How Boomers Can Avoid Going Bust In Retirement

Lou Carlozo, Investment Contributor for U.S. News & World Report, enlisted the expertise of several investment professionals to offer advice to those heading into retirement who may not have the financial security to do so. One of the “nuggets of wisdom” that Lou Carlozo offers comes from Dave:

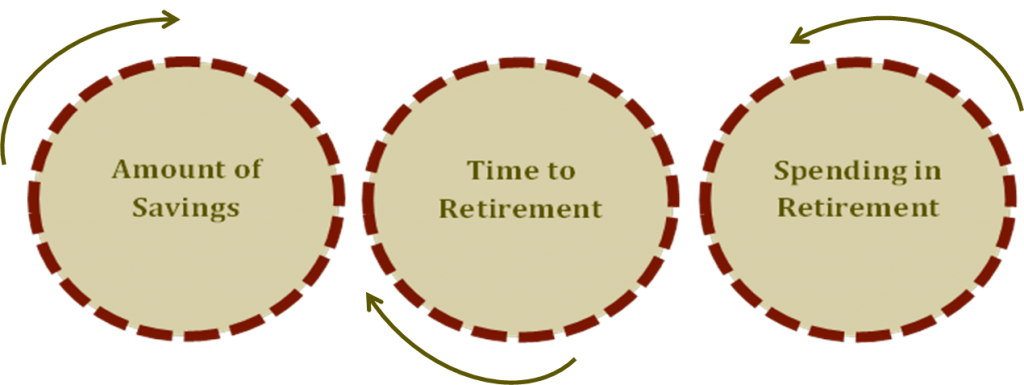

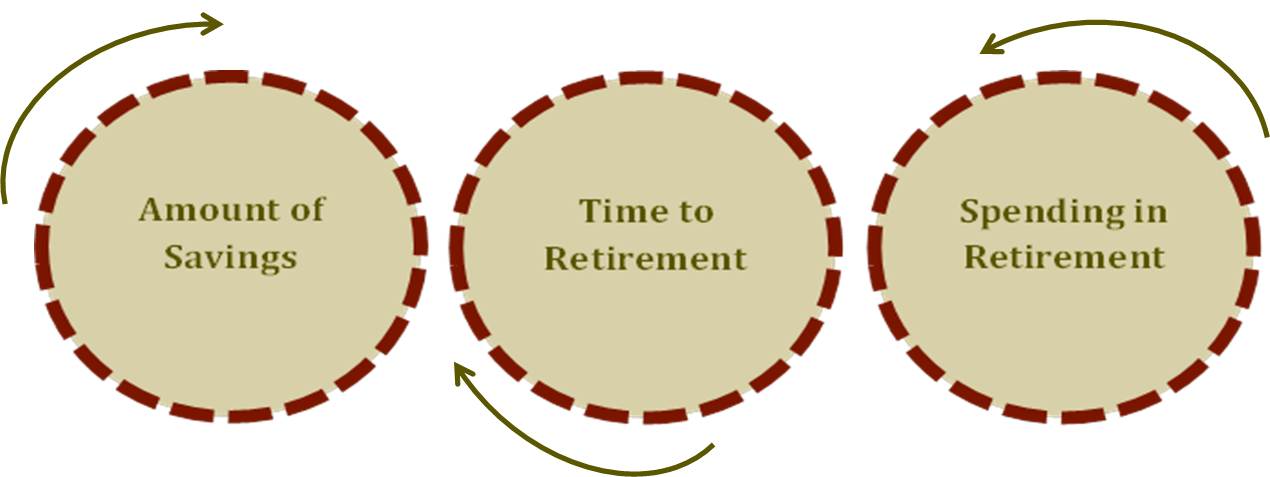

Work the “three levers.” A secure retirement, no matter your current situation, balances out your savings level, time until retirement and spending level in retirement. “That’s often the secret — looking for ways to make incremental changes across multiple fronts, which together can provide much more leverage than any one strategy alone,” says Dave Yeske, managing director at the wealth management firm Yeske Buie and director of the financial planning program at Golden Gate University’s Ageno School of Business. “The beautiful part of this story is that all three of those levers are within your control.”

And while the key drivers of an individual’s financial plan may differ, one of Yeske Buie’s goals is to show our Clients that they can take control of the levers, or dials, and adjust them in a way to allow them to Live Big® today, tomorrow, and throughout their retirement.