Financial Planning Policies for Young Adults

We often use the phrase that young people have an implicit superpower when it comes to saving – their age! The decisions that you make (good or bad) as a 23-year-old will have a significantly larger influence on your future than the decisions you make as a 33-year-old. It is never too early to focus on making sound financial decisions, and today we will dive into four actions that Yeske Buie suggests for young adults to help you best position yourself for financial success:

1. Track Your Spending

2. Establish an Emergency Fund

3. Start Saving for Retirement

4. Build Your Credit

1. Track Your Spending and Follow a Budget

Take advantage of technology! Budget spreadsheets and apps are more available than ever right now. These can help you organize your finances and provide clarity surrounding your cash flow. Having this knowledge can help you to make more informed and grounded decisions, along with reducing uncertainty and anxiety regarding your financial situation.

Implementing a budget will also help you identify your spending habits. Over-spending can be a common problem for young adults, and using a tracking system can help clear up any problems. Once identified, it is important to then take the next step and work towards lowering any unnecessary or unsustainable expenses. Set realistic expectations for your spending, ones that will get you on the right track, but not ones that are so drastic they will not be sustainable.

Review Regularly

If you are using a spreadsheet where you need to enter your purchases, make sure you do so every few days, so you do not fall behind. If you are using an app, go in and review if it is accurately labeling and grouping your transactions. Doing this frequently is required to stay up to date and ensure the tool you are using is without error.

2. Establish an Emergency Fund

One of the first steps in every financial plan is establishing an emergency fund. An emergency fund is a liquid, cash-invested account that is set aside for big, unexpected events, such as a job loss. Think of this fund as “Emergency Insurance.” One of the purposes of regular insurance (auto or home) is to protect you during unexpected consequential events. Your emergency fund essentially serves the same purpose; it is protecting you during the event of an income stoppage (although this is not the only reason for an emergency fund).

Since the pandemic, more Americans have recognized the importance of having an emergency fund. However, data still suggests that many Americans, especially young adults, would not be equipped to deal with a prolonged stoppage of income. In a survey conducted by CNBC that polled over 1,000 Americans between the ages of 18 and 34, 48% of participants reported having one month or less of savings to cover costs if their income stopped.

Appropriately, the next question is, “How much should be saved in my emergency fund?” The answer to this question is, “it depends” (as so many answers are in financial planning). Generally, a good starting place is to have 3 to 6 months of expenses saved in your emergency fund.

Should I Invest in My Emergency Fund?

No! Your emergency fund needs to be (1) liquid and (2) stable. While investing in your emergency fund might result in positive returns, that is not what this account is for. If you need to access these funds, you want to be confident in how much you have, and that you can access them immediately.

