable giving. And while some of the remaining $25 trillion is currently being inherited by the baby-boomer generation, much of that figure will be passed to the children and grandchildren of the largest generation in US history. On the strength of these figures alone, it is clear that planning for this transfer on a national level is of the utmost importance.

But what do these figures mean to you?

Engaging a financial planner to facilitate conversations about your estate plan can help to ensure that the transfer of your wealth is reflective of your values and desires. Several areas can be explored:

- The benefactor’s/beneficiary’s worldview and values;

- Lessons learned about money and how they’ve shaped one’s views about money;

- The source of the assets and the definition of their purpose;

- How the benefactor/beneficiary defines success;

- Whether leaving behind a legacy is important and how that legacy is defined;

- How to address the unique challenges and/or special needs of everyone involved.

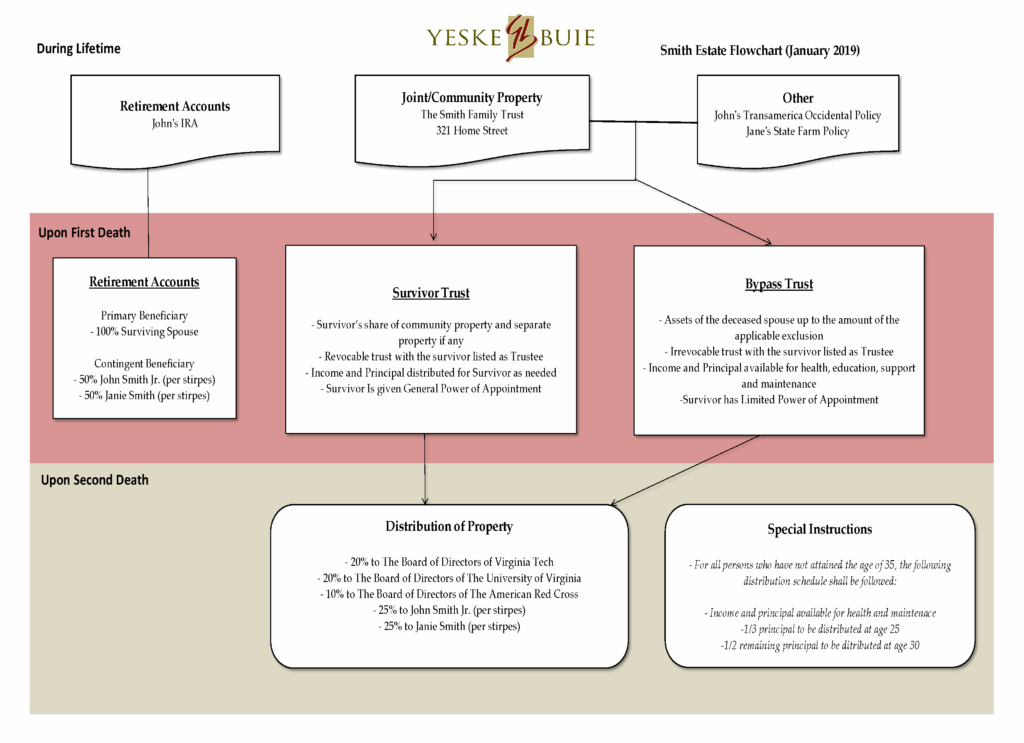

One of the ways we start this conversation with our Clients is by creating a flowchart of their estate plan to illustrate how their assets are scheduled to be distributed; creating a visual representation of the plan can be a powerful tool to jump-start the thought process of whether it truly reflects their desires. As our Clients’ plans evolve, we continually review their estate plan to see whether changes need to made. The iterative nature of revisiting this portion of their financial plan prepares our Clients for their role in the process and ensures the inevitable transfer of their assets reflects what is most important to them.