Identify, Implement, and Achieve

At Yeske Buie, we take pride in our ability to help our Clients pursue their Live Big goals, and whether that be through accomplishing personal or financial goals, we are here to help. In this piece, we share tips for identifying, implementing, and achieving goals in any aspect of your life.

Identifying Goals

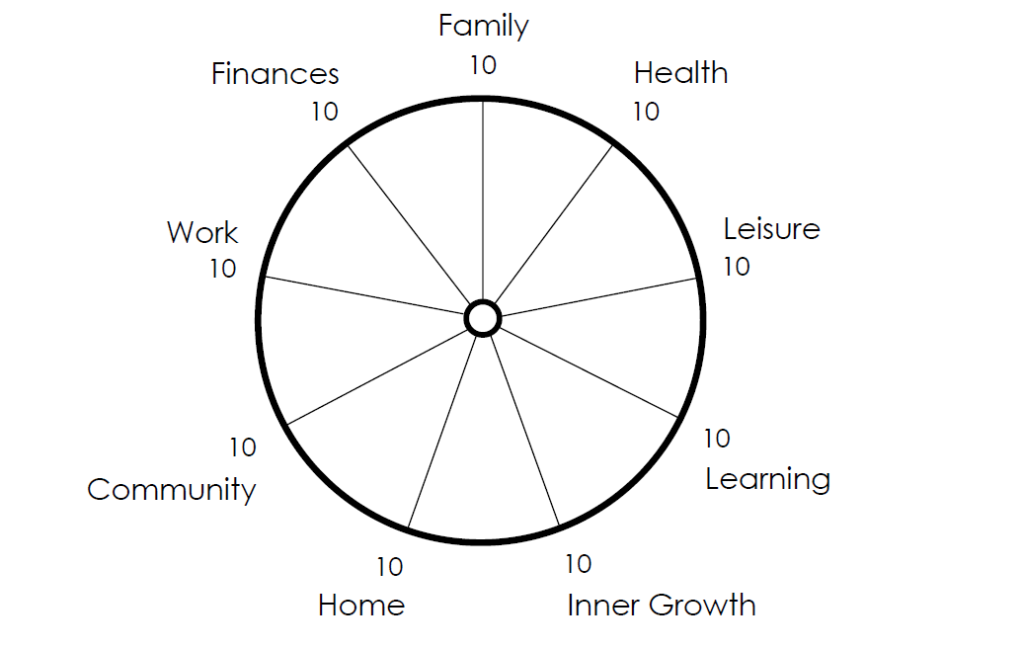

One of the first steps in the goal setting process is identifying the area of your life you wish to improve. An excellent tool that can be used to evaluate your current standing in any area of your life is the Wheel of Life created by our strategic partners at MoneyQuotient®. To complete the exercise, first identify a spoke on the wheel which you wish to improve. Then, determine where you wish to be in that area at some specific time in the future (6 months, 1 year, etc.), and think about the requisite steps you must take to get there in that time frame.

After you have identified the goal you wish to achieve, it is important to implement a plan of action – just like if you are driving from San Francisco to Los Angeles you’ll want to make sure you have a map (or Google Maps) to keep you going in the right direction. One goal setting theory (or map) we like is the SMART goal methodology. SMART goals can be defined as:

The Corporate Finance Institute provides an excellent deep-dive into each individual aspect of SMART goals in this article.

Implementing Goals

Of course, as financial planners, we would be remiss not to talk about setting goals in your financial life. We like to view financial planning as life-long goal seeking process. In its most simplistic terms, financial planning is deciphering what you currently have, what you will need in the future, and the steps needed to get there (unfortunately google maps cannot provide this solution). As your financial planners, we help you set SMART goals in your financial lives and put the necessary building-blocks in place to help them become a reality.

While self-discipline may come easier in the short-term when your motivation and passion is newly ablaze, we often have a way of losing motivation with long-term goals unless we put the necessary systems in place. We believe that financial planning policies, structured targets or habits, serve as a robust system to keep you on the right path. Financial planning policies take our behavioral faults as humans, such as the tendency to stick with default choices (aka “inertia”), and use them to our advantage. This is best depicted through a few examples:

- Automatic percentage savings of each paycheck to retirement accounts.

- Dollar Cost Averaging investing plans.

- Having X% of annual bonus as your annual vacation fund.

Implementing good financial planning policies makes setting and achieving financial goals easier as it requires less manual change and allows for quicker decision making. Author and entrepreneur James Clear beautifully captures this point saying, “You do not rise to the level of your goals. You fall to the level of your systems.” Financial planning policies build the necessary systems into your life to make your goals achievable.

So whether it’s the “on-cycle” for goal setting or not, think about what goal(s) you want to accomplish. Ask yourself how we at Yeske Buie can help you set the necessary processes and policies in place to ensure you are where you want to be 1-year, 5-years, or 30-years from now. During these trying times, it can be difficult to focus on anything other than the immediate short-term and surviving in this present moment. However, it is important to keep the future version of you in the forefront of your mind. At the very least this can help tune out some of the “noise” we are all facing in this current moment of our lives. If this topic feels relevant to you, please do not hesitate to reach out to us. We’re great people to think with and we are always happy to help!