A Practical Approach to Cash Flow Complexities

When life happens, the financial aspects of figuring out what to do next can make taking that next step an overwhelming task. Using policies to manage cash flow on an ongoing basis removes the budgetary uncertainties and clarifies the financial ripple effects of a given alternative, helping our Clients make decisions using the constraint that matters most: their values.

At Yeske Buie, we work on hundreds of financial plans each year. Although our Clients’ needs, goals, and circumstances vary, at the heart of every financial plan is the answer to a Client asking:

“What do I do if _____?”

The answer we’re able to give depends on the answer to two follow-up questions:

- “Is an adequate Emergency Fund available to be utilized?”

- “Does the recommended plan of action affect cash flow in a way that compromises other goals/needs?”

Let’s start with the first follow-up question by defining an “adequate” Emergency Fund – we recommend that our Clients set aside three to six months’ worth of take-home pay in cash before funding any other goals. There are a number of reasons why building an Emergency Fund takes precedence as the first step in building a healthy, robust financial plan:

- It’s the bridge to fill an income gap when waiting for a disability insurance claim if one is unable to work. Typical disability insurance policies require that a claimant wait 90 to 180 days (three to six months) before being eligible to receive benefits.

- It’s the first source of cash to cover deductibles related to auto, homeowners and health insurance claims. Having the funds available to cover a higher deductible allows one to pay a lower premium, which is a more efficient use of one’s resources.

- It allows one to meet unexpected out-of-pocket expenses without building up personal debt or disrupting the flow of cash used to fund other needs and goals.

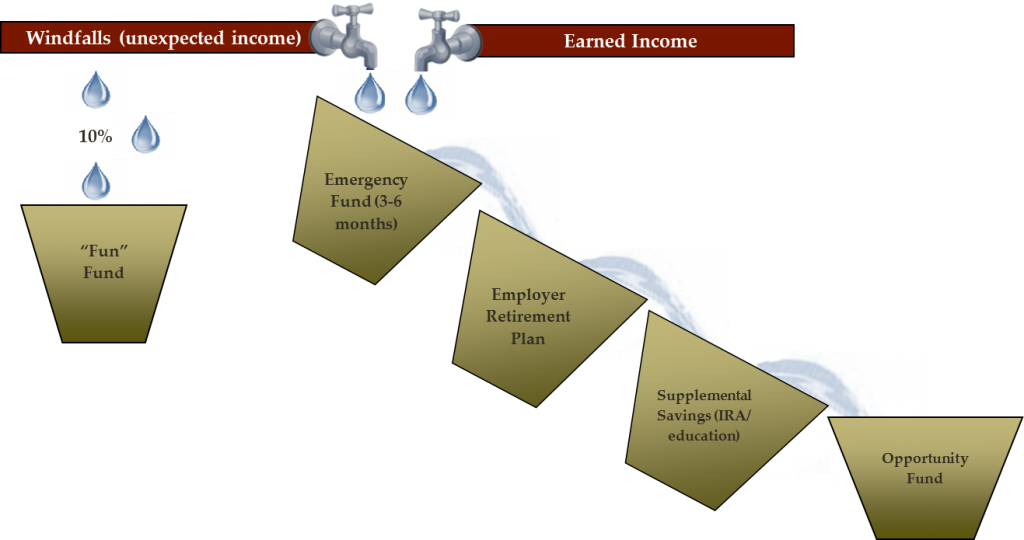

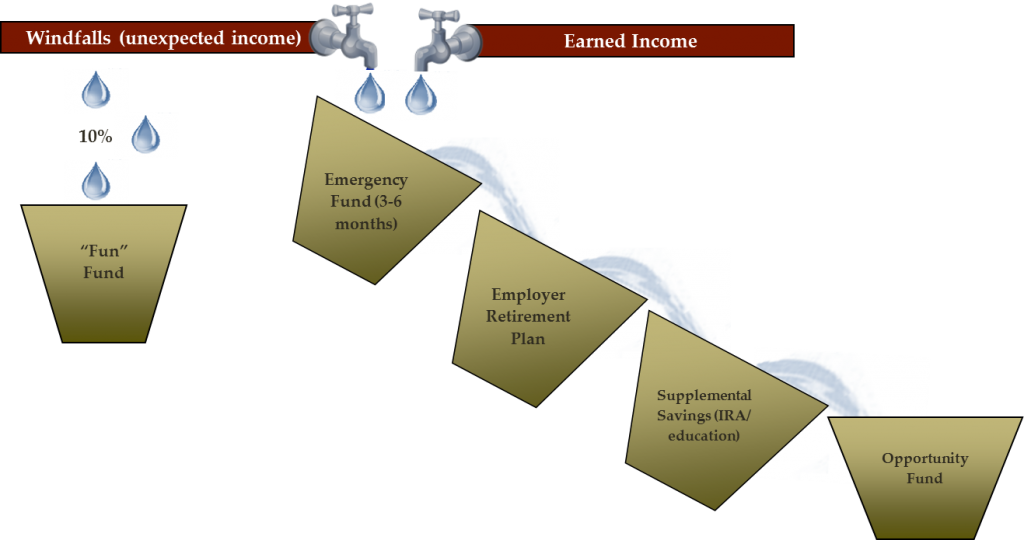

Having an Emergency Fund in place allows our Clients to evaluate trade-offs using their values as the constraint instead of their account balances, but that’s only half of the equation. We also have to assess the effect on ongoing cash flow, which is done best via policies. The following is an illustration of a basic set of Cash Flow Policies:

Let’s start with the right side (Earned Income). As you can see, the first “bucket” that must be filled is that of the Emergency Fund, which is funded after a Client’s monthly expenses have been paid. No dollars are directed towards any of the other buckets until that bucket is full; upon filling it, the flow of dollars is “tipped” into the next bucket – funding an Employer Retirement Plan account to take advantage of the tax benefits while saving for the primary goal of most Clients’ financial plans. This cascading structure continues from bucket to bucket as each one is filled subject to its unique constraints. Using policies in this way provides structure by having a plan in place for every dollar while allowing for flexibility via the dynamism embedded in the policies. For example, if a distribution had to be made from the Emergency Fund to cover an unexpected medical expense, deposits to the retirement accounts would stop and those funds would be directed to the Emergency Fund until the balance was back to target, at which point the retirement account contributions would resume.

The left side (Windfalls) deals with unexpected income. As hard as it can be to figure out what to do with one’s normal income in the absence of policies, it can be just as difficult to determine how to use windfalls in a way that is congruent with the rest of one’s financial plan. We recommend carving off 10% to be used right away so our Clients can get some immediate enjoyment from their newfound money, and then direct the rest in the same manner as they would their normal income. Doing so ensures that the goals that mean the most to them are funded first.

Using policies in this way to manage cash flow makes it easy to “stress-test” a plan when evaluating a trade-off – we can easily illustrate the effects of directing resources in a new direction and determine if that alternative fits with the Client’s current desires and long-term goals. Having that information allows our Clients to evaluate their options with full information and make their next step one that best fits their financial planning needs.