Disability Insurance: A Blind Spot in Financial Planning

For most working people, human capital (the value of one’s knowledge, skills, and potential for earning future income) is their most valuable asset. Anything that interrupts those earnings can wreak havoc on one’s financial plan, so it is important to have sufficient protection. Read on to learn more about the underestimated power of disability insurance.

In the last 10 minutes, 498 Americans became disabled. (This is according to the National Safety Council®, which, since its founding in 1913, has collected, analyzed, and reported preventable injury and fatality statistics.) In spite of the high risk, the Council for Disability Awareness says that a lack of disability insurance is a growing crisis for millions of working Americans.

We see this regularly with our Clients as well. We have spoken before on life insurance as a commonly neglected form of income replacement, but disability insurance is even more so. Many people aren’t sure about how much coverage they have or whether Social Security might kick in and cover them. Most commonly, people tend to underestimate the likelihood of becoming disabled. According to a 2007 survey done by the Council for Disability Awareness:

- 90% of people underestimate their own chances of becoming disabled, and

- 85% express little or no concern that they might suffer a disability lasting three months or longer.

For most working people, human capital (the value of one’s knowledge, skills, and potential for earning future income) is their most valuable asset. Anything that interrupts those earnings can wreak havoc on one’s financial plan, so it is important to have sufficient protection. In this piece we will explore:

- Why disability insurance is so valuable,

- What types of coverage you can obtain,

- How much insurance you need, and

- How Yeske Buie can help.

Why Is Disability Insurance So Important?

Disability insurance is important for the same reason that life insurance is important: it protects against lost earnings. In broad strokes, if something were to happen that meant you could no longer work, what would replace your income to cover unfulfilled obligations? If you can’t live without your income, then you need disability insurance to cover your basic needs. Regardless of whether you are able to work, you still need to pay your mortgage, buy groceries, and support the wellbeing of those who depend on you.

How secure are my life goals and my family’s goals if I’m no longer able to work?

Most people who have no problem buying life insurance can find it hard to justify the cost of disability insurance. However, studies have shown time and time again that you are much more likely to become disabled than you are to die during your working years. Consider the following statistics:

- In 2022, the Social Security Administration released probability tables for young adults entering the workforce. They concluded that, for a worker at age 20, the probability of becoming disabled before their normal retirement age (67) is 25%, and the probability of dying between age 20 and normal retirement age is only 13%.

- At age 40, the average worker faces only a 14% chance of dying before age 65 but a 21% chance of being disabled for 90 days or more.

- Each year, around 5% of working Americans will experience a short-term disability (six months or less) due to illness, injury, or pregnancy. Almost all of these are non-occupational in origin.

In addition, disability insurance covers more than people think. Evan Scarponi, Vice President and Chief Claims Officer at Prudential Group Insurance, says:

“There is a misconception that disability insurance only applies to physical illnesses and accident-related injuries, but its coverage is much broader than that. Pregnancy, orthopedic conditions that have a level of impairment, and cancer diagnoses can be considered disabilities. Behavioral health conditions can also be considered disabilities.”

Scarponi continues to say that Prudential expects behavioral health conditions to be among the leading causes of disability claims by 2030. A disability does not necessarily have to be severe in order for a person to receive benefits, either. Instead, the disability must cause a person to meet two simple criteria:

- They are unable to perform the duties of their job.

- They experience a loss of income of up to 20% compared to their pre-disability earnings.

What Types of Disability Insurance Are There?

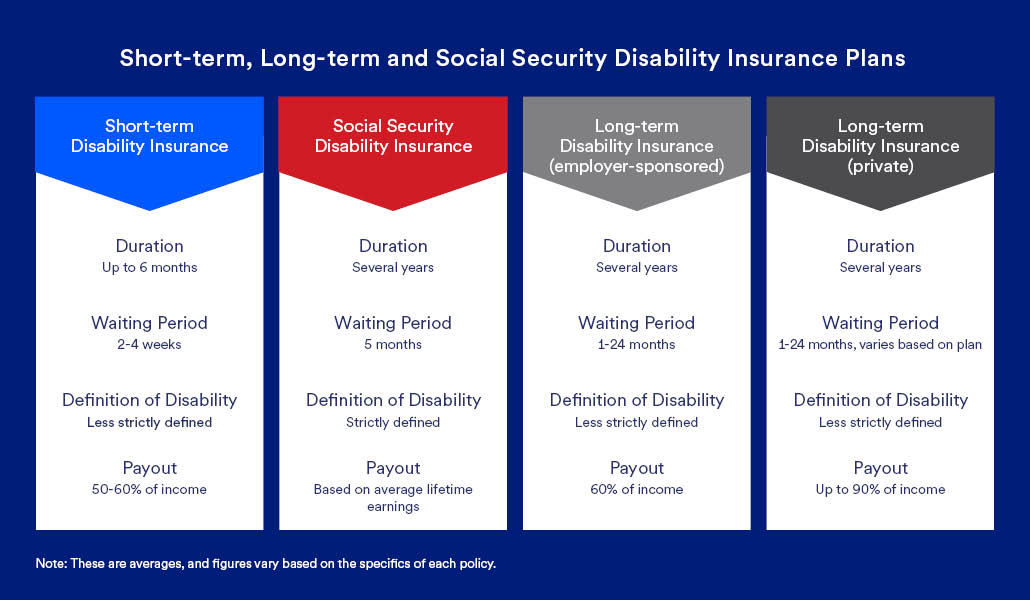

There are three broad categories of disability insurance: short-term, long-term, and Social Security (SSDI). (Many people think Social Security only pays retirement benefits, but you can also claim disability payments if you qualify.) These categories dictate when benefits are paid and for how long.

