Employee Stock Options: Simplified

At their most basic form, stock options are an incentive offered by an employer to an employee to buy a certain number of company stock shares on a certain date at a certain price. The employee is then incentivized to do what is in his/her power to help ensure that the company continues to grow and perform well and, therefore, the stock price continues to appreciate. A higher stock price increases the value of the employee’s stock options.

At their most basic form, stock options are an incentive offered by an employer to an employee to buy a certain number of company stock shares on a certain date at a certain price. The employee is then incentivized to do what is in his/her power to help ensure that the company continues to grow and perform well and, therefore, the stock price continues to appreciate. A higher stock price increases the value of the employee’s stock options.

There are many different types of stock options with different requirements (like holding period or tenure at the firm) and different tax treatment (like ordinary income taxes versus capital gains taxes). In this piece, we will focus on the two most common forms of stock options offered: Incentive Stock Options (ISOs – also known as Qualified Stock Options) and Non-Qualified Stock Options (NQSOs).

Where do you find the the major differences between these two types of stock options? You find them when you look at the taxes. There are many additional underlying differences, regulations employers must follow, and tax consequences and benefits for the company. In this piece, however, we will focus on these stock options in their most basic forms for simplicity.

Before getting into the details, there are some terms that will be helpful to understand:

- Grant Date: The date stock options are granted (or given) to the employee.

- Exercise/Strike Price: The price per share at which the employee will be allowed to buy the shares granted.

- Vesting schedule: the period of time over which the stock options become available to be exercised (i.e. the employee becomes able to buy the shares at the exercise price).

- Two types:

- Graded: A percentage of the options vest each year for a certain number of years (for example: 25% each year for four years)

- Cliff: 100% of the options vest after a certain number of years (for example, 100% after three years pass)

- Note: Vesting can also be tied to performance (versus time), but we will only explore time-based vesting schedules here.

- Two types:

- Exercise date: The date the employee buys the company shares.

- Holding period: The amount of time the employee owns the shares, after purchase, before selling.

- Expiration date: The date the employee’s right to buy the company shares ceases.

Incentive Stock Options

Incentive stock options are also known as Qualified Stock Options as they qualify for special tax treatment and are not subject to Social Security or Medicare Taxes when held for the required period of time. These options can only be offered to employees of the company.

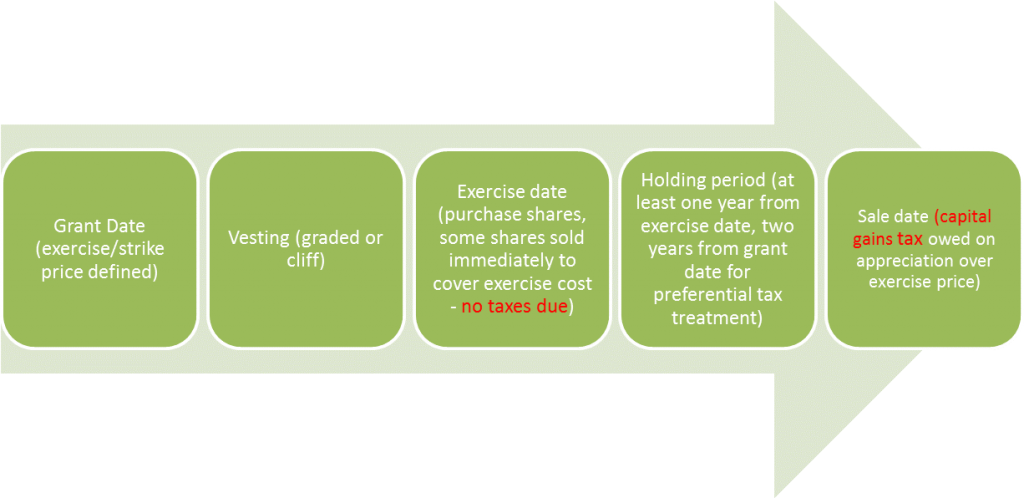

When the ISOs are granted to the employee, he/she does not yet actually own company stock – just the right to purchase that company stock in the future. The options vest over time, in one of the two vesting schedules defined above: graded or cliff.

As the options vest, the employee is able to exercise them by purchasing a certain number of shares at the stated exercise price. So where does the employee get the money to do so?

