Discovery Insights: Our Process, Your Journey

Financial planning is often thought to only include asset management, investing, and number crunching. And all of those pieces matter! But none of it matters if it’s not personal, relatable, and aligned with who you are and what matters to you. Our discovery process is the first step in our financial planning process once we’ve decided to work together – and it is one of the most important pieces of our relationship together. In this space, we share our thoughts on the importance of the discovery process and some of the behavioral science research that influences our approach.

Our discovery process is all about getting to know you. We endeavor to uncover your greatest hopes and dreams, and we strive to learn about what matters to you most – the people in your life, the organizations that speak to your heart, the activities in which you like to participate, and any and everything else you want to share with us. We often say that the operating instructions for the plan come from inside – your values system, your mind, and your heart.

A simple, number-crunched answer to a planning question may be possible, or even easy, but it won’t matter if it’s not aligned to your values and goals.

To some, this may seem obvious, but it cannot be stressed enough how important we feel this part of the process is!

Our discovery process starts with a simple question: “Tell us about yourself.” From this question, we hope to learn about all of your history that you’re willing to share, from the day you were born until now, or any period within. Sometimes, we’ll also ask questions like:

- Complete this sentence, “From my mother I learned that money is ____________”

- Complete this sentence, “From my father I learned that money is _____________”

- What is your first money memory?

- What is the first big purchase you remember?

While recollecting childhood memories may seem superfluous when talking with your financial planner, research shows that childhood experiences can have a significant impact on your relationship with money. One way these experiences manifest is through money scripts. Money scripts are generally unconscious, trans-generational thoughts and beliefs about money that are formed in childhood and influence adult decision-making (Klontz and Britt, 2012). There are four main categories of money scripts as described by Ted Klontz and Sonya Britt:

- Money Avoidance

- “Money avoiders believe that money is bad or that they do not deserve money. For the money avoider, money is seen as a source of fear, anxiety, or disgust.”

- Money Status

- “People who hold money status scripts see net worth and self-worth as being synonymous. They may pretend to have more money than they do, and as a result are at risk of overspending, in an effort to give people the impression that they are financially successful.”

- Money Worship

- “At their core, money worshipers are convinced that the key to happiness and the solution to all of their problems is to have more money. At the same time, they believe that one can never have enough money and they will never really be able to afford the things they want in life.:

- Money Vigilance

- “The money vigilant are alert, watchful, and concerned about their financial welfare. They believe it is important to save and for people to work for their money and not be given financial handouts. If they can’t pay cash for something, they won’t buy it, and they are less likely to buy on credit.”

Being aware of the money scripts you embody is beneficial as this awareness can help you better manage your thoughts and emotions about money and more productively approach your financial plan and the financial decisions in your life. It is our goal – and our privilege! – to listen and be with you as you explore your history and discover your relationship with money so that we can build a financial plan that is truly personalized for YOU.

In addition to discovering potential money scripts, the discovery process lets us hear and learn more about your values, goals, and dreams. We get the opportunity to hear about the successes in your past and present, and the Live Big® goals in your future. We learn what matters most to you, how you view money, and how your resources might support your lifestyle now and in the future.

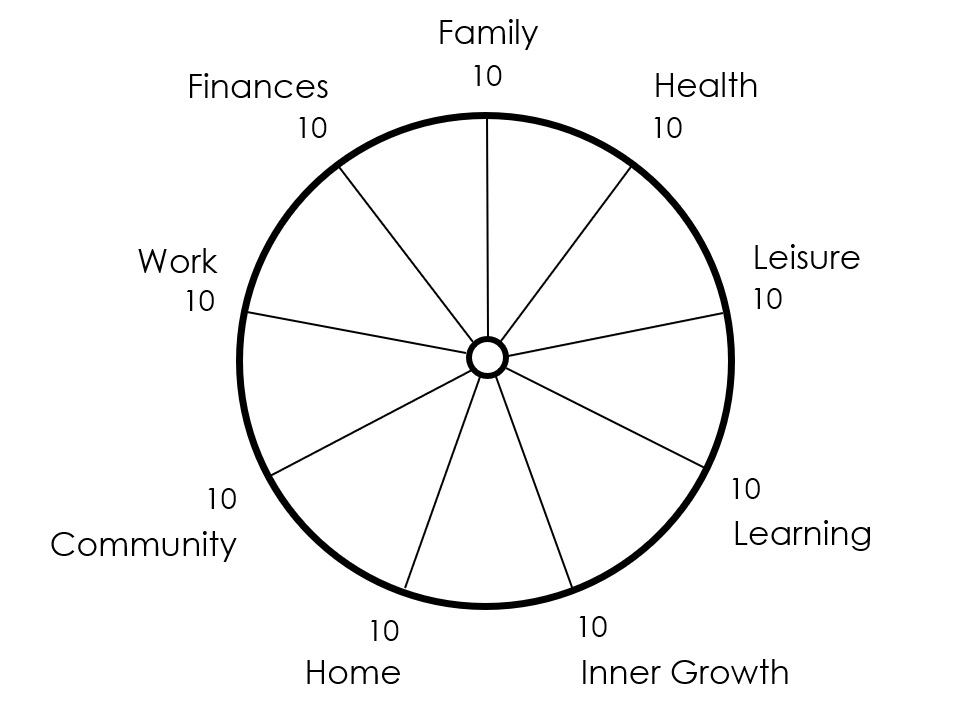

One of the ways we explore your present and future desires is by using the Money Quotient® Wheel of Life tool (pictured below).

This tool asks you to assess your growth and development in each facet of your life. After completing your personal assessment, we launch into a discussion about your selections – in what facets would you like to experience more satisfaction, how can we maximize your resources to help you feel more satisfied and balanced, and more. Then, for those desiring even deeper reflection, we offer two additional exercises – not required, but potentially enlightening and exciting to complete – the Visualize Your Future and the Goals for Life worksheets.

With everything we learn from your responses to our exploration together, we then get to work in creating an initial financial plan that aligns with the core of who you are – where you’ve been, where you are, and where you’re going.

And of course, our first discovery meeting isn’t the end of discovery – it’s an ongoing and eternal process! Life happens and life changes. Our goal is to live in a constant state of discovery, to always be learning who you are and what matters, and ensuring our work with you keeps that human top of mind.

As always, please don’t hesitate to contact us if you have any questions about our discovery process or otherwise, and keep an eye out for more on our planning process.

SOURCES

- Klontz, Bradley T. and Sonya L. Britt. (2016). How Clients’ Money Scripts Predict Their Financial Behaviors. The Journal of Financial Planning.