Insights from FPA Far West Roundup

The Yeske Buie Financial Planning Team (Elissa Buie, Dave Yeske, Yusuf Abugideiri, Jennifer Micieli, Jennifer Hicks, Lauren Stansell, and Sabina Smailhodzic) attended FPA Far West Roundup (FWR), an annual financial planning conference that was held on Thursday, August 14 to Sunday, August 17, 2014 on the UC Santa Cruz campus.

With fewer than 100 attendees, FWR offers a much more casual and intimate atmosphere than other financial planning conferences (a typical regional conference might draw 500 attendees or more). The collegial atmosphere has a significant impact on the vibe of the conference. For those four days, planners can focus solely on being students of the profession again. Attendees also have the opportunity to deepen personal relationships as everyone goes to the same sessions, eats meals together, and spends the free time together.

There is a clear devotion to learning, teaching, and growing as practitioners. Most of the planners own their own businesses yet willingly share their insights and experiences. It’s not a competition; in fact, the opposite is true as FWR is a great place to look into peer and mentorship opportunities. All share a common desire to improve the profession.

Speaker Sessions

Liabilities-Side Gamma: The Next Frontier (Don St. Clair)

Liabilities-Side Gamma: The Next Frontier (Don St. Clair)

This session brought a new dimension to how we conceptualize the role of debt. If it has a beginning and an end, it’s a debt. So, for example, the cost of four years of college, even if it’s being paid from cash flow, can be thought of (and planned for) as if it were a formal debt obligation. In treating the college education expense as a debt, you might choose to finance it over the 18 years leading up to college, or the 22 years including college, or you might put it on your home equity loan and pay it off over any time period you choose. Even though an expense may have no explicit interest rate, it can still be conceptualized as an interest free debt. This would be the case, for example, when you pay for four years of college directly out of current cash flow.

New Ideas in Retirement Income Planning (Wade Pfau)

One of the interesting questions raised in this session related to where we draw the line for having ‘good enough’ market information. What if the investment time period you have researched and built an investment philosophy around doesn’t reflect what actually happens within a reasonable variance band? Wade explored the interplay between economic theory and the day-to-day practice of financial planning. The former focusing more on theory, but the latter focusing more on what is realistic/practical. By the end of this presentation, it was affirming to realize that our investment philosophy was built with the best available information. It is not bullet-proof, but it’s the smartest way we’ve discovered to invest in the market.

Integrating a Client’s Money Mindset into Their Financial Plan (Michael Kay)

This session was a great reminder of the power of deep dialogue and discovery. We already incorporate worksheets such as the Financial Satisfaction Survey and the Life Transitions Survey into our annual update meetings. Even though these are simple checklists, they often trigger deeper discussions. At one point, planners were asked to share their most challenging or difficult client stories, which was truly fascinating. Those situations are very vulnerable moments, but sharing them allows others to better serve their clients when similarly challenging circumstances arise.

Captive Insurance Strategies (Timothy Barnthouse)

This is a complex strategy to take on insurance liability in order to maximize cashflow, tax, and a larger estate exemption, but was geared more towards households with very significant assets. Having said that, among the interesting possibilities is that one could, for example, use a captive insurance company to transfer $1mm per year to the kids/grandkids utterly free of gift tax.

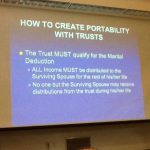

Portability – No Brainer or Brain Surgery? (Ray Sheffield & Mark Prendergast)

Portability – No Brainer or Brain Surgery? (Ray Sheffield & Mark Prendergast)

This was the biggest gem of the conference. Ray Sheffield is an estate attorney and he provided enough clarity to inspire tangible solutions for the newly introduced concept of “portability,” an issue we’ve been exploring since it was introduced into law two years ago. For estates where the spouse died between 2011-2013, where portability was not elected, and the estate stood a reasonable chance of piercing the estate exemption threshold, it is generally optimal for the surviving spouse to file for portability, which involves “breaking” the bypass, or credit-shelter trust. The deadline is 12/31/2014, but the approval process takes a while and should be started ASAP. In addition, Ray presented a compelling comparison between funding a bypass trust or funding a marital trust, otherwise known as an AB or ACB setup. Going forward, we will be reviewing each client situation to determine whether it’s time for a visit to their estate planning attorney.

I’d Rather Die than Talk to My Heirs about My Estate (Peter Johnson, Nancy Ross, Maureen O’Connell)

Collaborative planning is a new area that combines the expertise of a financial planner, estate attorney, accountant, and/or therapist. The idea is that when faced with a controversial situation, collaborative planning can be the step before the need for court proceedings, which usually doesn’t provide a suitable outcome for both parties, whereas collaborative planning could. The catch is that your current professionals will likely not be the same ones you employ in collaborative planning. This is done to ensure that all parties involved feel they are being represented fairly without bias towards one party over another.

Decision Architecture 101 (Dave Yeske)

In his presentation, Dave discussed policy-based financial planning with examples that included financial planning policies and the safe-spending policies – sound familiar? It’s always fun to see how other planners react and value the concepts that are shared from Yeske Buie. The information wasn’t new for our group, but we had a greater appreciation for the things we already do!

All in all, we had a great time at Far West Roundup and left the conference equipped with ideas and solutions to incorporate in our work with clients moving forward.