Asset Protection

In turbulent times like these, our Clients often ask how we’re protecting their assets. In this piece, we’ll focus on the measures our strategic partner, Charles Schwab, takes to focus on asset protection and ensure our Clients’ accounts are safe. Schwab is one of the largest and best capitalized broker/dealers in the world, with over $7 trillion in Client assets – more than half of the Independent Registered Investment Advisors in the US use Charles Schwab as their custodian.

Three layers of protection are provided to our Clients via the SEC’s Customer Protection Rule, the Securities Investor Protection Corporation (SIPC) and the Federal Deposit Insurance Corporation (FDIC):

- Customer Protection Rule: Mandates that broker/dealers do not commingle Clients’ assets with the broker/dealer’s; in the unlikely event of the broker/dealer’s insolvency, Clients’ investments in stocks and bonds are protected from creditors’ claims.

- SIPC: In the unlikely event that a broker/dealer goes out of business, SIPC ensures that Clients keep their assets and facilitates the transfer of their account(s) to another firm, after which the account(s) can be moved to any firm the Client chooses. SIPC insures accounts up to $500,000 per individual, including a maximum of $250,000 for cash.

- In the event SIPC is not able to make a Client whole, Schwab also partners with Lloyd’s of London to provide additional protection (up to $150,000,000 per Client, of which $1,150,000 is specifically for cash holdings).

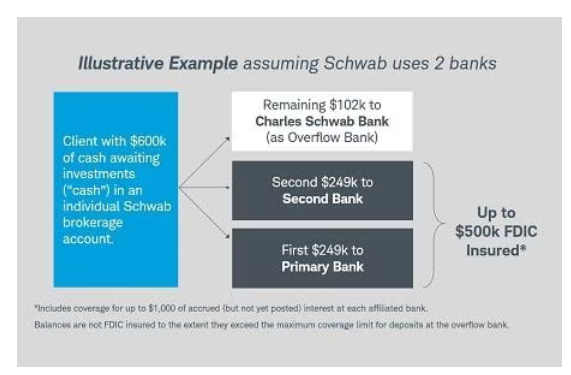

- FDIC: The cash balances in our Clients’ accounts, which are automatically deposited at Schwab Bank via the Bank Sweep feature, are FDIC-insured (up to $250,000 of coverage per individual). Because Schwab uses a two-bank system to protect its Clients, each individual Client has up to $500,000 of FDIC coverage per account – see below:

For more information ways that Schwab focused on asset protection, click here.