3. Start Saving for Retirement

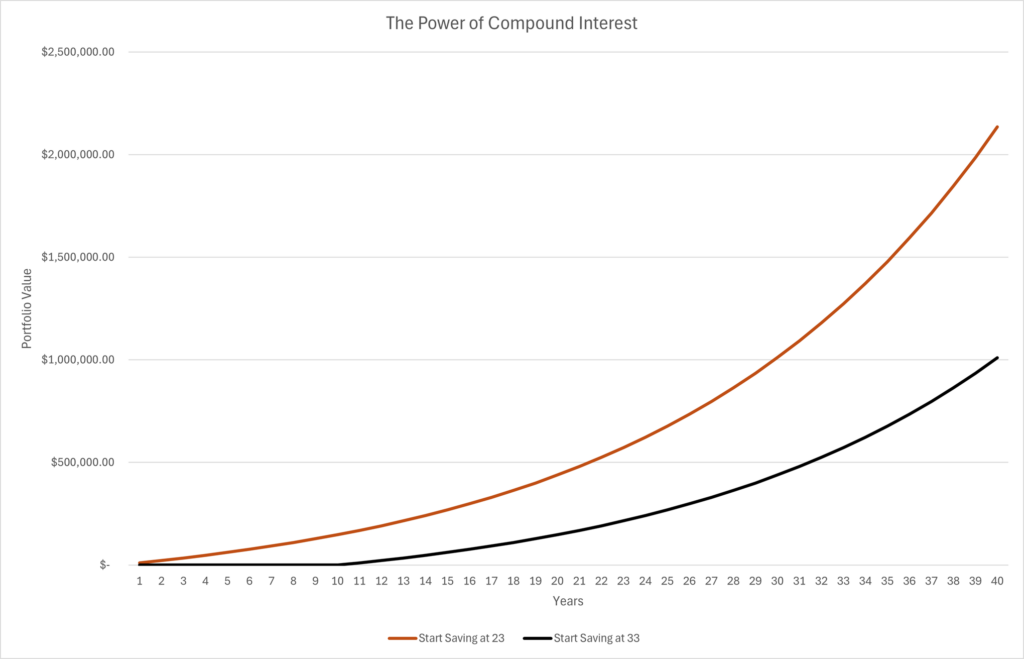

This concept can seem quite abstract, saving for something that is 30 to 40 years away, but it is never too early to start saving for retirement. As mentioned earlier, the good decisions you make as a 23-year-old will have a significantly larger impact than making those same good decisions 10 years later. This is because of the power of compound interest. The chart below shows the difference between saving $10,000 a year over a 40-year time horizon starting today (year 0), compared to starting in ten years (year 10), assuming a 7% annual rate of return in both scenarios.

As you can see, deciding to start saving at 23 instead of 33 results in over $1,000,000 of extra savings after 40 years. While this is a very simplified example, it demonstrates how much of an impact starting early can have when it comes to saving for retirement.

How Much Should I Save, and Where?

Again, it depends! A general recommendation to start with is to dedicate 10% of all your paychecks toward saving for retirement. If you are living below your means, this percentage could then be adjusted accordingly. When saving, it is important to utilize tax-advantage accounts. Examples of these accounts include Traditional IRAs, Roth IRAs, and 401(k)s. If your employer provides a retirement plan, it is a good idea to defer at least up to the match percentage offered in the plan. Doing this will essentially double your savings amount, as your employer will match your deferral. Finally, make sure these deferrals and matched contributions are being invested within the account, instead of sitting in cash. Getting the money in the account is a good first step, but we want to make sure we are capitalizing on the power of compound interest!

4. Start or Continue to Build Credit

Credit cards tend to be a trigger word (or phrase) in the world of finance – and for good reason. When used improperly, credit cards are dangerous and can cause large amounts of debt attached to high-interest rates. We are not suggesting that credit cards come without risks, but it is crucial that you start to effectively build credit as soon as possible. The bottom line is that if you want to make a large purchase one day that requires financing (house, car, etc.), being able to prove that you are a reliable lender will earn you a much better rate than someone who has no borrowing history.

How Do I Build Credit?

The most important factor in building credit is simply paying your bill in full and on time. Make sure you only put on the card what you can pay off at the end of each month. Paying your bills on time comprises 35% of your FICO score, and missing a payment could lower your credit rating. After this, trying to keep your monthly bill under 30% of your total credit limit is another effective way to build credit. This will help your utilization ratio which accounts for 30% of your FICO score. It may seem counterintuitive that using less of your available credit is better, but maxing out your available credit every month, even if you are paying it off, is an indicator that you might be spending at an unsustainable level, thus lowering your credit rating.

Defaults Matter

Default and automatic settings can have a big impact on your habits. Let’s play with a non-finance related example: according to studies conducted by the Health Resources & Services Administration and Statista, in both Spain and the United States, over 90% of the population is in favor of organ donation. Despite the common popularity, Spain has been a leader in organ donations for decades while the United States lags, falling about midway among developed nations. Why the difference? Spain has an opt-out policy, which automatically registers you as an organ donor unless you explicitly “opt-out.” The United States employs the opposite, an opt-in policy, where you must explicitly register to become an organ donor. The default creates the difference.

As it relates to building your credit, one of the ways you can leverage defaults to your advantage is by setting up auto-pay on your credit card, instead of needing to log in yourself and initiate the payment each month. Of course, you intend to pay your credit card bill each cycle, but installing this default will help you avoid any accidental missed payments that would hurt your credit score – after all the whole point of getting a card is to build credit, not to worry about it!

As always, your team at Yeske Buie is available to help you implement these policies and/or others that can set you up for financial success. If you’d like to learn more about any of these topics, please don’t hesitate to contact us.

Resources

- Get My 2024 Monthly Budget Template

- Can Your Emergency Fund Withstand An Emergency?

- How Well Do You Know Your 401(k) Plan?

- The Three Rs of IRAs

- CNBC Generation Lab Youth Money in the USA Survey

- Compound Interest

- Young People and Credit Cards: Why Its A Great Idea

- How Is Credit Utilization Ratio Calculated?

- Automate Credit Card Payments

- Credit Card Tips Everyone Should Know

- Organ Donor Statistics

- Country Highest Organ Donation Rates