Short-term disability insurance covers up to the first 6 months of a disability, during which a person might otherwise rely on their emergency fund to bridge the gap until long-term disability benefits are paid. SSDI has a waiting period of 5 months, and benefits will generally continue as long as a person’s medical condition has not improved. SSDI has a strict “any-occupation” definition of disability, which we define later.

Long-term disability insurance benefits begin after a longer waiting period (usually 3-6 months). Sometimes, long-term disability insurance benefits only last 3, 5, or 10 years, while others last until age 65. No matter what you may think about your coverage, it is important to read your disability insurance policy to understand what it covers, what it excludes, and when the benefits are paid.

The definition of “disability” is almost as important as the duration of the benefits. Disability insurance can be categorized as either “any occupation” or “own occupation.” As an example to distinguish the two, consider a surgeon who has injured his hands so badly that he can no longer operate (à la Doctor Strange).

Any-occupation (or “general”) disability insurance pays out only if you cannot work any job. In this example, the surgeon can still go work as a professor (or even as a Walmart greeter), so he is not eligible for benefits under this type of policy.

Own-occupation disability insurance pays out when you are unable to work your own job, even if you are able to go get a different one. These policies are typically more expensive but are much more valuable for high-paying, highly specialized jobs. Our surgeon may choose to become a professor or migrate to the administrative side of the hospital and still receive disability insurance payments under his own-occupation policy.

These policy types are not exclusive, either. It is possible to layer policies to reduce the cost. You can use a general (any-occupation) disability policy as a cheaper foundation and layer an own-occupation policy on top for additional coverage. That way, if you are still able to work part-time in a different capacity, the own-occupation insurance will supplement the part-time income. However, if you are going to purchase more than one policy, be sure to read both! You want to be sure that claiming benefits from one policy doesn’t preclude you from claiming benefits from the other.

How Much Disability Insurance Do I Need?

The general consensus among experts is that you can never have enough disability insurance. Insurance companies will not cover 100% of your salary because they believe it would provide you the incentive to become disabled. (Why work if you can sit at home, collect disability income, and still receive 100% of your salary?) Fortunately, employee benefits packages frequently offer group long-term disability insurance. Therefore, the broadest recommendation is to maximize the disability insurance coverage available to you through your employer.

There are two primary factors that affect how much disability insurance a person needs. The first is their emergency savings. Most long-term disability insurance policies don’t start paying benefits until after a waiting period of 90-180 days (3-6 months). While it is possible to acquire short-term disability insurance to cover those first 6 months, it can be expensive if not obtained through an employer-sponsored group insurance plan. If a person has sufficient emergency reserves, we typically recommend skipping the short-term disability coverage and maxing out the long-term coverage instead.

Second (and more importantly), consider how the premiums will be paid. As an employee, you will often have the choice between paying premiums with pre-tax dollars (giving you a tax deduction when paying these premiums out of your paycheck) or after-tax dollars (meaning you get no tax deduction for paying the premiums). If you pay the premiums with after-tax dollars, you will receive your disability insurance benefits tax-free. Considering that taxes can eat up 30-40% of a person’s income, you may only need benefits covering 60-70% of your income if you pay your premiums with after-tax dollars.

The tax treatment of insurance benefits will have a large impact on the net amount that actually hits your bank account, so it’s important to understand how the premiums are paid if you have access to a group disability policy at work.

It is also possible to obtain disability insurance outside of one’s employer. This is useful in situations where the employer-provided coverage has a cap (say, $5,000 per month) which is much lower than a person’s income. Private disability insurance also protects the policyholder when changing jobs, which can be beneficial if there is a gap in employment or if the new employer does not offer disability insurance coverage. However, private disability insurance is much more expensive than group insurance and should only be used as a supplement to employer-provided coverage when necessary.

How Can Yeske Buie Help?

At Yeske Buie, we incorporate a comprehensive insurance review into the financial planning process with our Clients as part of our “financial hygiene” overview. During the onboarding process, we evaluate existing policies and consider employer-sponsored coverage options, and we review Clients’ coverage annually as part of our financial hygiene check. If we determine there is a need for additional coverage, we connect our Clients with brokers and experts who can source private policies to fill in the gaps. We then use this information to inform a broader conversation with our Clients to determine if their existing coverage is adequate and to make recommendations for policies we believe will best serve their needs.

Though disability insurance is expensive, it is a critical part of protecting a person’s most valuable resource – their human capital. As financial planners, we strive to educate Clients and make even the most complicated topics approachable. While disability insurance is often overlooked by most Clients, our goal is to reiterate its importance due to the possibility of experiencing significant financial loss due to disability.

If you have any questions about disability insurance and how it fits into your financial plan, please don’t hesitate to contact us.

Resources:

- Disability Statistics from DisabilityCanHappen.org

- Survey Data from DisabilityCanHappen.org

- Disability and Death Probability Tables from the Social Security Administration

- Insurance Information Institute, iii.org November, 2005

- Integrated Benefits Institute, IBI Benchmarking Analytics Series: Which Diagnoses Drive STD Incidence, Costs and Lost Time?

- AskGMS, a group benefits market research firm, reports that 96% of in-force group short-term disability plans provide coverage for non-occupational disabilities only.

- 5 Things About Disability Insurance You Need to Know.

- Is Your Employer-Provided Disability Insurance Enough? The Money Guy Show.