Consolidated Appropriations Act, 2021

Although it was expected much sooner, a new stimulus bill, The Consolidated Appropriations Act of 2021, was signed into law on December 27, 2020. The bill is a whopping 5,593 pages and includes funding for the government through September 2021. Amongst the thousands of pages of text are quite a few provisions that may impact our Clients, so we’ve read up on the provisions (from trusted experts, not the entire 5,593 pages!) and have compiled a summary for you below. The bill includes renewed funds for additional Paycheck Protection Program loans to small businesses, extended unemployment benefits for 11 more weeks, a second round of stimulus checks, and a few other provisions we think are most applicable to you, our Clients. Read on to learn more:

Paycheck Protection Program

As you may have heard, funding for the Paycheck Protection Program (PPP) has been renewed in the most recent stimulus bill and will be available for application soon:

- If you have not previously received a PPP loan, you will be able to apply again for the initial PPP as long as you meet the requirements of the initial program, as detailed here.

- Note that first-time borrowers will not have the meet the 25% drop in revenue requirement.

- If you have previously received a PPP loan and have used the funds (or plan to do so within your eligibility window), you can apply for a second-draw loan under PPP 2.0. The requirements are slightly different in that you must have 300 or fewer employees (as compared to 500 or fewer) and you need to demonstrate that you experienced a 25% reduction in revenue during any quarter in 2020 as compared to that same quarter in 2019.

- The forgiveness requirements remain the same – you must spend at least 60% of the funds on payroll within the 8- or 24-week eligibility period you choose to use. Other approved expenses have been expanded from mortgage expenses, rent, and utility payments to include expenditures for things like personal protective equipment, supplier costs, software and operations expenditures, and repair costs due to public disturbances in 2020.

- You can read more about the stimulus package from the New York Times here and from the Wall Street Journal here.

- Further guidance and details on applying are expected from the SBA shortly, after which time you will be able to apply with your bank if you choose to do so.

Stimulus Payment

Another stimulus payment will be sent to all eligible taxpayers. Details:

- The payment amount is $600 per person: $600 for a single taxpayer, $1,200 total for a Married Filing Joint (MFJ) couple, plus $600 for each qualifying child under 17.

- Note: There is a movement to increase payments to $2,000 per person, but that has been stymied for the time being. The $600 payments are in process and will be received in the same manner as the last round of stimulus payments in 2020 (via direct deposit or check in the mail).

- Some taxpayers have already received the payments and others will take longer to arrive (like last time).

- To qualify, your Adjusted Gross Income (AGI) on your 2019 tax return must be below certain thresholds depending on your filing status:

- $75,000 – Single

- $150,000 – MFJ

- $112,500 – Head of Household

- If your income is above these thresholds, your payment will be reduced by $5 for every $100 over the threshold.

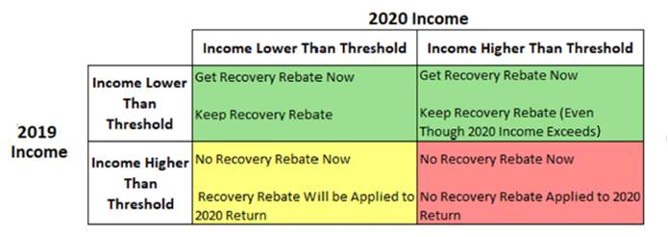

- If your 2019 AGI was too high but your 2020 AGI ends up being low enough to qualify, you will still get this payment in the form of a refundable credit when filing your 2020 tax return. Here is a great table from Kitces.com on the possible stimulus payment scenarios:

Extended Unemployment Benefits

- Regular unemployment compensation has been extended another 11 weeks until mid-March. The latest date at which you can receive the extended unemployment benefit (if you had not used all eligibility prior to this new law being signed) is April 5, 2021.

- There is an additional unemployment benefit of $300 per week for these 11 weeks.

- Pandemic Unemployment Assistance (PUA), which provides unemployment benefits to those not usually eligible like self-employed individuals, has also been extended another 11 weeks (and the $300 additional weekly benefit is included).

Deferred Payroll Taxes

- If your employer allowed it and you chose to defer payroll taxes in the fourth quarter of 2020, you will now have all of 2021 to repay those deferred taxes instead of only having until 4/30/2021.

Deductible Medical Expenses

- Medical Expenses above 7.5% of your AGI are deductible on your Schedule A (Itemized Deductions) permanently (at least until another tax law change). This deduction has been allowed previously, but above different levels of AGI (7.5% or 10%) and, in recent years, the level was determined by your age. Now all taxpayers can deduct medical expenses above 7.5% of AGI.

Charitable Contributions – Above-the-line deductions

- The CARES Act in 2020 provided for a $300 above-the-line deduction for cash gifts made to charity for anyone who uses the standard deduction, but it provided for this in 2020 only. This Act extends this benefit to the 2021 tax year and allows MFJ taxpayers to get up to a $600 deduction ($300 per person).

Flexible Spending Accounts (FSA) – Carryover

- If employers allow it, employees will be able to carry over unused 2020 FSA funds into 2021 (and again from 2021 to 2022).

Additional Provisions:

- The Energy-Efficient Homes Credit and Qualified Fuel Cell Motor Vehicle Credits are extended through 2021.

- The FAFSA will be simplified! It is currently 108 questions and will be reduced to no more than 36 questions by 7/1/2023.

Provisions Potentially Expected and Not Included:

- There was no extension to the 8/31/2020 deadline to roll unwanted Required Minimum Distributions (RMDs) back into IRAs. As you may recall, RMDs were eliminated in 2020, but some taxpayers had already taken funds out of their IRAs. They could roll these amounts back into their IRAs by 8/31/2020 and treat the distributions as they never happened (which meant no taxable income from those distributions for 2020).

- Don’t worry – if this applied to you, we reached out to you well before the deadline with our recommendation and, if applicable, helped you roll your RMD back into your IRA.

- There was no mention of a waiver of RMDs for 2021. We expect RMDs to proceed as usual again this year and we will act accordingly.

- No additional student loan relief was included. Initially, for federal loans, interest rates were dropped to zero and payment requirements were halted through 9/30/2020 (then extended through 12/31/2020 and again through 1/31/2021). No further extensions were included in this bill.

As always, please contact us with any questions you have on the below information or anything else you’ve read/heard/seen about the bill that you’d like to discuss further. We’re always available to be your thinking partner, to help clarify complex new laws, and to “walk it around the block” with respect to your life and your Live Big® journey.