How It Works: TheLiveBigWay® Safe-Spending System

We believe we bring value to our Clients in a number of ways, but one of the most significant ways we impact their lives is through TheLiveBigWay® Safe-Spending System. We’ve discussed the philosophy behind this system in the past, focusing primarily on our approach to managing sustainable distributions and applying the three decision rules that act as guardrails for the system. Now, in this space, we take the conversation a step further by explaining the Safe-Spending System in detail and offering tips for successfully implementing the system in your own life. Specifically, we will discuss:

- Calculating the Safe-Spending Target

- What Actually Counts as Spending

- Identifying and Tracking Spending

- Implementing the Safe-Spending System

Wondering how much you can safely spend from your portfolio in retirement? Let’s learn how we can confidently answer that question together!

Calculating the Safe-Spending Target

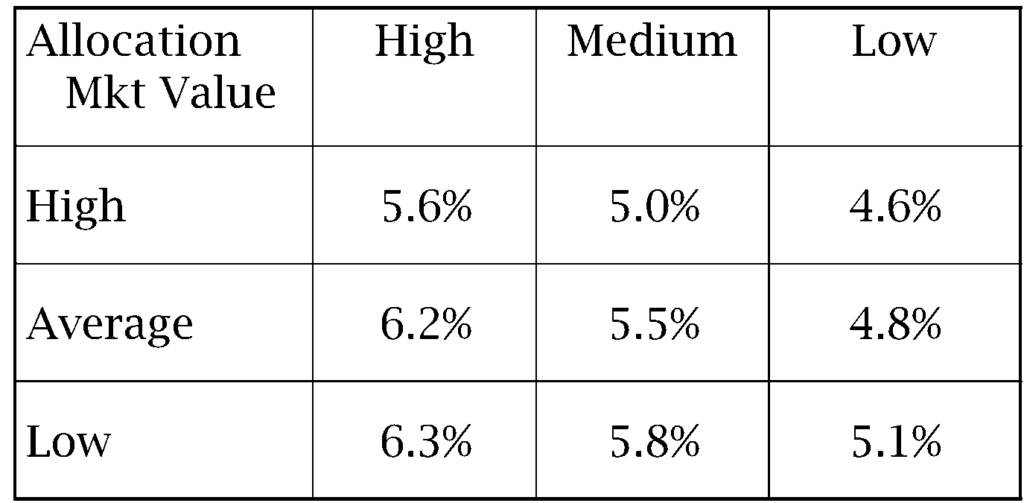

To determine a Client’s initial Safe-Spending Target, TheLiveBigWay® Safe-Spending System applies an initial spending rate to the value of the Client’s portfolio at the time that they begin spending. The initial spending rate is determined by a Client’s allocation to equities (stocks) within their portfolio (categorized as High, Medium, or Low) and the relative stock market valuations at the time (or how “expensively” stocks are priced relative to historical averages, categorized as High, Average, or Low). A higher equity allocation or a lower relative stock market valuation will result in a higher initial spending target.

A Client will be guided by TheLiveBigWay® Safe-Spending System for as long as they continue to take distributions from their portfolio. Once a Client has begun spending, their Safe-Spending Target is updated once per year. This update occurs every January and relies on three variables:

- Year-end portfolio value

- Prior 12-month portfolio returns

- Prior 12-month rate of inflation

These three variables are then fed into an analysis which identifies whether any of three decision rules (The Inflation Rule, The Capital Preservation Rule, and The Prosperity Rule) have been triggered. Depending on the outcome of this analysis, a Client’s spending target may increase, decrease, or remain the same. Those three decision rules are laid out in greater detail in the article linked above.

What Actually Counts as Spending?

For many clients, TheLiveBigWay® Safe-Spending System takes some getting used to, and that’s okay. Clients will often ask questions such as,

- “How do I track my actual spending?” and,

- “How do I set a budget based on my Safe-Spending Target?”

A common theme among questions such as these is the underlying question, “What actually counts as spending?”

