How the Alphabet Affects Your Charitable Giving

IRA, RMD, QCD… what does it all mean? Maybe you know, maybe you don’t. We’re here to help! We’re going to talk about charitable giving in retirement and how you might be able to use these acronyms to get more bang for your tax-deductible buck with your charitable giving if it applies to you.

First, the acronyms:

- IRA = Individual Retirement Arrangement (to the IRS…the A stands for Account to most)

- IRAs are a form of retirement account (and often where your various employer retirement plans will end up over time so you can consolidate and have everything in one place). Contributions to Traditional IRAs are tax-deductible (subject to income limits), withdrawals are penalized before age 59.5, and distributions are subject to ordinary income tax (this is an important piece to remember when we get to the charitable giving from an IRA).

- RMD = Required Minimum Distribution

- Uncle Sam let you get a tax deduction for contributing to your retirement account and, eventually, Uncle Sam wants that tax revenue! Starting at age 72, you’ll be required to take a minimum amount out of your IRA every year (based on the 12/31 balance the prior year and the IRS life expectancy table factors). This amount is taxable to you as ordinary income (like your salary was).

- QCD = Qualified Charitable Distribution

- QCDs are distributions from your IRA that go directly to a qualified charity. The three great things about QCDs are: they go to charity and support causes that matter to you; they count towards your annual RMD; and they are not taxable.

- There are additional rules and considerations – read more here.

Because QCDs are nontaxable distributions from your IRA and count as part of your RMD, you can essentially reduce your taxable income by a dollar for every dollar you donate directly to charity. But it’s not as simple as just giving all your money away!

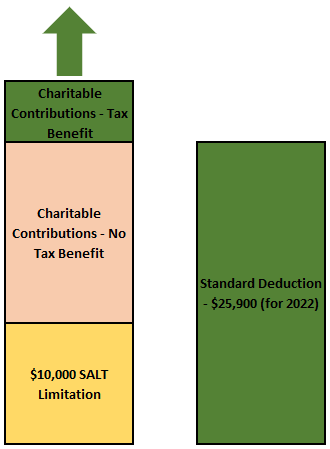

For many, giving to charity in cash gives the same dollar-for-dollar tax deduction, but not all. The 2017 Tax Cut and Jobs Act (TCJA) increased the standard deduction (deduction against income that any taxpayer gets and uses if itemized deductions are not larger) for 2018 and beyond from $12,700 to $24,000 for a married couple (now $25,900 in 2022). It also limited the state income tax deduction to $10,000 (which could be way less than someone in a high tax state paid). So, beginning then, for clients who no longer have enough in itemized deductions (think mortgage interest, state taxes limited to $10,000, and charitable donations) to meet that higher limit, the standard deduction is taken on the return.

For these same clients, because they get that standard deduction no matter what, the charitable donations aren’t actually responsible for reducing their taxable income and taxes any longer. The donative intent, of course, is still there (and vital!), but the tangible benefit isn’t there. It’s only when total itemized deductions go above that standard deduction that the charitable contributions further reduce taxable income. (For those who have enough itemized deductions to be above that standard deduction before charitable giving, the tax benefit is the same whether funds are given in cash or as QCDs from the IRA.)

For clients in this situation (not meeting the standard deduction with itemized deductions available) who also happen to be subject to RMDs, QCDs offer that visible/tangible benefit of a dollar-for-dollar deduction in income for gifts to charity. And, as a plus, these clients still get that full standard deduction! We’ve talked to many of you about this strategy (implementing if and when it does make sense) and will continue to do so. As always, let us know if you want to talk more!

We will note that the Tax Cut and Jobs Act is currently set to sunset (go away) after the 2025 tax year (starting in 2026) so traditional cash contributions for those with lower itemized deductions may again offer the same tax benefit. We’ll be paying attention, as always, to any tax law changes coming and plan with you accordingly.