Most often, employees find it easiest to do what is called a cashless exercise: where shares are sold immediately to cover the exercise cost. The employee, therefore, does not have to come up with the cash needed to buy those shares when exercising the options, he/she simply gets the net shares (total shares vested minus shares sold to cover exercise price).

If, after exercise, ISO shares are held at least two years from the grant date and one year from the exercise date, the taxes upon selling the shares will be levied at favorable capital gains tax rates on the appreciation of the stock price (fair market value on sale date minus exercise price paid for shares). Because no ordinary income tax is due upon exercise or sale, if the above requirements are met, no taxes need to be withheld or accounted for in the cashless exercise, only the exercise cost.

If the shares are not held for the required time period above (after exercise), and are sold, a disqualifying disposition has been made. At that point, the shares are treated like NQSOs for tax purposes and both ordinary income tax and capital gains taxes will be due on different amounts. See the below section on NQSOs for more information.

Below is a timeline of events for ISOs (where the holding period requirement is met):

The one caveat that is vital to explore when deciding how many of your ISOs to exercise at any given time is that the Alternative Minimum Tax can be triggered. The appreciation over the exercise price on the exercise date is included as an add-back item when calculating whether or not someone is subject to the AMT. (While the details are a bit burdensome to explain here, if this applies to you, we will be sure to review it thoroughly in our analysis and would be happy to coordinate with your tax professional to ensure a comprehensive review and recommendation.)

Nonqualified Stock Options

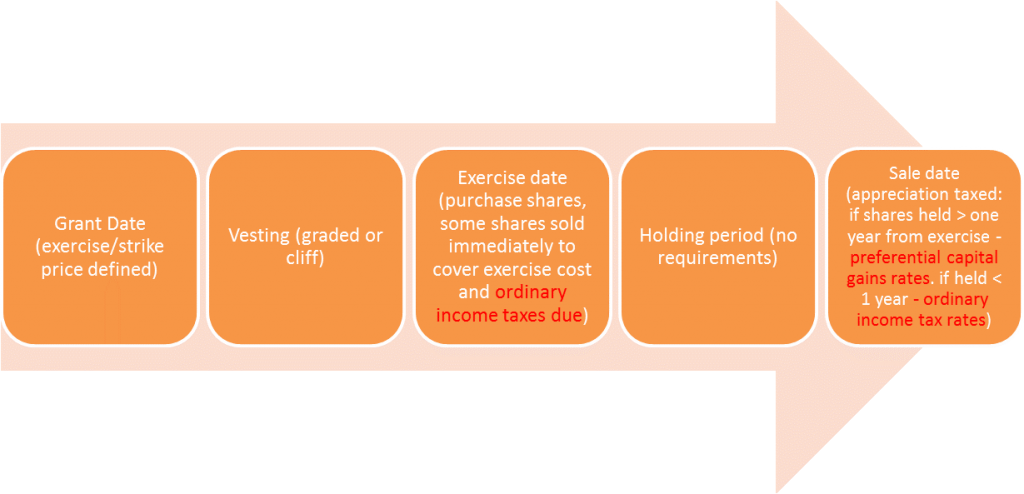

Nonqualified Stock Options (NQSOs) are the most common type of stock option offered by companies. Contrary to ISOs, NQSOs do not qualify for preferential tax treatment and they can be offered to anyone (not restricted to employees only).

NQSOs also give an employee the right to purchase a certain number of company shares at a certain exercise price on a certain date (after vesting). On exercise date, the income generated from the difference in the exercise price and the fair market value of the stock on that day is taxed as ordinary income (and thus included on your W-2) regardless of how long it has been since the grant date. Then the holding period begins and capital gains taxes are assessed if the shares are held for more than one year. If the shares are sold within one year, ordinary income tax rates apply to the short-term capital gains.

In this scenario too, employees often do a cashless exercise. Here, however, at exercise date, in addition to shares being sold to cover the exercise cost, shares are sold to cover the estimated ordinary income taxes (including Social Security and Medicare taxes) on the total number of shares being exercised.

Below is a timeline showing the steps for NQSOs:

While there are other, less common, forms of stock options and many more details than we’ve shared here, we felt a basic overview might be helpful to you or someone you know. The most important thing is to know what options you have and to not let them expire! You could potentially be leaving a lot of money on the table.

If you have stock options and would be curious to learn more about them and what we would recommend you do with them, please don’t hesitate to reach out to us!