Financial Planning WONK – Per Capita versus Per Stirpes

All beneficiary designations are the same, right? Unfortunately, that’s not the case. The language adopted by the financial institution that holds your IRA or other retirement account might cause you to unintentionally disinherit your grandkids. Most financial institutions treat multiple beneficiaries “per capita” rather than “per stirpes” when distributing assets of a deceased account holder. This is for the convenience of the financial institution but may not serve your true interests. Here’s why.

The difference between “per capita” and “per stirpes” is as follows:

- “Per capita” means that the grantor of the assets (you) intends that no one except the named beneficiary will receive a share of your assets at your death.

- “Per stirpes,” which is Latin for “by the branch,” means that the grantor of the assets (you) intends for the named beneficiary’s heirs (or “branch” of the family) to receive the named beneficiary’s share of the assets at your death in the event that the named beneficiary has predeceased you.

Here’s an example:

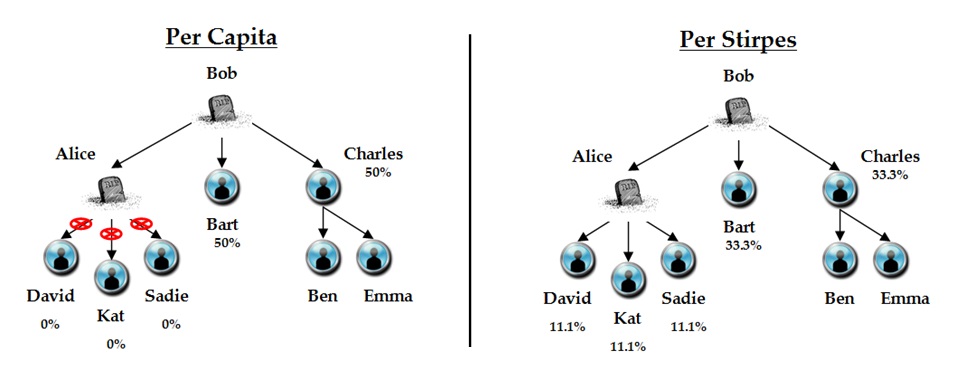

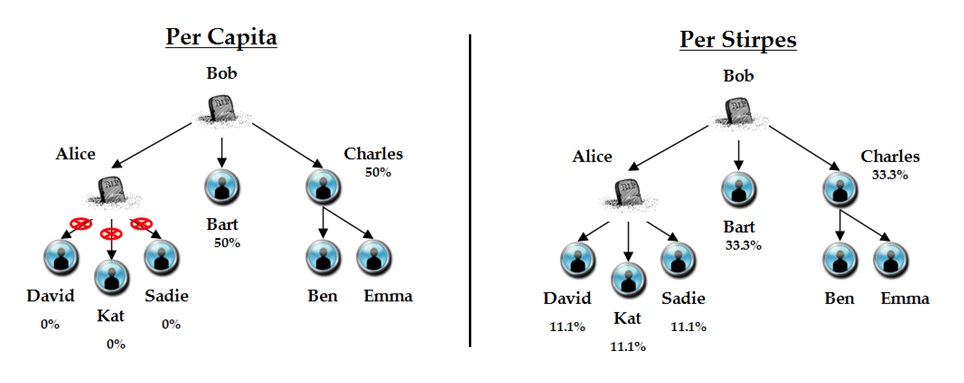

Bob has three children: Alice, Bart, and Charles. If Bob dies and leaves his IRA assets to his children in equal shares, each will inherit 33 1/3% under both the “per capita” and “per stirpes” notations.

- If Alice predeceases Bob under the “per capita” notation, her children would receive NOTHING. Bob’s IRA assets would be split 50/50 between Bart and Charles.

- If Alice predeceases Bob under the “per stirpes” notation, her children would receive her share of 33 1/3%, and Bart and Charles would receive their 33 1/3% share as well.