For the purpose of the Safe-Spending System, anything that is distributed from the portfolio is considered to have been “spent.” It boils down to the system’s focus on withdrawals in reality, a Client’s Safe-Spending Target is determined more by the value of their portfolio than by the amount that they spend each year.

It feels important to note here that TheLiveBigWay® Safe-Spending System can only be reliably modeled on assets that are invested and allocated in alignment with one another. That is to say, YeskeBuie can only be confident in the sustainability of the system when every part of that system is invested, rebalanced, and monitored in the same way. So, Clients with significant assets outside of our management may not derive as much value from TheLiveBigWay® Safe-Spending System because a portion of their spending is supported by assets not included in their Spending Target.

Identifying and Tracking Spending

So, all that said, how can a Client actually track their spending?

There are two ways that a Client can obtain more timely feedback on their spending. The first is to log into their Client Private Page® and review their portfolio reports, which are updated monthly. YeskeBuie utilizes the Transaction Ledger from each Client’s Global Report every January to summarize Clients’ spending during the prior year. This report, while not exactly full of detail, will give Clients a precise representation of all of the cash flow activity that affects their Safe-Spending Target each year.

For more timely information, Clients can set up a Schwab Alliance profile and log in there to review recent transactions in their accounts. Clients can view the transaction history in a specific account by logging into Schwab Alliance then selecting History under the Accounts tab. Filtering by Transaction Type, Clients should filter out the following transaction types: Adjustments, Dividends, Interest, Corporate Actions, Fees, and Trades to end up with a summary of all net spending from the account over the given time frame.

Regardless of which method a Client chooses, tracking expenses retroactively can only do so much to help Clients prepare a forward-looking budget. This task is particularly difficult when accounting for irregular expenses, such as tax payments or large vacations. When evaluating their spending, Clients should always be disciplined and recognize that a single month is not representative of an entire year.

Implementing the Safe-Spending System

At YeskeBuie, we have been putting TheLiveBigWay® Safe-Spending System into practice since before the Great Recession, and we have seen Clients implement the system in many ways. Some Clients choose to make a single annual distribution equal to their Safe-Spending Target and budget from that amount throughout the year. Others will take irregular, unscheduled distributions to replenish their savings accounts as needed. Still others will set up a Schwab Investor Checking account and use their Schwab trust or brokerage account as a checking account for maximum efficiency.

However, the Clients whom we’ve seen have the most success under this system choose to set up a monthly distribution from their Schwab accounts and manage their expenses from their checking accounts. This approach turns a Client’s portfolio into a monthly paycheck and provides a Client consistent, reliable income that can be used to create a regular budget.

Similar to a paycheck provided by an employer, Clients must be aware that taxes do count against their spending target each year. In the same way that tax withholdings reduce one’s monthly paycheck, tax bills will also count as spending against the Safe-Spending Target. However, only taxes paid directly from a Client’s Schwab account will count as spending. For instance, taxes withheld from Social Security do not count as “spending” because those tax payments did not reduce the value of the Schwab portfolio. Conversely, this means that Clients are free to think of Social Security as additional spending above and beyond their Safe-Spending Target. Therefore, the Safe-Spending Target is not the maximum that a Client can spend. Rather, it is only the maximum that we believe can be sustainably withdrawn from a Client’s portfolio in a given year.

Lastly, when possible, we encourage Clients to set their monthly distributions below the identified Safe-Spending Target so that if a reduction must be made, the actual distribution may not be affected. Building in additional layers of resiliency in this way creates peace of mind while increasing the portfolio’s capacity to weather the inevitable storms in financial markets.

We’re Here to Help!

If you have questions about how TheLiveBigWay® Safe-Spending System can help make your money work smarter for you, please don’t hesitate to contact a member of YeskeBuie’s Financial Planning Team at AFP@YeBu.com. We’d love to help bring clarity to your situation, provide advice based on empirically validated theory, and engage in the ‘straight talk’ that is essential in navigating life’s journey.